ASCO 2025 – Dizal goes after the BTK leaders

DZD8586 shows some evidence that it can rescue BTK failures, but its precise role remains unclear.

DZD8586 shows some evidence that it can rescue BTK failures, but its precise role remains unclear.

One of the follow-up molecules Dizal has after sunvozertinib, the EGFR drug due an FDA approval decision imminently, is the BTK/Lyn inhibitor DZD8586, and an ASCO presentation on the latter made the bold claim that this molecule remains active irrespective of prior treatment with covalent or non-covalent BTK inhibitors, or BTK degraders.

In the clinic this remains partly proven, at least in terms of strict responses by Recist criteria. As Dizal tries to upset the order in BTK inhibition, for which patients DZD8586 might be suitable goes to the heart of the molecule's dual design, which is meant to give it activity even in those who have lost BTK sensitivity.

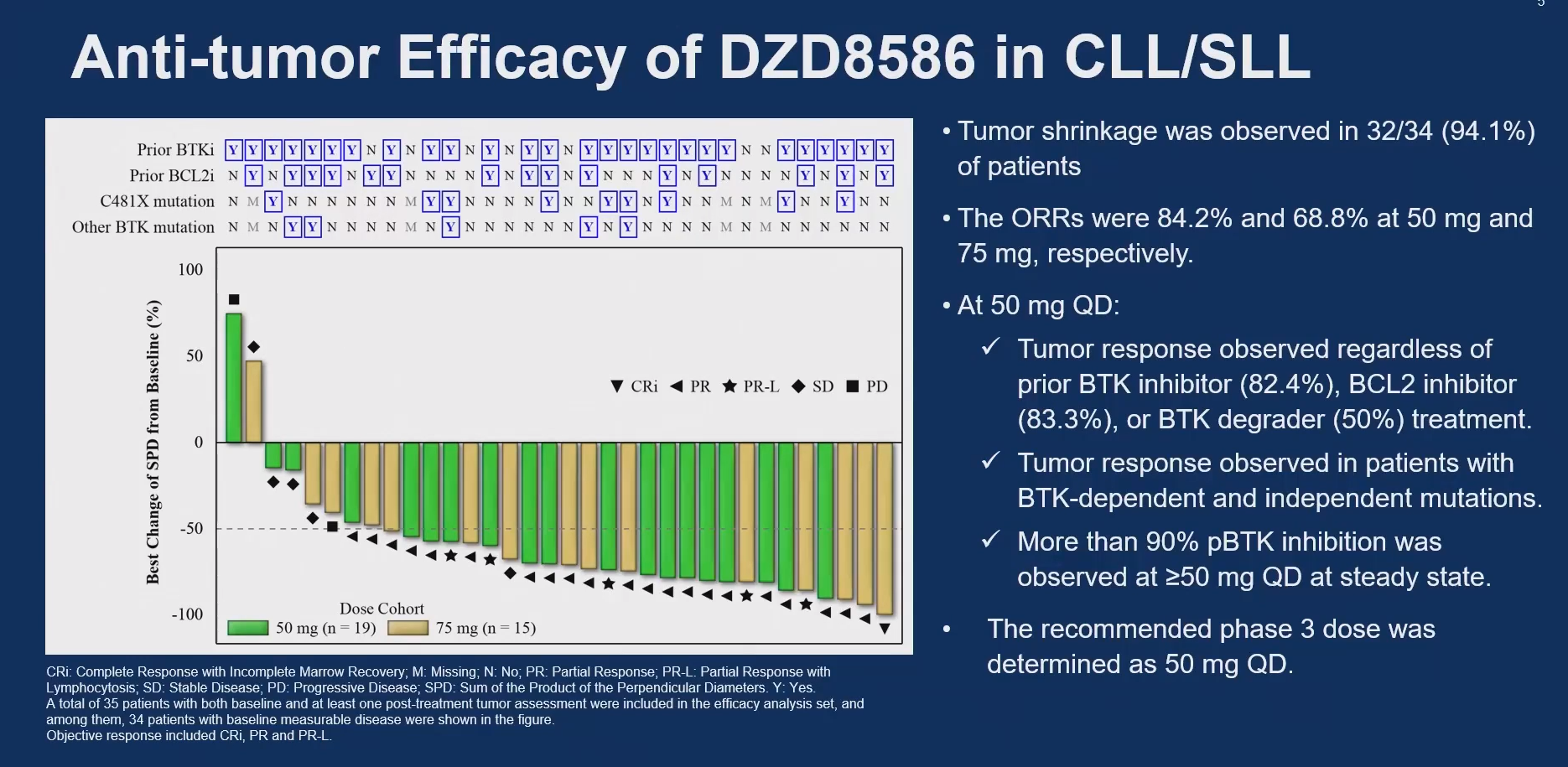

The ASCO dataset, from two mid-stage Chinese trials, now comprises 51 CLL patients treated with 25-100mg doses, and comes after Dizal presented early but similarly inconclusive results in lymphoma at ASH 2023. DZD8586 is also now in a phase 3 study in relapsed/refractory CLL, where it's being compared against bendamustine/Rituxan.

Speaking to ApexOnco Dizal's chief executive, Xiaolin Zhang, said DZD8586 arose from work suggesting that half of the patients who relapse on traditional BTK inhibitors have mutations that effectively render BTK "dead", so the disease no longer relies on the BTK pathway.

Dizal found this especially to be the case in patients who fail on Lilly's Jaypirca, a non-covalent BTK inhibitor that is said to remain active in many patients who are given covalent inhibitors but relapse by developing the C481 mutation. Lyn, a member of the Src tyrosine kinase family, is thought to be an alternative resistance mutation.

The ASCO data focused only on 50mg and 75mg doses, where ORRs of 84% and 69% respectively were seen. 50mg is the dose taken forward into phase 3, and here the investigators split out activity in patients on prior BTK inhibitors (82% ORR) and a prior BTK degrader (one response in two subjects).

However, while nearly all patients experienced tumour shrinkage, the authors weren't able to claim any responses in those who had received a non-covalent BTK inhibitor, who comprised 12% of the overall dataset. After ASCO Dizal told ApexOnco that three of four patients did in fact respond to DZD8586 after a non-covalent BTK inhibitor.

The way CLL patients might be treated is important in the context of Jaypirca's ability to rescue covalent BTK failures, and the possibility that BTK degraders might be better than either covalent or non-covalent inhibitors – suggested to some extent by studies of BeOne's BGB-16673 and Nurix's NX-5948. Whether DZD8586 might be better still is key.

DZD8586's phase 3 study doesn't appear on clinicaltrials.gov, but Zhang said it included ex-China patients, so wasn't geared only towards approval in China. However, he said he wasn't interested in pursuing an accelerated pathway in the US, based on phase 2 data, citing a fast-changing landscape as complicating a confirmatory trial.

Sunvo first

That said, Dizal's first shot at breaking into the US remains the EGFR inhibitor sunvozertinib, awaiting FDA approval for relapsed NSCLC harbouring an EGFR exon 20 insertion, a use for which it's already approved in China.

Its US filing was accepted in January with priority review, suggesting a PDUFA date in July. The supporting WU-Kong1 study part B included patients after chemo with or without Rybrevant, but Zhang confirmed that the label Dizal was seeking was in post-chemo patients, without a restriction to post-Rybrevant use.

The company also has early work on a fourth-generation EGFR inhibitor, DZD6008, designed to hit classic as well as resistance mutations, including some developed in response to treatment with Tagrisso, with high selectivity for mutated versus wild-type EGFR. An ASCO poster showed three responses among 12 patients, all in post-Tagrisso subjects, but only two of these were confirmed.

Ultimately, whether Dizal is able to sell any drug outside China is up in the air. As it has no US presence, even if sunvo is approved by the FDA its launch depends on Dizal finding a licensing partner.

This story has been updated to add post-ASCO comments from Dizal.

1835