Two more in vivo Cars head for the clinic

New first-in-human study initiations feature yet more in vivo Car assets.

New first-in-human study initiations feature yet more in vivo Car assets.

There’s no sign of a slowdown for in vivo cell therapy, with two more such projects entering their first-in-human studies this month. The moves, from Create Medicines, the company formerly known as Myeloid Therapeutics, and China’s Shenzhen Genocury, have emerged in new clinicaltrials.gov listings, and follow two in vivo Car-Ts that recently entered phase 1.

Another double-act is evident in androgen receptor (AR) degradation, with AstraZeneca and GSK both attempting to emulate Bristol Myers Squibb’s 2024 success with this approach. And dual-payload ADCs remain hot too, with Callio entering phase 1 with a project it picked up last year from Hummingbird Bioscience.

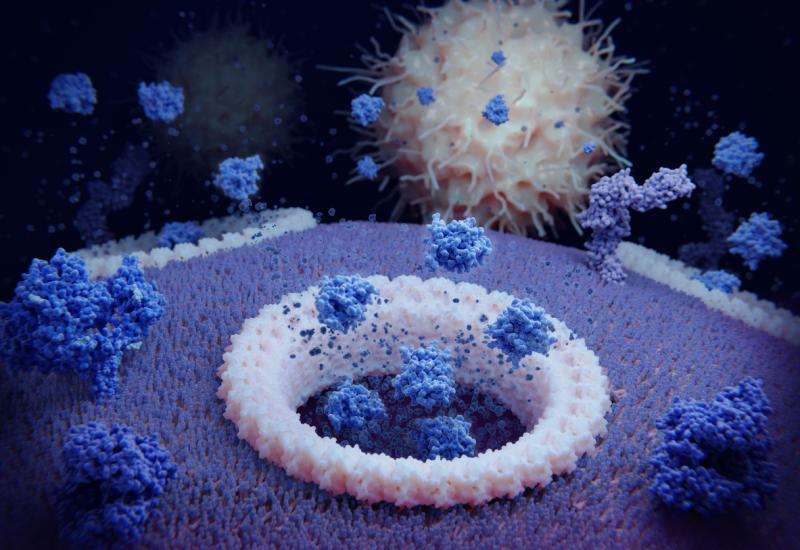

In vivo cell therapy aims to generate Car-positive cells inside a patient’s body through the delivery of genetic material, rather than by transfecting cells ex vivo and reinfusing the resulting expanded cell product. Until recently there were 13 in vivo Car-T assets in the clinic, but then PersonGen’s anti-CD19 project LV009 and Legend’s GPRC5D-targeting LVIVO-TaVec200 started phase 1.

Now come Shenzhen Genocury’s JY232 and Create’s MT-304. The former is an in vivo Car-T targeting BCMA and is to be studied in BCMA-positive multiple myeloma, while the latter is an anti-HER2 Car project, whose phase 1 trial will recruit patients with HER2-positive solid tumours.

A year ago privately held Myeloid Therapeutics was focused largely on in vivo Car-macrophages, but last October it rebranded as Create Medicines, saying it wanted to expand into T and NK cells too. MT-304 appears to be its first clinical project that doesn't just utilise macrophages, and follows the entries into phase 1 of myeloid cell Cars against GPC3 (MT-303) and TROP2 (MT-302).

Create’s investor presentation names NK cells and unspecified myeloid cells as the cell types that MT-304 is expressed on and redirects, without giving more detail. Meanwhile, Shenzhen Genocury’s JY232 appears to be a more typical, albeit in vivo, Car-T therapy.

Recently disclosed first-in-human studies*

| Project | Mechanism | Company | Trial | Scheduled start |

|---|---|---|---|---|

| HX111 | Ox40 ADC | HanX Biopharmaceuticals | Unspecified | 19 Jan 2026 |

| JY232 | BCMA Car-T (in vivo) | Shenzhen Genocury | R/r multiple myeloma | 20 Jan 2026 |

| MT-304 | HER2 Car-NK/Car-myeloid cell (in vivo) | Create Medicines | HER2+ve solid tumours, +/- Opdivo | Jan 2026 |

| AZD9750 | AR degrader | AstraZeneca | Andromeda, metastatic prostate cancer, +/- saruparib | 5 Jan 2026 |

| GSK5471713 | AR degrader | GSK | Metastatic castration-resistant prostate cancer | 27 Feb 2026 |

| CLIO-8221/ HMBD-802 | HER2 dual-payload ADC | Callio/ Hummingbird | Solid tumours | 28 Feb 2026 |

| CR-001 | PD-1 x VEGF MAb | Crescent/ Kelun | Ascend, solid tumours | Feb 2026 |

| ATG-022 | Claudin18.2 ADC | Antengene | Clinch-2, gastric or GEA | 1 Mar 2026 |

| GVV858 | Likely CDK2 inhibitor | Novartis | ER+ve HER2-ve breast cancer & cancers with CCNE1 amplification | 16 Mar 2026 |

| PLT012 | CD36 MAb | Pilatus (ex Elixiron) | Solid tumours | Mar 2026 |

Note: *these projects were first listed on the clinicaltrials.gov database between 17 Dec 2025 and 13 Jan 2026.

In protein degradation the androgen receptor (AR) is one of few targets to have yielded promising clinical data, courtesy of Bristol’s gridegalutamide at the 2024 ESMO conference.

Other clinical-stage AR degrader projects include Chia Tai’s TQB3201 and Novartis’s Arvinas-originated luxdegalutamide, and these are now being joined by Astra’s AZD9750 and GSK’s GSK5471713. The former, an internal Astra asset, was revealed at last year’s AACR, but the latter has only come to light through the new clinicaltrials.gov entry, and it’s not clear where it was originated.

Hot areas

Two other areas of research that remain hot are anti-PD-(L)1 x VEGF bispecifics and dual-payload ADCs, and both feature among first-in-human study entrants.

CLIO-8221/HMBD-802, an anti-HER2 project, was among three dual-payload ADCs that Callio licensed from Hummingbird in March 2025, and appears to be the first to enter the clinic. The molecule uses topoisomerase 1 inhibitor and ATR inhibitor payloads, and was at AACR 2024 said to be able preclinically to overcome resistance to topo payload-based ADCs.

In the VEGF bispecific space AbbVie recently paid RemeGen $650m for rights to RC148, while Crescent licensed Chinese rights to CR-001 to Kelun for a rather more modest $20m, as part of a cross-licensing arrangement. CR-001 start phase 1 in February, and the study is to be run in the US and sponsored by Crescent.

47