J&J’s new trispecific play

JNJ-95566692 enters phase 1, with Qilu neck and neck.

JNJ-95566692 enters phase 1, with Qilu neck and neck.

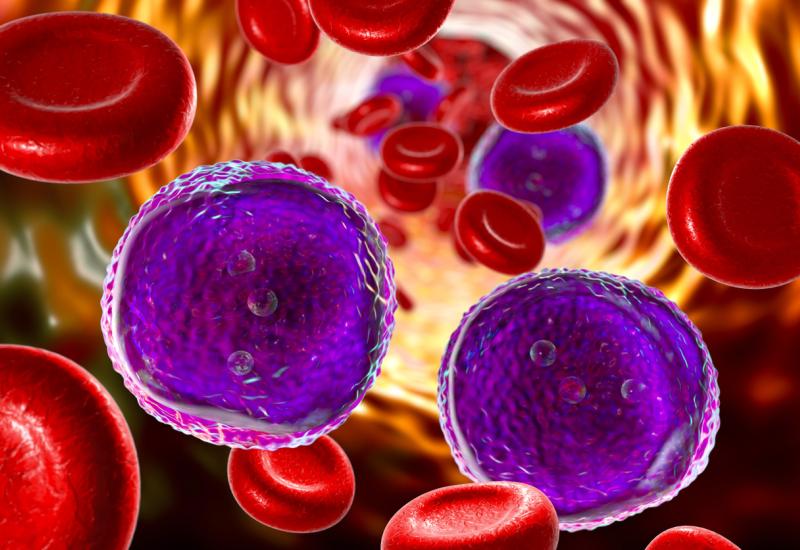

Johnson & Johnson is firmly marking trispecific T-cell engagers as an area of interest, moving to start a phase 1 study of JNJ-95566692 this month, according to new listings on the clinicaltrials.gov registry.

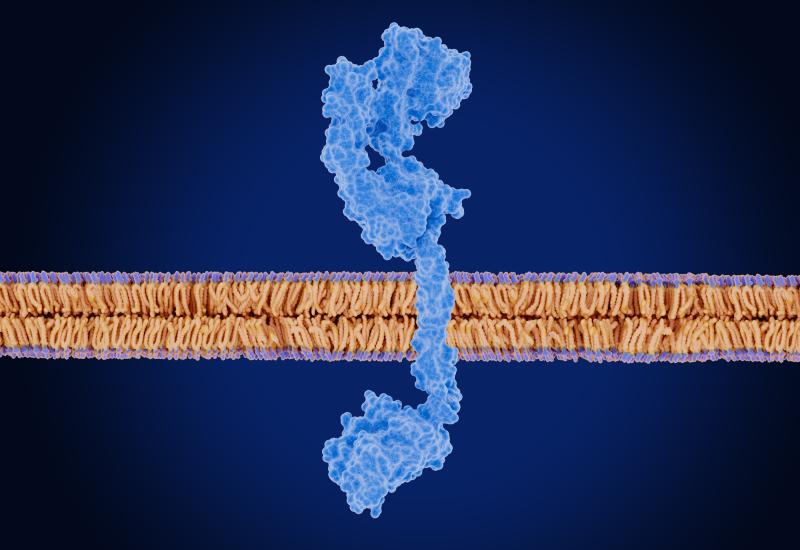

The company has already made a mark here, with its first take on the mechanism, the anti-BCMA x GPRC5D T-cell engager ramantamig, starting phase 3 imminently. JNJ-95566692 targets CD79b and CD20, and coincidentally Qilu is taking an identically acting asset, QLS2313, into phase 1 at the same time. Equally surprising is that JNJ-95566692 isn’t J&J’s first shot at CD79b x CD20 blockade.

That honour belongs to JNJ-80948543, an anti-CD79b x CD20 T-cell engager that started a phase 1 trial in non-Hodgkin’s lymphoma and chronic lymphoblastic leukaemia in mid-2022. That study remains active, having recruited 167 out of an initially planned 180 patients, though no results from it have publicly been disclosed.

As such it’s not clear whether JNJ-95566692 marks an attempt by J&J to improve on any shortcomings of JNJ-80948543, though it would be logical to draw such a conclusion. It’s also unclear how the two molecules differ from one another, but perhaps they target different epitopes.

JNJ-95566692, JNJ-80948543 and ramantamig are J&J’s only trispecific T-cell engagers, according to OncologyPipeline. Another curious parallel with Qilu is that the Chinese company is separately developing a ramantamig me-too, having taken the anti-BCMA x GPRC5D T-cell engager QLS4131 into phase 1 in mid-2024.

In the CD79b x CD20 space little is known about Qilu’s QLS2313, so again it’s difficult to compare this molecule against the J&J projects. CD79b is most notable for being the target of Roche’s marketed ADC Polivy, and until recently there had been very little industry interest in developing other molecules that hit this protein.

Recently disclosed first-in-human studies*

| Project | Mechanism | Company | Trial | Scheduled start |

|---|---|---|---|---|

| IASO208 | CD20 Car-T | IASO Biotherapeutics | R/r B-cell malignancies | 21 Nov 2025 |

| 125I-CLR 121125 | Phospholipid ether radioconjugate | Cellectar Biosciences | Triple-negative breast cancer | 5 Dec 2025 |

| ZX-8177 | ENPP1 inhibitor | Nanjing Zenshine | Solid tumours | 26 Dec 2025 |

| M7437 | Ly6E ADC | Merck KGaA | Solid tumours known to have high Ly6E expression | 2 Jan 2026 |

| PLB-002 | Claudin6 ADC | PrimeLink BioTherapeutics | Solid tumours | 12 Jan 2026 |

| JNJ-95566692 | CD79b x CD20 T-cell engager | Johnson & Johnson | Non-Hodgkin’s lymphoma | 16 Jan 2026 |

| QLS2313 | CD79b x CD20 T-cell engager | Qilu | R/r haematological malignancies | Jan 2026 |

| DPTX3186 | β-catenin inhibitor | Dewpoint Therapeutics | Wnt-activated solid tumours | Jan 2026 |

Note: *these projects were first listed on the clinicaltrials.gov database between 19 and 31 Dec 2025.

Recent first-in-human study initiations also include two ADCs, Merck KGaA’s anti-Ly6E molecule M7437, and PrimeLink’s anti-LPB-002, which hits Claudin6.

The former is especially intriguing, as Merck had earlier only said that this was an ADC against an undisclosed target, using an exatecan warhead, and derived from “an undisclosed collaboration”. It’s only the new clinicaltrials.gov listing that discloses Ly6E as M7437’s target.

That’s especially relevant for Zymeworks, which presented ZW327, an anti-Ly6E ADC, at last year’s AACR conference. ZW327, still in preclinical development, appears to be the only other active industry asset apart from M7437 that hits Ly6E, Roche having discontinued the anti-Ly6E naked MAb RG7841 all the way back in 2016.

Claudin6, meanwhile, was once the domain of BioNTech, via several mechanistic approaches, but the company backed away from this target last year.

And a private US biotech, Dewpoint Therapeutics, is starting a phase 1 study of the β-catenin inhibitor DPTX3186, four months after closing a series D specifically geared towards development of this asset. However, that raised just $59m, significantly lower than Dewpoint’s $150m series C; the company’s series A to D financings combined total $346m.

2072