Bispecific cytokine delivers for Innovent at last

Innovent’s perseverance with a cytokine approach is rewarded with $1.2bn from Takeda.

Innovent’s perseverance with a cytokine approach is rewarded with $1.2bn from Takeda.

One of the best performing biopharma companies since this year’s ASCO conference has been Innovent, whose stock has surged 40% on the promise of the anti-PD-1 x IL-2 fusion protein IBI363. Investor enthusiasm was rewarded on Wednesday when Takeda gave Innovent $1.2bn up front for ex-China rights to this molecule and to the anti-Claudin18.2 ADC arcotatug tavatecan.

Considering its impressive up-front element the deal is notable for at least two things. Firstly it represents Takeda going against the industry trend away from cytokine-based approaches; and secondly Claudin18.2 is a hugely competitive area, and the Japanese company will be entering a space that features 18 other clinical-stage ADCs, according to OncologyPipeline.

Nevertheless, arcota-T is well advanced among this group, featuring among seven projects in phase 3 trials, having entered pivotal development in gastric (G-Hope-001 study) and pancreatic cancers (G-Hope-002). It also has a key design characteristic, using a warhead developed by Lonza's Synaffix division, which has also licensed ADC tech to Boehringer Ingelheim and to Mitsubishi Tanabe.

Cytokine for the win

That said, the Takeda deal’s main driver appears to be IBI363, which emerged as Innovent’s lead after the company hit a roadblock in 2022 in trying to get the anti-PD-1 MAb sintilimab, then licensed to Lilly, approved in the US.

IBI363 is an anti-PD-1 x IL-2α-biased fusion protein, and largely on the back of its promise Innovent shares have risen 135% year to date, including a 40% climb since ASCO. Analysts at Macquarie were long sceptical of IBI363, given the failures of cytokine approaches elsewhere in the industry, but more recently accepted that the ASCO data derisked IBI363 somewhat.

Nevertheless, “we are not convinced Innovent has sufficiently addressed [IBI363’s] toxicity issue”, wrote Macquarie’s Tony Ren in a note after the conference. “We are marginally more positive on IBI363 after ASCO 2025, but note [that] IL-2 is not high on the in-licencing agenda at large pharma.”

Takeda might not be a large pharma company, and in this some Innovent shareholders might be disappointed. However, $1.2bn is not to be sneezed at, especially for an approach that in recent years has delivered notable failures.

Perhaps the biggest was the blow-up of Nektar/Bristol Myers Squibb’s IL-2 project bempegaldesleukin. More recently the Alkermes spin-out Mural Oncology discontinued the IL-2 asset nemvaleukin alfa, while Roche scrapped the technologically more complex eciskafusp alfa, an anti-PD-1 x IL-2v fusion protein that bore some resemblance to Innovent’s IBI363.

The key with all these is to avoid the documented toxicities of IL-2, eciskafusp alfa by focusing on the IL-2v variant, and IBI363 by using IL-2Rα bias, with IL-2βγ attenuation. The IBI363 presentation at ASCO reported 21% and 40% rates of serious treatment-related adverse events at doses of 1/1.5mg/kg (62 patients) and 3mg/kg (57) respectively, and rates of TRAEs leading to discontinuation of 7% for each dose.

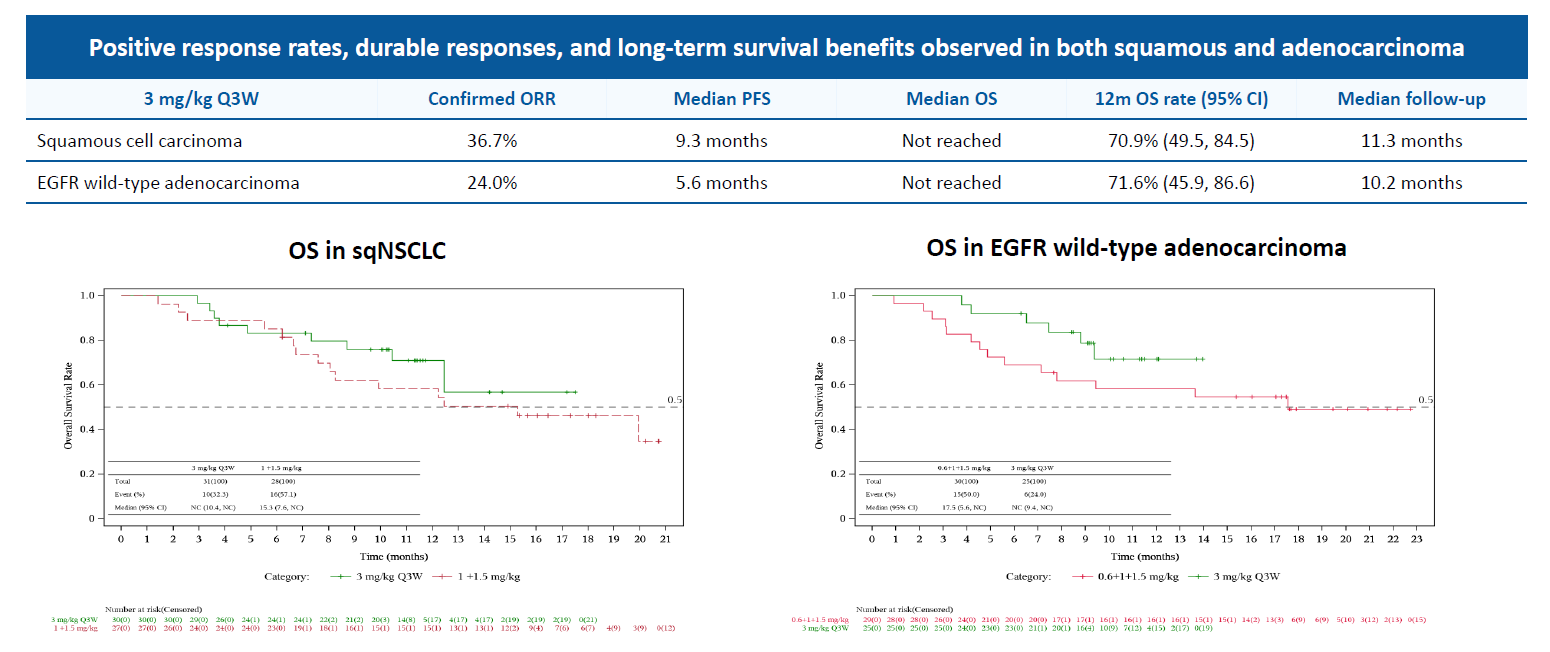

But it was IBI363’s activity in this study, in checkpoint-relapsed NSCLC, that was especially notable. This amounted to confirmed response rates of 37% in squamous NSCLC, and 24% in EGFR wild-type adenocarcinoma NSCLC, figures that seem impressive considering that nearly all patients had failed anti-PD-(L)1 therapy.

Phase 1 data for IBI363 in post-IO non-small cell lung cancer

Based on these data Innovent has moved IBI363 into phase 3, with clinicaltrials.gov just revealing the Marslight-11 study, in 600 squamous NSCLC patients who have failed anti-PD-(L)1 therapy and chemo. This will compare IBI363 against docetaxel, measure overall survival as primary endpoint, and begin on 30 October.

It’s listed as a Chinese/US trial, so presumably its US part will now be co-run with Takeda; interestingly, the US profit/loss relating to IBI363 under the deal will be split 60/40 in the Japanese company’s favour. Innovent has separately promised to take IBI363 into phase 3 development in late-line colorectal cancer.

The new deal also includes a third asset, Innovent’s bispecific anti-EGFR x B7-H3 ADC IBI3001. However, at present Takeda only has an option over IBI3001, which entered phase 1 in January. It’s possible that phase 1 data will spur Takeda to exercise this option, which would trigger further payments for Innovent.

3190