Karyopharm investors fasten their seatbelts

A binary Xpovio catalyst is set for March.

A binary Xpovio catalyst is set for March.

The latest stage of Karyopharm’s attempt to turn its approved drug Xpovio into a viable business is about to play out, with the product’s pivotal Sentry trial in front-line myelofibrosis set to read out in March.

The setting, in which a novel agent is combined with the standard of care, Jakafi, and tested against Jakafi alone, is notoriously difficult; it has already seen off AbbVie’s navitoclax, and seriously derailed Novartis’s pelabresib. Karyopharm needs all the luck it can get, having just reported full-year Xpovio sales of only $146m – seven years after the drug was first launched.

Xpovio, a CRM1-mediated nuclear export inhibitor, is approved for second-line and relapsed/refractory multiple myeloma, as well as for late-line diffuse large B-cell lymphoma, the last setting on an accelerated basis. After its first approval Karyopharm’s stock peaked in early 2020, since when it has lost 97% of its value.

Karyopharm’s market cap stands at just under $150m, making the company one of the lowest valued biotechs that boast a marketed oncology drug. Xpovio is licensed to Menarini in Europe, but on current revenues it’s unprofitable, meaning that Karyopharm continues to haemorrhage cash: last year the group burned through a net $45m, and ended with just $64m in the bank in addition to well over $200m of debt.

As such, perhaps the most immediate hope for the company is that Sentry will yield a sufficiently positive result to allow it to raise more cash.

Key endpoints

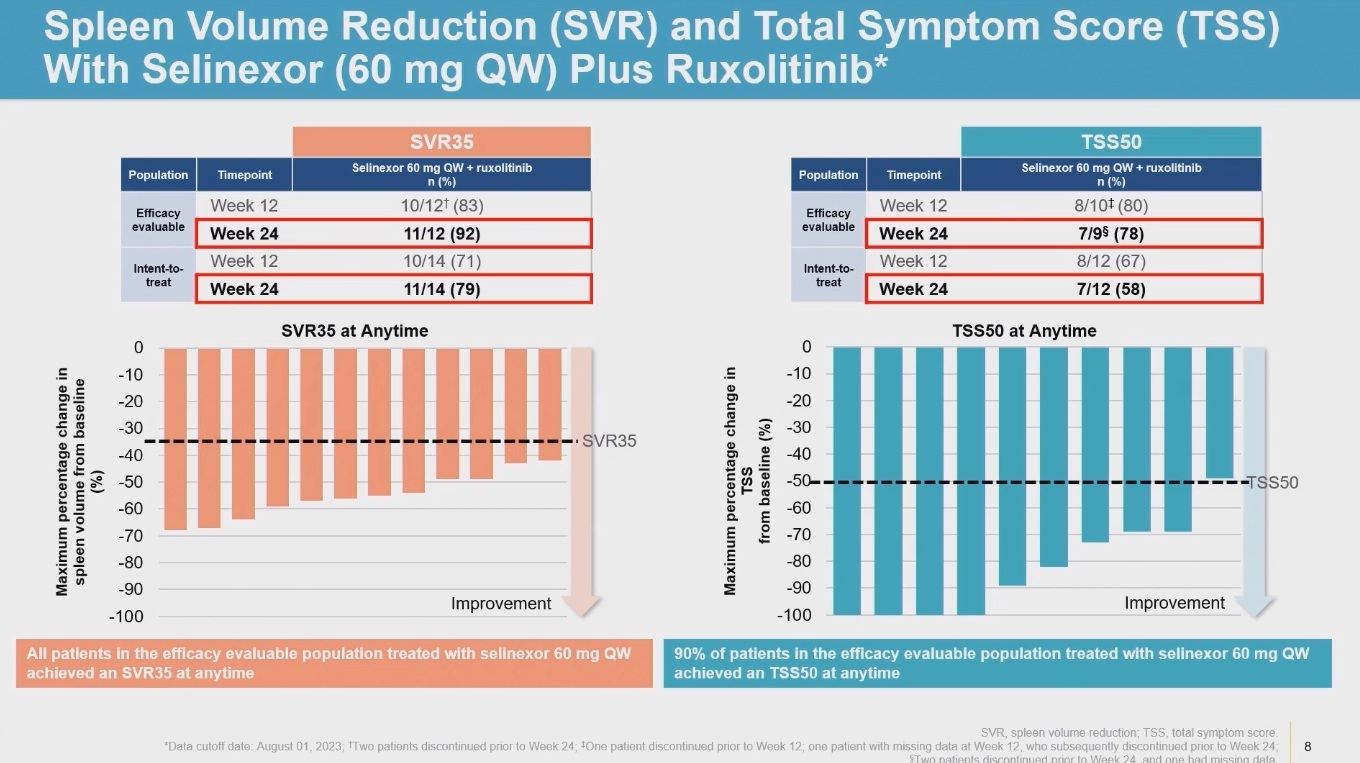

Sentry has two key endpoints, 24-week SVR35 (a measure of spleen volume reduction) and TSS (a measure of symptom improvement). These are typical metrics for a front-line myelofibrosis study, though experience has shown that for regulators the latter – a measure of actual disease improvement – is far more important than the former.

This problem notoriously caught out AbbVie’s Bcl-2/Bcl-XL inhibitor navitoclax, which when combined with Jakafi succeeded on SVR35, but was numerically worse than Jakafi on TSS, and ended up being discontinued.

Meanwhile, Novartis bought MorphoSys for €2.7bn on the promise of the latter’s BET inhibitor pelabresib, which in a similar setting failed to beat Jakafi on TSS, but appeared to have done enough on subgroup analyses to secure the Swiss group’s buy-in. That was until a US filing had to be abandoned in 2024, largely because of toxicity, though a new phase 3 study is now starting.

What does all this portend for Karyopharm? Probably that TSS remains a vital metric – Jakafi secured first-line approval based on 46% of patients seeing 50% or greater TSS reduction by week 24 in its registrational Comfort-1 study – and that safety remains a key consideration.

Both have already been in focus for Xpovio. In 2023 Karyopharm reported data from a phase 1 study of a Jakafi combo in first-line myelofibrosis, where 24-week TSS50 rate came in at an impressive 58%, but where severe anaemia (seen in 43% of patients) and severe thrombocytopenia (29%) spooked investors.

Phase 1 data with Xpovio + Jakafi in 1st-line myelofibrosis

Considerations about Xpovio’s therapeutic window go to the heart of the drug’s bumpy progress in multiple myeloma and lymphoma, where approvals came with labelled warnings of thrombocytopenia, anaemia and other toxicities. Multiple myeloma was controversial, with the FDA going against a negative adcom vote, and it’s probably fair to say that Xpovio has been eclipsed by other novel agents.

First-line myelofibrosis offers some chance of redemption but, given Karyopharm's precarious situation, whether even a positive result can rescue the drug remains an open question.

93