Monjuvi hits in the front line, but what about Revlimid?

Having been delayed by nearly a year, the result of Monjuvi’s Frontmind study in first-line lymphoma could flatter Incyte’s acquisition of this drug. Monjuvi, an anti-CD19 MAb, sold $103m (+19%) in the first nine months of 2025 in follicular lymphoma and relapsed/refractory diffuse large B-cell lymphoma; that seems unimpressive, but Incyte paid just $25m to take Monjuvi from Novartis to satisfy antitrust concerns over Novartis’s 2024 takeover of the drug’s originator, MorphoSys. On Monday Frontmind was toplined positive for PFS, and Incyte said the data would be filed with regulators in the first half. Approval would open up a larger indication than the relapsed-refractory setting currently backed by Monjuvi’s accelerated US nod, but that of course depends on full data. Frontmind’s design was unusual: control was R-Chop chemo, but active treatment wasn’t Monjuvi plus R-Chop, but Monjuvi plus Revlimid and R-Chop. The disclosed hazard ratio for PFS of 0.75, with a fairly high confidence interval upper bound, is bound to raise questions given that adding Revlimid to R-Chop has been shown to improve PFS and OS numerically versus R-Chop alone. It’s been argued that Revlimid and Monjuvi act synergistically, but the precise contribution of the Incyte drug remains unclear.

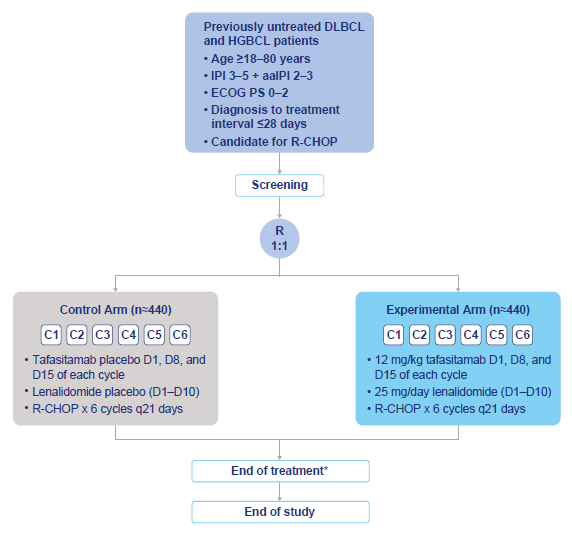

Frontmind study design

1672