The conjugate enthusiasm bypasses Mythic

The private ADC company is being wound down.

The private ADC company is being wound down.

The Nasdaq biotechnology index looks set to end the year up 30%, and antibody-drug conjugates remain among the most keenly researched oncology assets, but one company has run out of luck: Mythic Therapeutics, a private biotech that aimed to go back to basics in ADC development, is closing shop.

The first sign that things weren’t going well appeared on clinicaltrials.gov last week, when the phase 1 Kismet-01 study of Mythic’s lead asset, MYTX-011, was marked as terminated. This week the group confirmed the worst, saying it had found it impossible to raise the additional cash necessary to continue operations, and that as a result it was winding down and selling off assets.

Mythic focused on improving the release of an ADC in the tumour cell instead of outside, where healthy tissue is put at risk, and thus on delivering more payload to cells expressing low levels of a target antigen, with improved safety. Outlining the approach to ApexOnco last year the company’s chief science officer, Brian Fiske, said Mythic was one of few ADC players not fixated on linker-payloads and bystander activity.

In spite of this promise – and the fact it had been backed up with data at ASCO – none of the various financing possibilities Mythic had pursued came to fruition. The company had raised $103m in a series B round in late 2021, and that money was at one point expected to last only until the end of 2024, so the current year looks to have been run on a shoestring.

Target or focus?

It’s not clear why, given such promise, Mythic couldn’t attract the necessary funding. One possibility is that MYTX-011’s target, cMet, wasn’t sufficiently interesting.

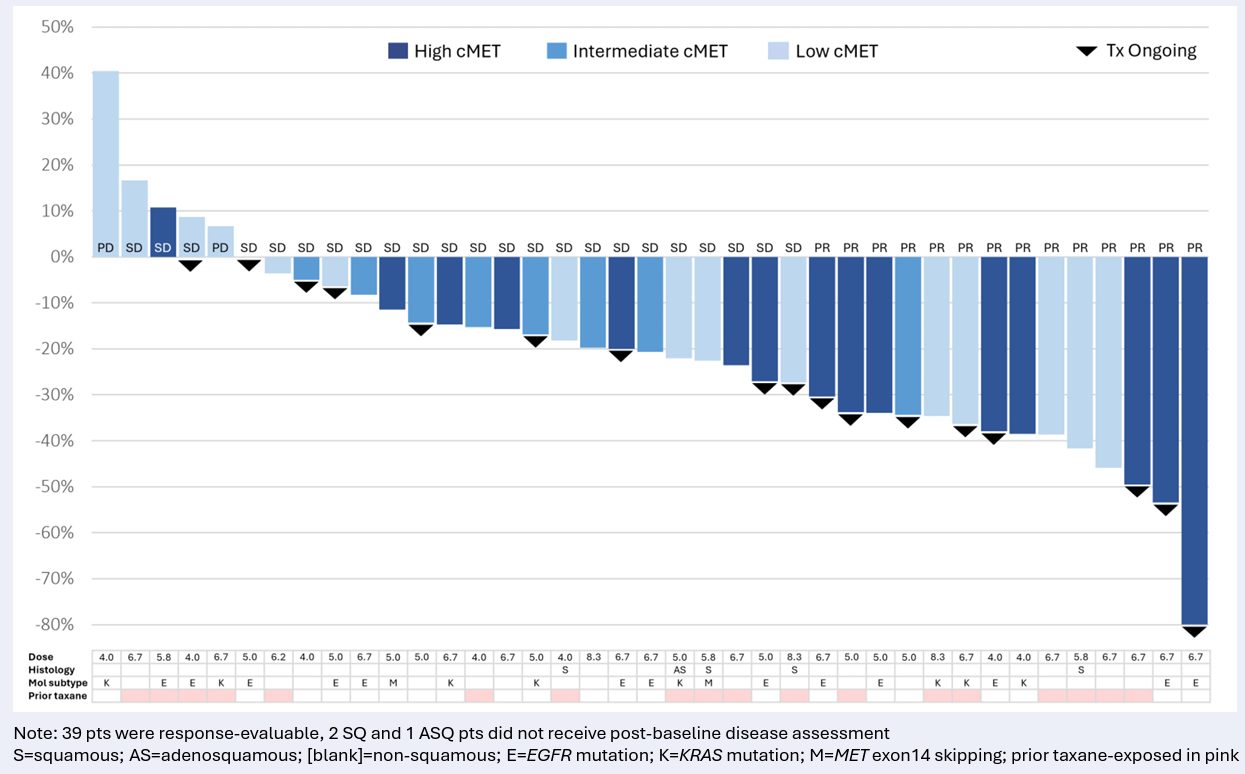

After some notable duds the cMet space has seen success at last, with AbbVie securing approval for Emrelis this year and boasting a follow-on anti-cMet ADC, telisotuzumab adizutecan. However, Emrelis was approved in relapsed NSCLC patients with high cMet overexpression, defined as ≥50% of tumour cells with strong staining, leaving the opportunity open for MYTX-011.

Indeed, Fiske told ApexOnco this week that he was “proud that we were able to show clinical data at ASCO demonstrating some important aspects of the science, including higher response rate versus Emrelis in cMet-low” patients. “Unfortunately that wasn't enough.”

Another possibility is that the ADC field in general is still obsessed with linker-payload technologies rather than working to improve basic biology, and Mythic simply didn’t tick the right boxes. However, this week alone has shown the shortcomings of even the highly touted deruxtecan warhead, with clinical holds revealed on studies of ifinatamab deruxtecan and Datroway.

Mythic stresses that MYTX-011's study wasn’t discontinued for clinical but for business reasons. The company is now seeking to sell off its assets, among which the most important might be rights to this project and the surrounding technology.

“I still think MYTX-011 can be a drug and a great option for patients in the right hands,” said Fiske.

Waterfall from Kismet-01 study of MYTX-011 at ≥4.0mg/kg Q3W

1727