Astra and J&J tussle over first-line lung

The companies clash over survival curve similarities – and differences.

The companies clash over survival curve similarities – and differences.

With the results of the Flaura2 and Mariposa studies now published, the makers of Tagrisso and Rybrevant, AstraZeneca and Johnson & Johnson, have launched a battle of words, each emphasising different aspects of their data to claim the upper hand. The result is a growing debate over which approach should define the next standard of care in first-line EGFR-mutated NSCLC.

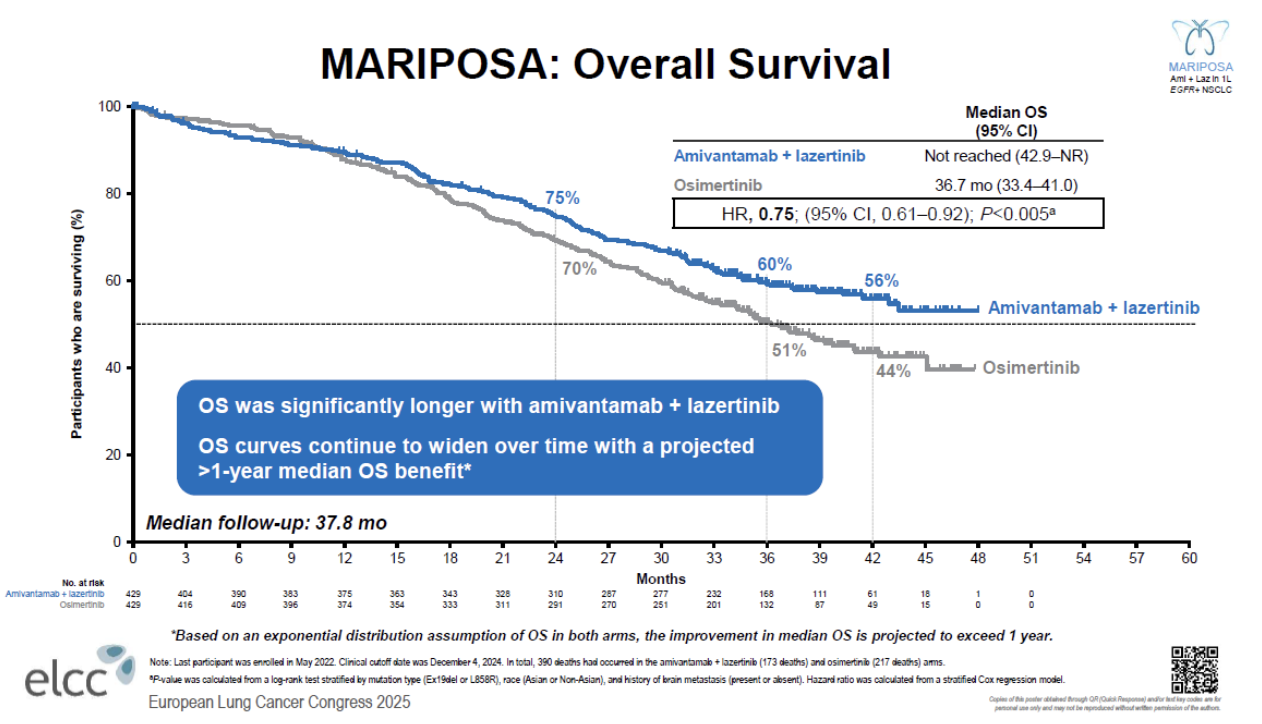

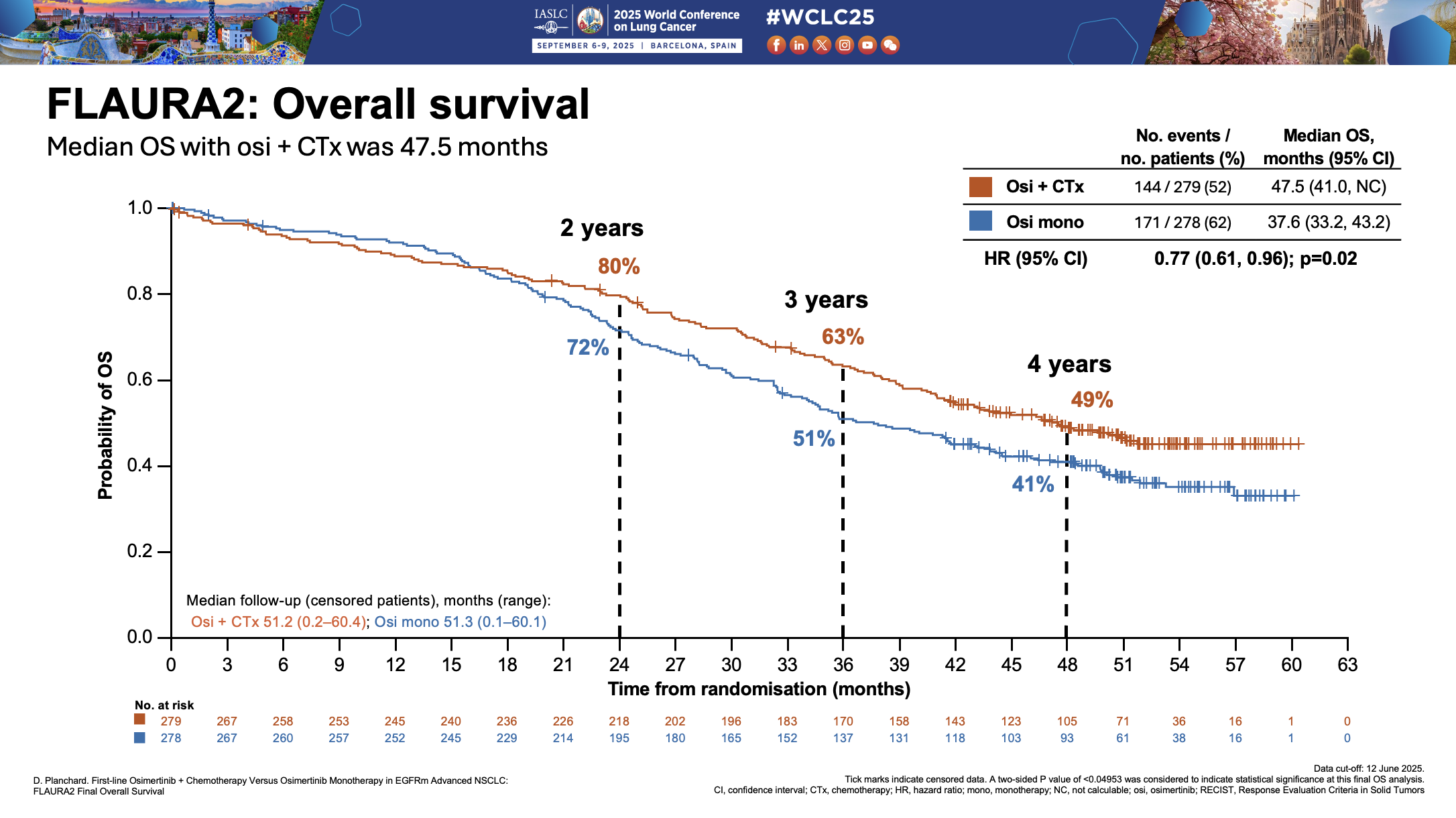

At the heart of the debate lies the survival benefit. On the face of it, the overall survival curves in the Flaura2 trial of Tagrisso plus chemo and the Mariposa study of Rybrevant plus Lazcluze look almost identical; however, in separate interviews, both companies have claimed that the survival curves are not comparable, but for different reasons.

J&J hasn't shied away from framing the debate as one of innovation versus repetition. “If you want to use two old drugs, fine. But it’s not changing the biology. Tagrisso plus chemo isn’t advancing innovation very much. It’s just doing something that’s been done before,” Mark Wildgust, J&J oncology’s vice-president of global medical affairs, told ApexOnco.

This pointed remark highlights the company’s strategy of taking a bold swing with Mariposa in an effort to dislodge the incumbent and redefine first-line care.

Separating curves

J&J contended that in Mariposa the curves separated early and continued to widen over time, and the company projected a median OS of more than four years with Rybrevant plus Lazcluze. The company also pointed out that the hazard ratio for OS had improved with each subsequent readout, whereas it had worsened over time in Flaura2.

AstraZeneca's head of lung cancer, Arun Krishna, pushed back, saying the dataset in Mariposa was less mature, at less than 45% versus 57% in Flaura2, which makes projecting a median unreliable. This is especially true, he said, when the curves cross over, as they do in Mariposa, as it suggests that the benefit is not consistent over time.

However, it's notable the curves in Flaura2 also cross.

This crossover has become a talking point. For J&J's Wildgust the phenomenon was simply “noise in the system – just a few patients who were a little bit sicker in one arm versus the other”.

AstraZeneca’s Krishna offered a different perspective, saying that greater toxicity with the active arm could negatively hit survival early on, but that the curve would then favour therapy as durable responses kick in.

Still, he noted that in Flaura2 there hadn’t been “any major differences” between the Tagrisso plus chemo and Tagrisso arms on adverse events and dropout rates.

Wildgust said the crossover in Mariposa hadn’t been caused by toxicity, although he admitted that there was a “good portion” of patients who discontinued early because of infusion-related reactions and rash with Rybrevant plus Lazcluze.

He also noted that Mariposa’s dosing regimen was not fully optimised; since the trial, the company has been trying to address these issues with prophylactic therapies and once-monthly subcutaneous Rybrevant dosing, for example in the Cocoon and Copernicus studies. Wildgust reckons that, “with the fully optimised regimen, that outcome will be even better than we see today”.

Another potential explanation that Krishna put forward for the curves crossing over in Flaura2 was differences between certain subgroups of patients, for example those with exon 19 mutations, who tended to do well with Tagrisso monotherapy.

Indeed, he contended that among this subgroup, which tends to have a relatively low tumour burden, Tagrisso monotherapy might be enough. “For sicker, more symptomatic patients, we would probably give combination therapy.”

Wildgust, meanwhile, was adamant that, given the results of both Mariposa and Flaura2, there was “no place” for Tagrisso monotherapy, or even TKI monotherapy more broadly.

Resistance

J&J is also highlighting resistance mechanisms as a key focus area. Wildgust noted that patients on Tagrisso or Tagrisso plus chemo tended to develop resistance quickly, whereas Rybrevant showed a significantly lower rate, according to a new analysis of Mariposa, presented at World Lung.

Krishna, on the other hand, argued that J&J “does not have any proof to really support that it actually is suppressing resistance, which then actually impacts outcomes”.

He added that resistance mechanisms were expected with any targeted therapy and should not dictate first-line decisions for all patients. Instead, clinicians may focus on identifying which patients are more prone to develop those resistance mechanisms, rather than applying a one-size-fits-all strategy.

Ultimately, treatment decisions in first-line EGFR-mutated NSCLC will continue to rest with physicians and patients. However, the onus will be on J&J to take market share from Tagrisso, which is already familiar to most clinicians in this setting and sold $6.6bn in 2024. J&J only recently started disclosing revenues for Rybrevant plus Lazcluze, which totalled $320m in the first half of 2025.

4155