ESMO 2025 – domvanalimab flies the flag for TIGIT

Full data from Edge-Gastric are presented at ESMO.

Full data from Edge-Gastric are presented at ESMO.

With Roche taking the opportunity of ESMO to detail four clinical study failures of its now discontinued anti-TIGIT MAb tiragolumab, it was left for Arcus to fly the flag for this mechanism with its Gilead-partnered domvanalimab, a molecule that now is one of just two key remaining anti-TIGITs in development.

Arcus was already an early beneficiary of ESMO’s 13 October abstract drop, its stock climbing 14% that day on publication of the first overall survival number from the Edge-Gastric study, combining domvanalimab with the anti-PD-1 MAb zimberelimab and chemo in first-line gastroesophageal adenocarcinomas. ESMO on Saturday saw the full data presented, along with the survival curves.

If domvanalimab remains one of the industry’s last shots at the TIGIT mechanism, even this claim is debatable; Arcus has had to rethink its approach in lung cancer, and the Edge-Gastric data have been subjected to various cuts. In November 2023, for instance, the company argued that the uncontrolled trial showed competitive response rates in high PD-L1 expressers, a post hoc analysis.

All-comers

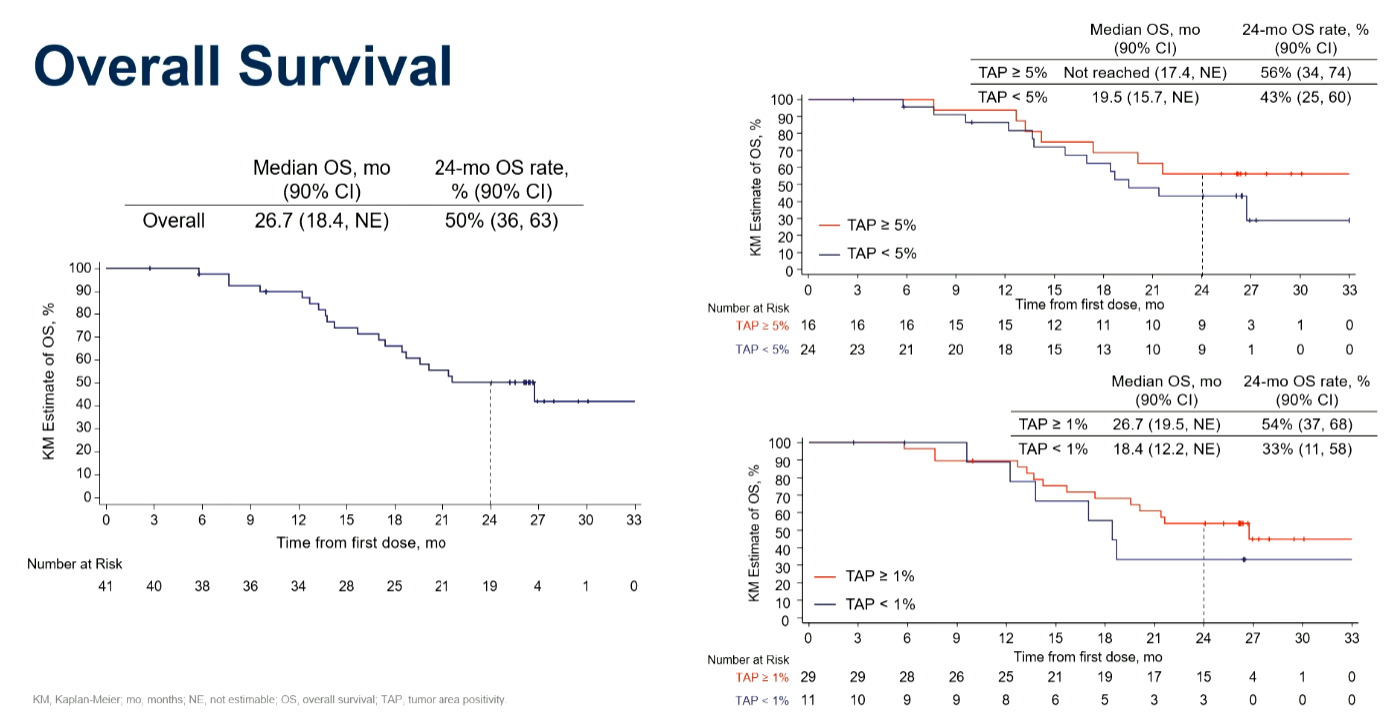

Now the narrative has shifted back to all-comers, with Arcus highlighting the intent-to-treat population in overall survival numbers from Edge-Gastric. Here the domvanalimab/zimberelimab/chemo triplet tested in the trial’s cohort A1 yielded mOS of 26.7 months, which Arcus argues is “well beyond what would be required to demonstrate clinically meaningful benefit over standard of care”.

The narrative switch back to all-comers comes as OS data in PD-L1 expressers were also revealed, and yielded an identical mOS number of 26.7 months. The investigators also cut the data for higher PD-L1 expression (≥5%), and here the median has yet to be reached, though this comprises only 16 patients.

Survival curves from Edge-Gastric

On a cross-trial basis the all-comers finding, from just 41 patients, does look competitive against mOS of 13.8 and 12.9 months with chemo combos of Opdivo (Checkmate-649) and Keytruda (Keynote-859) in similar first-line settings. In theory the number might bode well for Arcus’s own phase 3 trial, Star-221, which compares the TIGIT/PD-1/chemo triplet versus Opdivo plus chemo.

However, while Edge-Gastric doesn’t have a formal control, it does include a cohort that could provide vital information about domvanalimab’s contribution: cohort A2 tests zimberelimab plus chemo alone, but curiously nothing has been revealed about how its patients have fared.

As for safety, a 29% rate of infusion-related reactions was highlighted, but curiously the presenter, Dr Yelena Janjigian of Memorial Sloan Kettering, suggested that because "domvanalimab is an Fc-silent antibody most of the infusion-related reactions are likely due to PD-1 [zimberelimab]".

Gilead paid Arcus $750m to exercise opt-in rights to domvanalimab in 2021, before the TIGIT mechanism at Roche, Merck & Co, BeOne/Novartis and iTeos/GSK. The only company even more heavily invested in TIGIT than Arcus/Gilead now is AstraZeneca, with the anti-PD-1 bispecific rilvegostomig.

2057