A new clinical KRAS degrader

Three private biotechs enter clinical trials, one targeting KRAS.

Three private biotechs enter clinical trials, one targeting KRAS.

With rumours about a possible acquisition continuing to swirl around Revolution Medicines, and Erasca sitting on a 100% share price bump over five days, it’s clear that broad KRAS approaches remain hot. Now another player, privately held PAQ Therapeutics, is entering the game, with the start of a first-in-human study of its KRAS degrader PT0511.

The development is one of several featuring private biotechs, as revealed in new listings on the clinicaltrials.gov registry. Also new into the clinic are another degrader – this one’s target is undisclosed – from Neomorph, and a Car-T therapy against PSMA, AB-3028, originated by ArsenalBio.

However, only PAQ appears to have tapped venture financiers for cash last year, closing a $39m series B round in May. Neomorph doesn’t appear to have raised money since its $109m series A back in 2020, though it did strike technology deals covering degraders, with Novo Nordisk in 2024 and with AbbVie a year ago, and these will have given it additional cash.

In terms of VC financing ArsenalBio is the most impressive of the trio by far. The San Francisco-based group raised $325m in a series C round in September 2024, just two years after closing a $220m series B. With such rich backing it might come as a surprise that ArsenalBio discloses just two pipeline projects, and that AB-3028 is its first to enter human trials.

KRAS interest

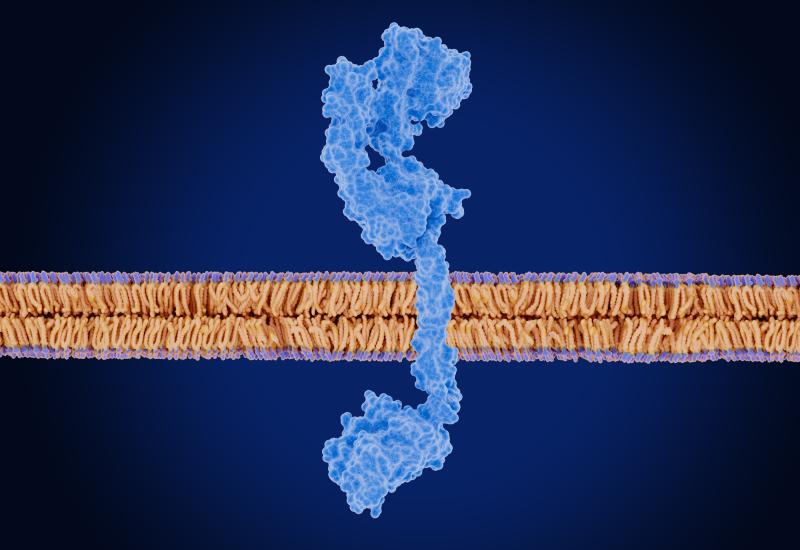

PAQ’s stated goal is to unlock the power of KRAS degradation, and the $39m it raised was actually geared towards funding a phase 1 trial of its first project, the anti-KRAS G12D degrader PT0253.

Now comes PT0511, a project about which very little has been disclosed, but which appears from the clinicaltrials.gov entry to have pan-KRAS activity. Erasca’s Joyo-derived ERAS-0015, the subject of recent investor enthusiasm, is a pan-RAS molecular glue, while the post prominent competing pan-KRAS degrader is probably Astellas’s ASP5834.

Recently disclosed first-in-human studies*

| Project | Mechanism | Company | Trial | Scheduled start |

|---|---|---|---|---|

| BEAM-103 | CD117 MAb | Beam | Healthy volunteers (sickle cell disease project) | 27 Oct 2025 |

| PT0511 | KRAS degrader | PAQ Therapeutics | +/- Erbitux in KRASm solid tumours | 12 Nov 2025 |

| LVIVO-TaVec200 | In vivo GPRC5D Car-T | Legend | R/r multiple myeloma | 10 Dec 2025 |

| RPTR-1-201 | Undisclosed TCR-based bispecific | Repertoire Immune Medicines | +/- PD-(L)1 in solid tumours | 15 Dec 2025 |

| NEO-811 | Undisclosed degrader | Neomorph | Clear cell renal cell carcinoma | 19 Dec 2025 |

| TQB3217 | USP1 inhibitor | Chia Tai Tianqing | Unspecified | Dec 2025 |

| TY-1054 | TEAD inhibitor | TYK Medicines | Solid tumours | 1 Jan 2026 |

| AB-3028 | PSMA Car-T | ArsenalBio | PSMA+ve metastatic castration-resistant prostate cancer | Jan 2026 |

Note: *these projects were first listed on the clinicaltrials.gov database between 15 and 26 Dec 2025.

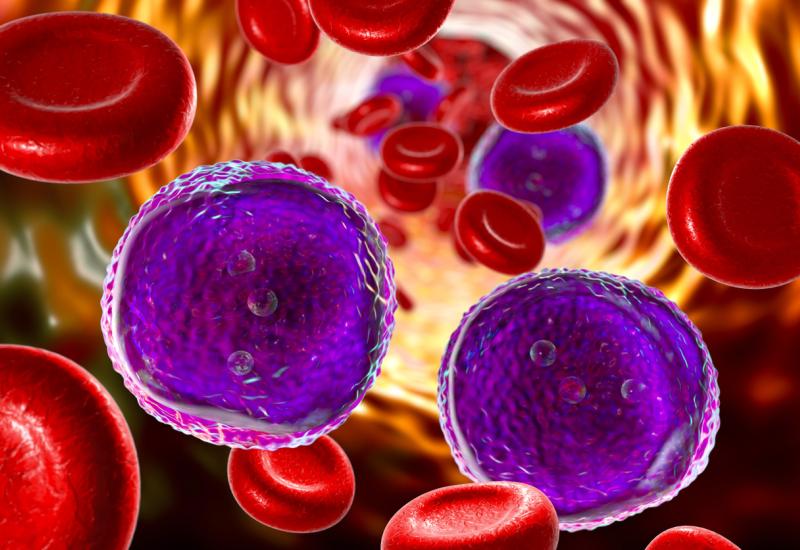

When it comes to hot areas of research it’s impossible also to ignore in vivo Car-T therapy, and the latest trial listings reveal another entrant, Legend’s GPRC5D-targeting LVIVO-TaVec200.

This comes shortly after PersonGen’s anti-CD19 project LV009 became the 14th in vivo Car-T to go into human trials, with enthusiasm still backed by case reports in studies of Kelonia’s KLN-1010 and EsoBiotec’s (now AstraZeneca’s) ESO-T01. LVIVO-TaVec200 is actually Legend’s second clinical-stage in vivo Car-T, the group having taken LVIVO-TaVec100, whose target is undisclosed, into phase 1 last May.

Biotech investors focused on small-molecule approaches will also note the continued interest in USP1 and TEAD, with first-in-human studies featuring Chia Tai’s TQB3217 and TYK Medicines’ TY-1054 respectively. Both targets have seen setbacks, with the latter recently featuring Novartis’s discontinuation of IAG933 over lack of tolerability and efficacy.

2106