J&J tries to outdo Tecvayli

With a phase 3 trial of the trispecific T-cell engager ramantamig, J&J will challenge itself.

With a phase 3 trial of the trispecific T-cell engager ramantamig, J&J will challenge itself.

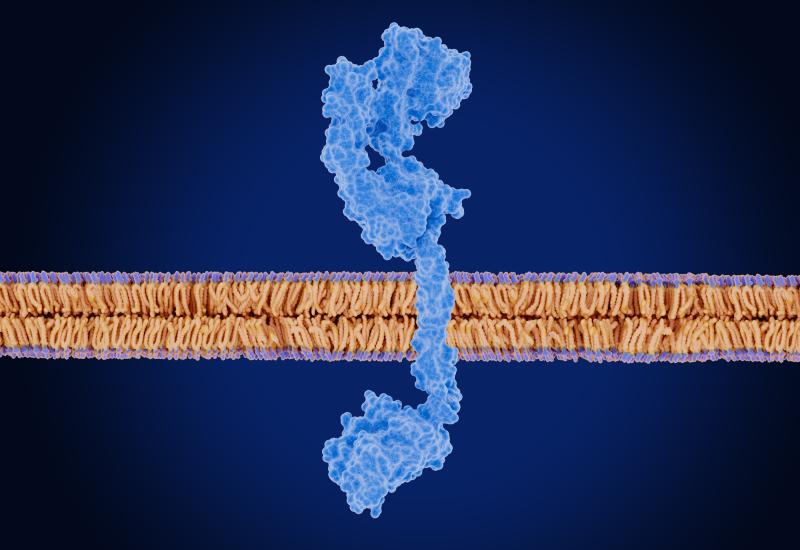

At this year’s ASCO Johnson & Johnson looked like it was trying to eclipse its existing T-cell engagers with a trispecific project against BCMA and GPRC5D, and now it’s official: the group is testing the latter asset, ramantamig, versus its own Tecvayli in a phase 3 multiple myeloma trial.

J&J has jumped straight from phase 1 to phase 3 with ramantamig, but doesn’t believe that it’s rushed things, the company’s vice-president of global medical affairs, Mark Wildgust, told ApexOnco in a pre-ASH briefing. “We studied 26 different schedules and doses of ramantamig in that initial phase 1,” he said, adding that this allowed the company to find the optimal dose.

In phase 1 a regimen comprising an initial 5mg, then a 100mg monthly subcutaneous dose led to a 100% overall response rate among 27 patients who were naive to therapies hitting BCMA and GPRC5D – the two targets of ramantamig, previously known as JNJ-79635322.

This is presumably the dose that J&J is taking into phase 3, although this isn't disclosed in the recent clinicaltrials.gov listing.

It’s also unclear whether patients will be BCMA and GPRC5D naive, as this isn’t specified among the study’s inclusion and exclusion criteria. In BCMA/GPRC5D-exposed patients, ramantamig led to a 55% ORR across doses in phase 1.

Third line

The phase 3 trial, Trilogy-4, which is due to start next February, will enrol patients who have received at least three prior therapies, including a proteasome inhibitor, an immunomodulatory drug, and an anti-CD38 antibody such as J&J and Genmab’s Darzalex.

Still, J&J believes that the ultimate market for ramantamig will be the second and first-line settings, and perhaps even the precursor condition smouldering myeloma, Wildgust said. Combos could be the way forward in earlier lines, and J&J also has a phase 1 combination study under way.

Tecvayli, a BCMA-targeting T-cell engager, currently has FDA accelerated approval for fifth-line multiple myeloma. However, various earlier-line trials are ongoing, and the Majestec-3 study recently showed a benefit with Tecvayli plus Darzalex in patients with one to three lines of prior therapy – setting this combo up to be used as early as first relapse, if approved.

J&J also has a GPRC5D-targeting T-cell engager, Talvey, which has the accelerated nod for fifth-line multiple myeloma. One question is why J&J isn’t comparing ramantamig to a combination of Tecvayli and Talvey, given that it believes the new project could be more than the sum of its parts, as the molecule has been redesigned to incorporate “optimised binders”.

Either way, if ramantamig succeeds, J&J looks set to cannibalise its existing drugs. As well as Tecvayli and Talvey it markets the BCMA-targeting Car-T Carvykti in the second line. Working out the sequence of these therapies could be a problem for the future. First, J&J has to show that ramantamig does indeed represent an improvement.

Ramantamig studies

| Trial | Setting | Regimen | Note |

|---|---|---|---|

| Ph1 79635322MMY1001 | r/r multiple myeloma or AL amyloidosis | Monotx (uncontrolled) | Data at ASCO 2025: 100% ORR with RP2D in BCMA/GPRC5D-naive pts |

| Ph1 79635322MMY1002 | 1st to 4th-line multiple myeloma | + Darzalex (+/- Revlimid) or Pomalyst (uncontrolled) | Completes Mar 2028 |

| Ph3 Trilogy-4 | 4th-line multiple myeloma | Monotx, vs Tecvayli | To start Feb 2026 |

Source: OncologyPipeline & clinicaltrials.gov.

2389