Black Diamond picks brain cancer for silevertinib

Though lung cancer looks promising a partner is now needed.

Though lung cancer looks promising a partner is now needed.

The good news for Black Diamond Therapeutics is that its lead EGFR inhibitor silevertinib looks active in the first-line lung cancer setting the company had prioritised earlier this year. The bad, however, is that a pivotal study is needed to back a regulatory filing, and that Black Diamond can’t afford to run one without a licensing partner.

Thus the troubling pivots continue for Black Diamond, which instead is now planning to undertake pivotal development of silevertinib in glioblastoma. Potential in this especially difficult setting is backed by very early data, and presumably the decision to fund pivotal development here rather than in NSCLC is driven by the former’s lower cost.

Black Diamond ended September with $136m in the bank, largely thanks to a $70m fee from Servier, which in March licensed the RAF inhibitor BDTX-4933, on which Black Diamond had given up. $136m will fund the company into the second half of 2028, with the assumption that its pivotal spend targets only glioblastoma, while a partner funds NSCLC.

Investors didn’t take kindly to such revelations, sending Black Diamond stock down 22% on Wednesday.

First-line lung

Silevertinib, a fourth-generation EGFR inhibitor, has already shown potential in relapsed NSCLC patients pretreated with Tagrisso, specifically in those with so-called PACC (P-loop alpha-c helix compressing) mutations.

However, any regulatory pathway here won’t become clear until PFS data emerge in the first half of next year. And in any case Black Diamond has prioritised the front-line setting, citing this as a larger market than relapsed NSCLC.

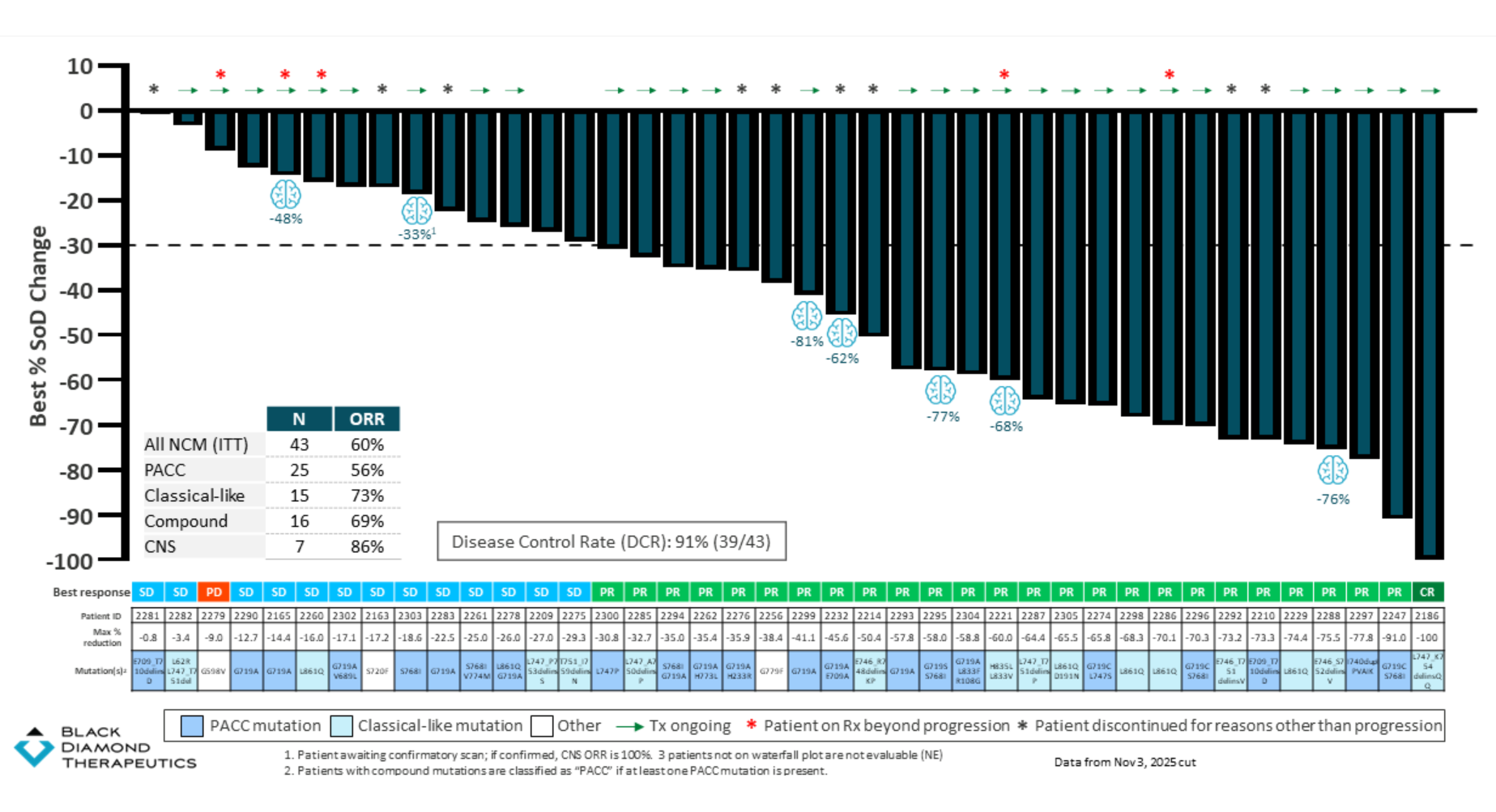

Wednesday brought the first data from this trial’s dose-expansion cohort in front-line patients with non-classical EGFR mutations. These typically lie outside the scope of drugs like AstraZeneca’s Tagrisso, and amount to a key resistance mechanism, and here Black Diamond cited a confirmed ORR of 60% among 43 front-line patients.

This included a 56% response rate in patients with PACC mutations. Such a consideration is relevant because ArriVent will shortly start the phase 3 Alpacca trial with its rival molecule firmonertinib in first-line PACC-mutant NSCLC; if ArriVent seizes the PACC niche for itself, that leaves silevertinib with non-PACC, non-classical mutations, where the ORR is 67% among 18 patients.

Silevertinib in first-line NSCLC with non-classical mutations

If ArriVent’s Alpacca is a blueprint then a pivotal silevertinib trial in first-line NSCLC would require some 500 patients to be enrolled, and silevertinib to be compared against Tagrisso or Gilotrif; neither drug is approved for PACC mutations, but some guidelines do recommend their use for non-classical mutations, so they represent a standard of sorts.

Running a 500-patient trial is clearly outside Black Diamond’s financial capabilities, and instead the company has moved to begin a pivotal phase 2 study of silevertinib in front-line glioblastoma. This will test a Temodar combo versus Temodar alone, and seek to enrol 75 patients with EGFRvIII-positive disease into each of these two cohorts; initial PFS data are expected in 2028.

The backing for this comes largely from safety and pharmacokinetic data. Some time ago phase 1 dose-escalation results showed one confirmed partial response among 19 pretreated glioblastoma patients with measurable EGFRm disease given silevertinib monotherapy.

3474