Gilead gets into in vivo Car-T

Interius, one of the most advanced players, will cost $350m.

Interius, one of the most advanced players, will cost $350m.

With in vivo Car-T becoming increasingly hot, it was probably only a matter of time before Gilead got in on the action, and the group on Thursday swooped for one of the most advanced players, Interius BioTherapeutics.

The $350m up-front fee is about in line with the $425m that AstraZeneca shelled out for EsoBiotec earlier this year, but much lower than the $2.1bn that AbbVie paid for Capstan in June; the latter deal is largely focused on autoimmune disease.

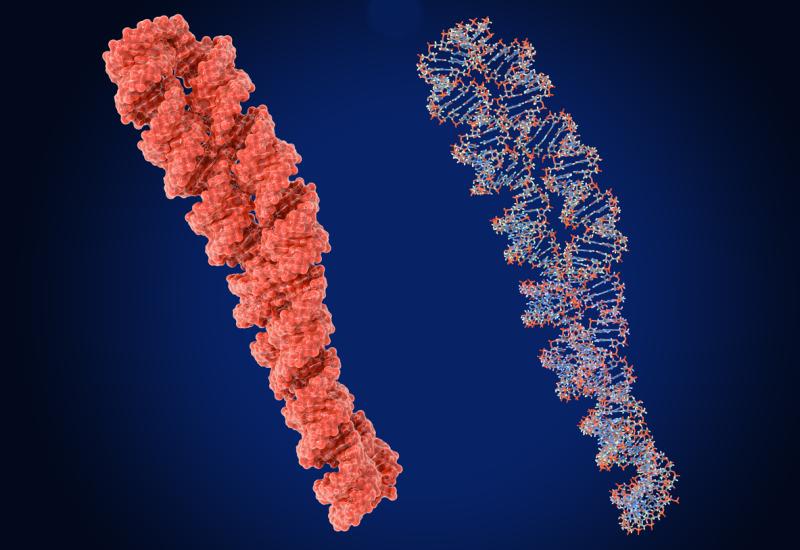

In vivo Car-T is designed to spur a patient's body to manufacture their own Car-T therapy, thereby reducing the cost, time and inconvenience associated with current autologous products.

Privately held Interius is one of a handful of in vivo Car-T players already in the clinic, with its lead project, the CD20-targeted INT2104, starting the Australian first-in-human Invise trial in B-cell malignancies last October. Initial results are expected in the second half, so perhaps Gilead had a sneak peek and liked what it saw.

Another relatively advanced player is Umoja, which has two assets in the clinic for B-cell cancers: UB-VV111, which targets CD19, and is in the US/Australian phase 1 Invicta trial; and UB-VV400, which hits CD22, and is in a Chinese phase 1.

AbbVie also has a collaboration with Umoja, which includes an option to license the smaller group’s CD19 projects, including UB-VV11. It’s not clear what the recent Capstan deal means for Umoja, as Capstan’s lead project, CPTX2309, also hits CD19.

Despite Interius and Umoja being first to the clinic, the EsoBiotec-originated ESO-T01 beat them to the punch in reporting data. Case reports published in July detailed four responses among four Chinese multiple myeloma patients receiving a low dose, bolstering hopes for the project and in vivo technology in general.

Several big groups are already involved in in vivo Car-T, with some showing more intent than others. If the excitement continues, more deals could follow.

Notable in vivo Car-T deals

| Big partner | Target | Deal type | Financials | Date |

|---|---|---|---|---|

| Gilead | Interius | Acquisition | $350m up front | 21 Aug 2025 |

| AbbVie | Capstan | Acquisition (main focus on autoimmune) | $2.1bn up front | 30 Jun 2025 |

| AstraZeneca | EsoBiotec | Acquisition | $425m up front | 17 Mar 2025 |

| Novartis | Vyriad | Collab | Undisclosed | 20 Nov 2024 |

| Astellas | Kelonia | Collab & tech licence | $40m up front | 15 Feb 2024 |

| AbbVie | Umoja | Collab & licence option | Up to $1.4bn (incl milestones) | 4 Jan 2024 |

| Sanofi | Tidal Therapeutics | Acquisition | $160m up front | 9 Apr 2021 |

Source: OncologyPipeline.

2611