ArriVent moves to take on Rybrevant

Furvent, in first-line EGFR exon 20 insertion lung cancer, reads out imminently.

Furvent, in first-line EGFR exon 20 insertion lung cancer, reads out imminently.

ArriVent’s focus with the tyrosine kinase inhibitor firmonertinib has increasingly been on lung cancer harbouring co-called PACC mutations, but a more traditional setting still remains in play. That setting is NSCLC with EGFR exon 20 insertion, where a first-line phase 3 study called Furvent is expected to yield data shortly.

Furvent’s results had earlier been expected last year, and their slippage has accompanied Arrivent’s growing moves into NSLCC with PACC (P-loop alpha-c helix compressing) mutations, where the pivotal Alpacca trial began recently. Nevertheless, some analysts still see an important opportunity for firmonertinib to unseat Johnson & Johnson’s Rybrevant in the exon 20 niche.

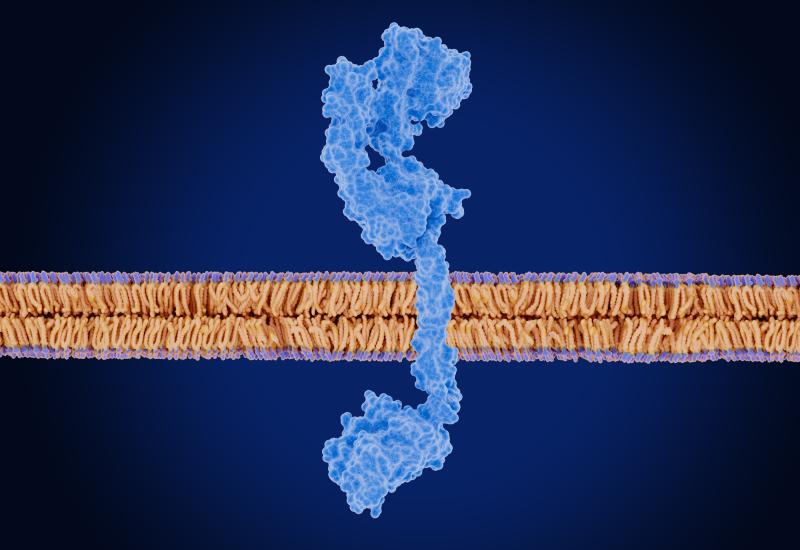

A key difference between the two assets is that Rybrevant is an antibody, which binds to cMet and EGFR. But the J&J drug has secured approvals in first-line and relapsed exon 20 insertion EGFR-mutant NSLCC, respectively as part of a chemo combo (backed by the Papillion study) and as monotherapy (Chrysalis), and so it represents a key comparator for firmonertinib.

In line good enough?

Jones Research analysts have written that an oral drug in monotherapy, like firmonertinib, can “easily capture” most of the market if its efficacy is at least in line with Rybrevant plus chemo.

While technically all firmonertinib needs to do to succeed is to beat Furvent’s chemo control cohort, the real baseline is Rybrevant. In J&J’s Papillon study 67% of patients had confirmed responses to Rybrevant plus chemo, and the combo yielded 11.4 months of median progression-free survival.

Another key consideration is the toxicity of a MAb/chemo regimen, and Papillon showed considerable haematological adverse events, including a 33% rate of grade ≥3 neutropenia.

In gauging Furvent's success probability investors have one early trial to go by, and that comes courtesy of Allist, the Chinese company from which Arrivent licensed firmonertinib. Allist reported data from this study, called Favour, at the World Lung congress in 2023, showing a 79% ORR in 28 patients given a 240mg daily dose; 240mg as well as 160mg are being tested in Furvent.

With the caveat that Chinese data might not translate into a global setting, and that results would naturally be expected to wane in the wider setting of phase 3, the Favour results do at least show that Arrivent is in with a chance. Diarrhoea was a major side effect, common to many kinase inhibitors, but the incidence of grade 3 events looked impressively low.

Against the odds

If Arrivent succeeds in this treatment niche it will have done so against some considerable odds. Two small-molecule EGFR inhibitors have been approved for EGFR exon 20 insertion NSCLC – Takeda’s Exkivity and just last year Dizal’s Zegfrovy – but the first was pulled from the market after flunking a confirmatory trial.

Importantly, Zegfrovy (like Exkivity before it) is approved for relapsed patients, so it doesn’t yet represent a direct threat to ArriVent. Also looming large are the discontinuations of several clinical-stage EGFR exon 20 insertion inhibitors, from companies including Spectrum, Blueprint and Black Diamond.

That’s not to say that Zegfrovy might not in future become a threat, but Dizal is notable for not having a US presence, so the potential of that drug in the west remains unknown. In the first-line WU-Kong15 trial Zegfrovy yielded a confirmed ORR of 73% among 26 patients given 200mg daily, and a global phase 3, WU-Kong28, ends shortly.

Another potential newcomer is Otsuka/Cullinan’s zipalertinib, whose rolling US filing for relapsed EGFR exon 20 insertion NSCLC is to be completed in the current quarter; however, no front-line data have been disclosed publicly in EGFR exon 20 insertion NSCLC, and zipalertinib’s first-line phase 3 study tests a chemo combo.

Another possible future competitor is Oric Pharmaceuticals, though that company’s enozertinib is at least three years behind firmonertinib, and has struggled in the related setting of HER2 exon 20 insertion NSCLC.

Selected work in 1st-line EGFR exon 20 insertion NSCLC

| Project | Company | 1st-line trial | Data | Note |

|---|---|---|---|---|

| Rybrevant | J&J | Papillon (ph3) | ORR 67%, mPFS 11.4mth | US fully approved Mar 2024 |

| Firmonertinib | Allist/ ArriVent | Favour (Chinese) | ORR 79% | Key focus is PACCm NSCLC |

| Furvent (ph3) | Data due in Q1 2026 | |||

| Zegfrovy | Dizal | WU-Kong15 (Chinese) | ORR 73%, mPFS 10.1mth | US accelerated approved for 2nd-line use, Jun 2025 |

| WU-Kong28 (ph3) | Ends Feb 2026 | |||

| Zipalertinib | Otsuka/ Cullinan | Rezilient2 (various lines) | None available specifically for 1st-line EGFR ex20ins | 2nd-line filing due Q1 2026 |

| Rezilient3 (ph3) | Chemo combo; enrolment to complete H1 2026 | |||

| Enozertinib | Oric | ORIC-114-01 (various lines) | 1st-line data due in H2 2026 | Also targets PACCm NSCLC |

| Exkivity | Takeda | Exclaim-2 (ph3) | ORR 32%, mPFS 9.6mth, failed to beat chemo | 2nd-line US accelerated approval withdrawn |

Source: OncologyPipeline.

1165