For $3bn J&J holds on to Halda

The private biotech adds another asset to J&J’s prostate cancer pipeline.

The private biotech adds another asset to J&J’s prostate cancer pipeline.

For just over $3bn Johnson & Johnson is to go even deeper into prostate cancer, on Monday announcing the all-cash acquisition of the private US biotech company Halda Therapeutics.

The move comes just one month after Halda unveiled its first clinical data, covering its androgen receptor-targeting lead project HLD-0915. The results looked impressive but came from just a handful of patients, a fact that makes the $3.05bn valuation J&J just put on this business, which contains no other clinical assets, appear steep.

A separate question is how HLD-0915 will fit into the complex web of prostate cancer therapeutics J&J is developing. The company’s prostate cancer pipeline includes the anti-PSMA ADC ARX517 – itself the result of the $2bn acquisition of Ambrx last year – and the in-house anti-KLK2 T-cell engager pasritamig.

It’s clear that J&J is eager to keep its position at the forefront of prostate cancer treatment. The company is already a well-established player, through the marketed standard of care Zytiga plus the follow-on drug Erleada, and will no doubt be conscious of the likes of Novartis and Lilly branching out into radiopharmaceuticals, in both cases through acquisitions.

Why Halda?

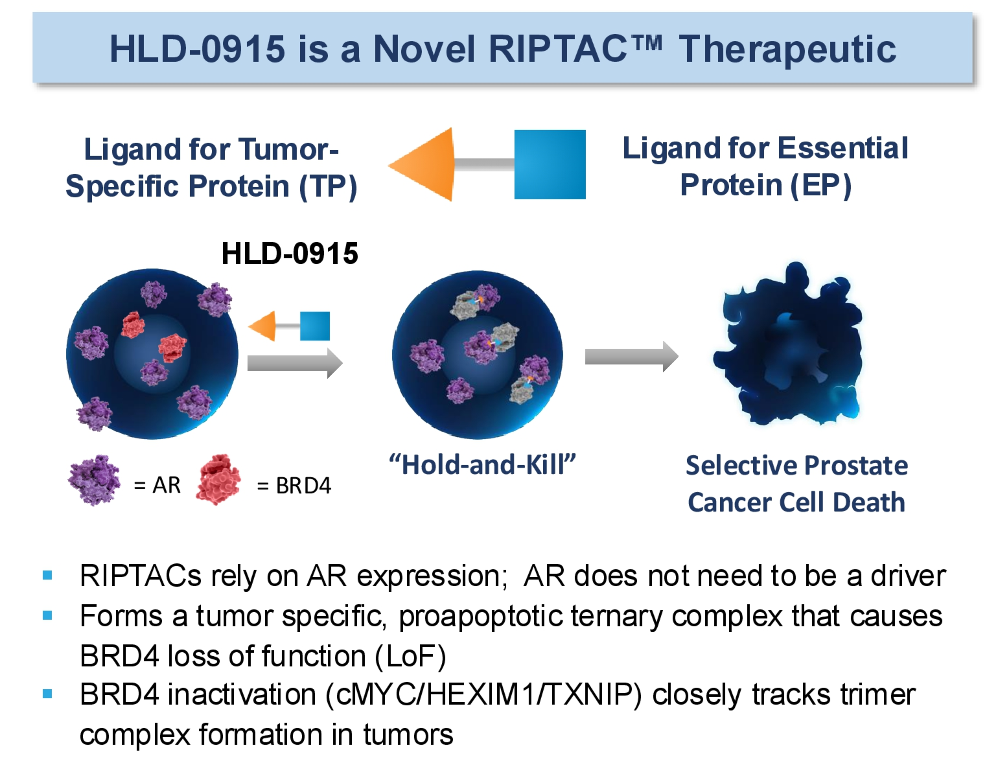

The attraction of Halda lies in that company’s so-called RIPTAC approach, an acronym that stands for regulated induced proximity targeting chimera. This involves the simultaneous binding of a tumour-specific antigen and a protein with an essential function for cell survival, with the resulting formation of a complex that disrupts the essential protein and triggers tumour cell death.

HLD-0915 is Halda’s most advanced RIPTAC, and specifically is an oral, heterobifunctional small molecule. It hits the full-length androgen receptor (AR) as well as the essential protein BRD4, and is said to remain active even if the AR has undergone a mutation, which might be driving resistance; the result is BRD4 loss of function and an antitumour effect.

As for evidence of this working clinically, at October’s Triple (EORTC-NCI-AACR) symposium Halda reported a 59% rate of PSA50 responses among 22 patients with relapsed, metastatic, castration-resistant prostate cancer. This looked impressive on a cross-trial basis, as did the fact that it translated into a 100% formal response rate, though the latter involved just five patients.

An important competitor for biotech investors is Janux, whose market cap stands at nearly $2bn on the back of a heavily curated dataset for the masked anti-PSMA T-cell engager JANX007, in a similar prostate cancer setting.

Another intriguing fact is that Halda was founded by Craig Crews, who in 2013 launched Arvinas, a company that has made a name for itself in target degradation, but which now faces some hard choices. Before Arvinas Crews co-founded Proteolix, the originator of the multiple myeloma drug Kyprolis.

Halda’s private holders are now celebrating an important payday: the company raised just $202m from venture financiers, including a $126m series B in August 2024, and has now managed to turn this into $3.05bn.

Depiction of HLD-0915's mechanism of action

2731