Rakuten sheds light on its conjugate

The company secures funding to push its lead candidate towards US approval.

The company secures funding to push its lead candidate towards US approval.

Rakuten Medical has raised $100m in a series F round, the fourth-biggest venture capital fund raising in oncology in the past month, to support US development of its lead antibody-dye conjugate Akalux (ASP-1929). The light-activated cancer therapy comprises the antibody used in Erbitux linked to IRDye 700DX.

The therapy received regulatory approval in Japan in September 2020 for head and neck carcinoma, and Rakuten is now running two global phase 3 trials. However, the status of the first, in third-line head and neck cancer, is sketchy, and it appears likely that the study hasn't yielded the expected result.

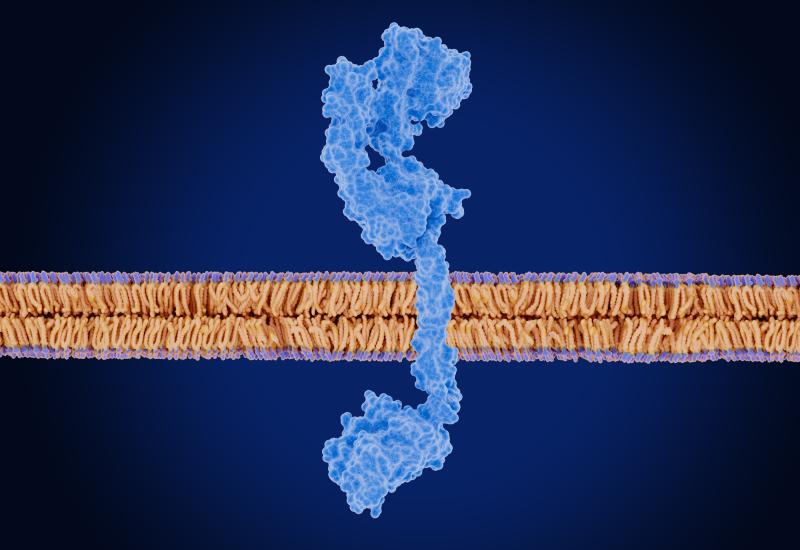

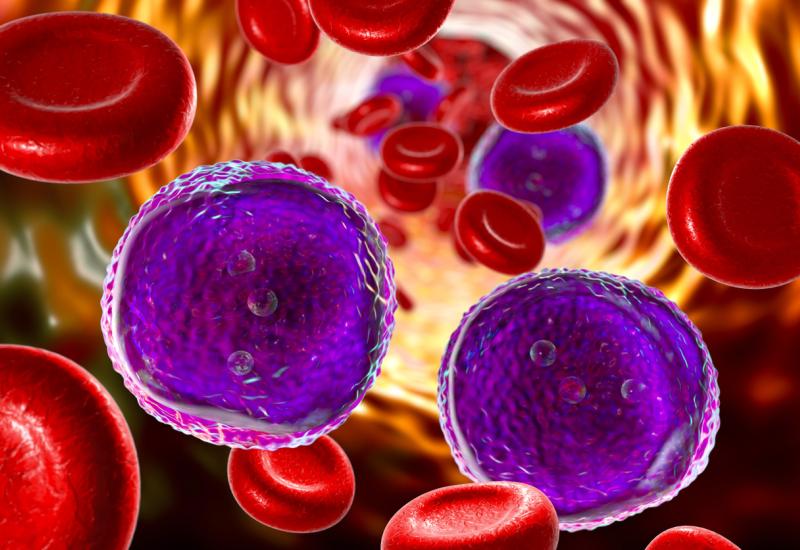

The company’s Alluminox platform pairs tumour-targeting antibodies with a light-activatable dye. Once illuminated at the tumour site, the conjugate is designed to be activated and trigger localised tumour cell death. The company argues that the effect goes further, driving both innate and adaptive immune activation through immunogenic cell death and by stripping away immunosuppressive cells in the tumour microenvironment.

Let there be light?

The first pivotal study, ASP-1929-301 (Luzera-301), is evaluating Akalux as a third-line treatment for recurrent or metastatic head and neck cancer. The trial was expected to be completed in December 2025, but the group hasn't provided any updates since 2024. Rakuten told ApexOnco that data from the trial would be "analysed and presented at upcoming medical conferences to inform future research and real-world application", which doesn't suggest a high degree of optimism over the results.

A second study, ASP-1929-381 (Eclipse), is testing Akalux in combination with Keytruda as a first-line therapy for recurrent head and neck cancer. The phase 3 trial compares two doses of Akalux, 320mg and 640mg, plus Merck & Co's anti-PD-1 MAb, versus Keytruda alone, with overall survival as the primary endpoint. Completion is expected in September 2028, with Rakuten Medical planning to submit a US BLA later that year.

Last September the company disclosed updated results from 18 patients treated with the same combo in the phase1/2 ASP-1929-181 study. Akalux plus Keytruda produced an ORR of 28%, with a median overall survival of 25.6 months. Serious adverse events were reported in 63% of patients, with no treatment-related deaths observed.

Investors might be cheered by a cross-trial comparison with Keynote-048, the trial that led to the approval of Keytruda in first-line head and neck cancer, where median overall survival for patients with a PD-L1 expression of ≥1% was 12.3 months, roughly half of what has been reported so far with the Akalux/Keytruda combination.

However, these kinds of cross-trial comparisons should be taken with a pinch of salt, and Rakuten still has it all to prove in Eclipse. And its backers have a while to wait to see if their money has been put to good use.

$100m+ venture financing rounds in the past month

| Company | Note/purpose |

|---|---|

| Protego Biopharma | $130m series B, led by Novartis; to advance PROT-001 into a pivotal trial for AL amyloidosis |

| Triana Biomedicines | $120m series B, includes Pfizer among investors; to advance ALK degrader TRI-611 |

| D3 Bio | $108m series B, incudes WuXi AppTec among investors; to support global phase 3 study of elisrasib |

| Rakuten Medical | $100m series F; to advance Akalux Eclipse global phase 3 trial |

Source: OncologyPipeline.

818