The month ahead: June’s upcoming events

Crunch time approaches for UroGen.

Crunch time approaches for UroGen.

June will see the world’s biggest cancer conference, ASCO, but there’s plenty more going on for oncology watchers. Other meeting taking place next month include the European Hematology Association's annual symposium and the ESMO gynaecological cancers congress, amid the usual investment bank events.

Several FDA approval decisions are also due in June, including a ruling on UroGen’s controversial bladder cancer project UGN-102, which received a narrow thumbs down at a recent adcom. There are also some big trials set for a first-half readout, including the Costar Lung study of GSK’s cobolimab, and Tropion-Breast02, testing AstraZeneca and Daiichi’s Datroway in first-line triple-negative breast cancer.

Gilead recently got one up on Astra and Daiichi, reporting a win with its rival TROP2 ADC Trodelvy in the analogous Ascent-03 study. However, Gilead merely noted that there had been “no OS detriment” with Trodelvy, so there could be room for Datroway to do better.

Hopes are dimmer for GSK’s cobolimab, an anti-Tim-3 Mab that’s still standing despite the discontinuation of various similarly acting projects. Costar Lung compares cobolimab plus Jemperli plus docetaxel, versus docetaxel alone in post-PD-(L)1 lung cancer; another arm will test a Jemperli/docetaxel doublet. The study was once set to yield data in late 2024.

UroGen decision

UroGen’s stock, meanwhile, reached all-time lows following its FDA adcom last week. At the adcom the FDA criticised the company for running a single-cohort study of UGN-102, after apparently advised it to carry out a randomised trial.

A decision is also due on Merck’s stalwart Keytruda in perioperative head and neck cancer, but there are questions about whether any label would be limited to PD-L1 expressers.

And Nuvation could get the go ahead for its first project, the ALK/ROS1/NTRK inhibitor taletrectinib, in ROS1-positive NSCLC regardless of therapy line. Nuvation is ahead of its rival Nuvalent, which is set to file its contender zidesamtinib with the FDA by mid-year in TKI pre-treated ROS1-positive NSCLC. However, Nuvalent has a market cap of over $5bn, versus Nuvation’s $800m.

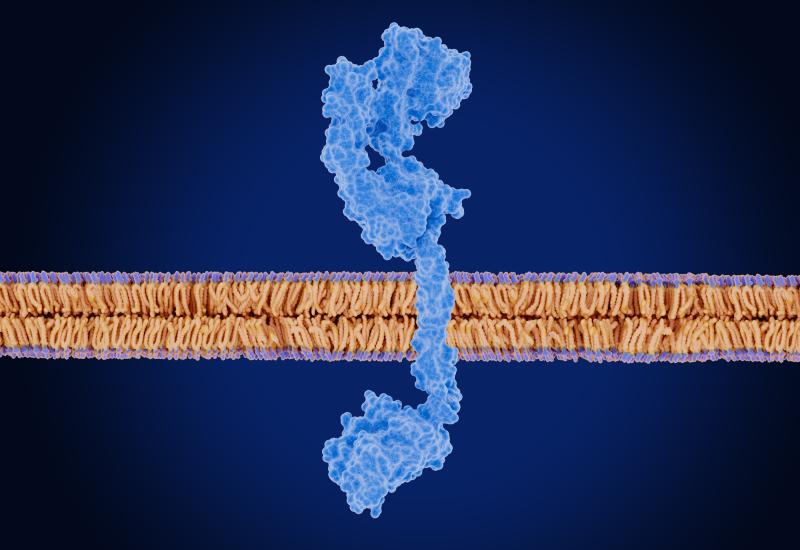

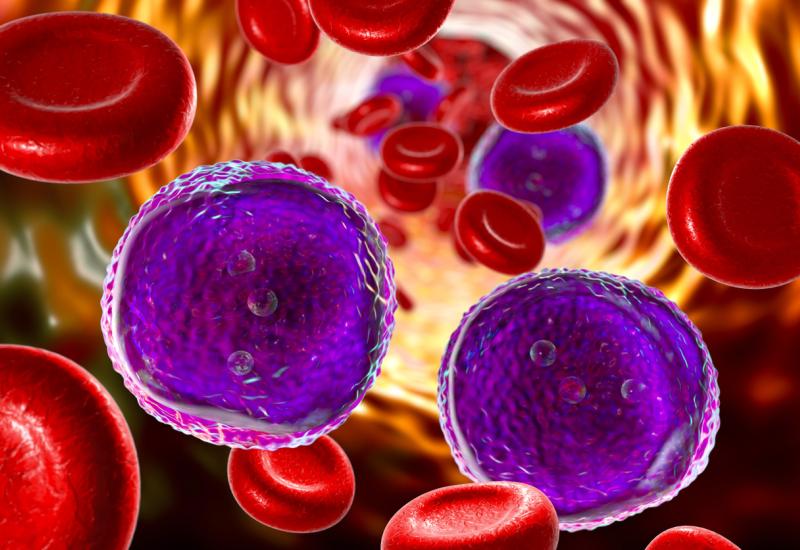

Lilly could also be due a couple of big oncology FDA decisions, for its oral SERD imlunestrant and non-covalent BTK inhibitor Jaypirca. The latter already has accelerated approval for chronic lymphocytic leukaemia following a BTK inhibitor and BCL2 blocker. This could be confirmed and expanded by the Bruin CLL-321 trial, in an earlier post-BTK setting – but a lack of overall survival benefit has left questions about whether approval might be rescinded entirely.

Lilly hasn’t provided a PDUFA date for Jaypirca, but disclosed in February that it had completed global regulatory filings, and the drug has already got the EU nod.

The company has been similarly reticent about imlunestrant, except to say in its fourth-quarter earnings call that the project had been filed for metastatic breast cancer. Lilly later confirmed to ApexOnco that the submission concerned imlunestrant monotherapy in ESR1 mutants – the patient subgroup that benefitted in the supporting Ember-3 trial.

Ember-3 also tested imlunestrant plus Lilly’s CDK4/6 inhibitor Verzenio, a combo that prevailed in all comers, but data here are less mature, the spokesperson said, adding that Lilly would pursue submissions here “when appropriate”.

June’s upcoming events

| Event | Timing | Details |

|---|---|---|

| ASCO | 30 May - 3 Jun | Chicago |

| William Blair annual growth stock conference | 3-5 Jun | Chicago |

| Jefferies global healthcare conference | 3-5 Jun | New York |

| Goldman Sachs annual global healthcare conference | 9-11 Jun | Miami |

| European Hematology Association conference | 12-15 Jun | Milan |

| UGN-102 PDUFA | 13 Jun | Low-grade, intermediate-risk NMIBC (Envision); May adcom voted 4-5 against benefit/risk |

| International Conference on Malignant Lymphoma | 17-21 Jun | Lugano, Switzerland |

| ESMO gynaecological cancers congress | 19-21 Jun | Vienna |

| Roche hematology investor event | 23 Jun | Virtual |

| Keytruda PDUFA | 23 Jun | Neoadjuvant + adjuvant HNSCC (Keynote-689, new use) |

| Taletrectinib PDUFA | 23 Jun | ROS1-positive NSCLC (line agnostic, Trust-I & II) |

| BeOne Medicines (formerly known as BeiGene) R&D day | 26 Jun | Virtual |

| CHMP day | 27 Jun | Decisions could come on Exelixis/Ipsen’s Cabometyx in neuroendocrine tumours (Cabinet, FDA approved Mar 2025); Iovance’s Amtagvi in relapsed melanoma (C-144-01 trial, FDA approved Feb 2024) |

| Data from ph3 Costar Lung trial of GSK’s cobolimab + Jemperli + chemo in 2nd-line NSCLC (post-PD-(L)1/chemo) | H1 2025 | Various anti-Tim-3 MAbs abandoned |

| Data from ph3 Tropion-Breast02 trial of Astra/Daiichi’s Datroway in 1st-line TNBC (PD-L1-ineligible) | H1 2025 (delayed from H2 2024) | Rival Ascent-03 study of Gilead’s Trodelvy just toplined positive |

| Imlunestrant PDUFA | Assumed Jun | 2nd-line ER+/HER2- breast cancer, monotherapy in ESR1m only (Ember-3) |

| Jaypirca PDUFA | Assumed Jun | Decision on full approval in relapsed CLL (Bruin-CLL-321, confirmatory trial) |

Note: HNSCC=head and neck squamous cell carcinoma; NMIBC=non-muscle invasive bladder cancer. Source: OncologyPipeline.

1085