BridgeBio Oncology shows early promise

The group’s on/off KRAS G12C inhibitor looks good, though patient numbers are small.

The group’s on/off KRAS G12C inhibitor looks good, though patient numbers are small.

BridgeBio Oncology Therapeutics claims that its KRAS G12C inhibitor BBO-8520 could have an edge over other drugs in the class, and on Wednesday the company released data that could help back this up.

The company claimed a 65% overall response rate in second-line KRAS G12C-mutant NSCLC in the phase 1 Onkoras-101 trial. The results look better on a cross-trial basis than those with the approved G12C inhibitors, Amgen’s Lumakras and Bristol Myers Squibb’s Krazati, and also suggest that BBOT could give newer players like Revolution Medicines a run for their money. Still, the update concerned just 17 patients, so will need to be confirmed in larger trials.

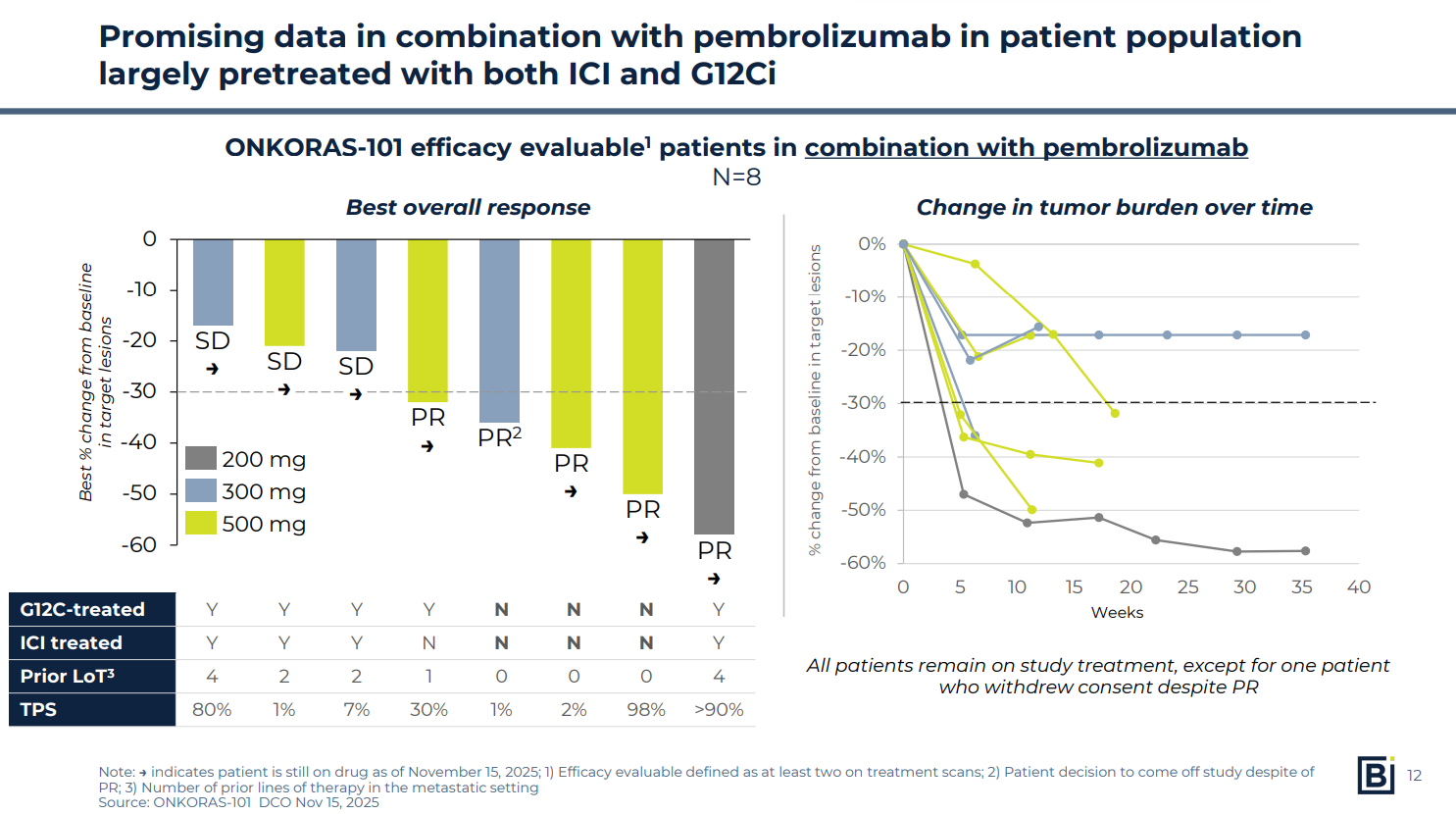

BBOT also presented promising data with a combination of BBO-8520 and Keytruda – a regimen that has proven tricky with other KRAS G12C-targeting agents. Results here were even earlier, though, involving only eight patients.

Investors seemed encouraged, with BBOT’s stock closing up 4% on Wednesday.

On and off

BBO-8520 targets both the “on” and “off” states of KRAS G12C, while the approved drugs only target the off state. BBOT believes that this could increase BBO-8520’s potency versus older agents, and lower the drug levels needed for activity.

Data from Onkoras-101 suggest that this claim could be holding up. In trials used for accelerated approval in second-line NSCLC, Lumakras produced an ORR of 36%, while Krazati’s response rate was 43%.

The 65% ORR claimed by BBOT also includes one unconfirmed response; excluding this takes the ORR with BBO-8520 down to 58%, which still looks better on a cross-trial basis than the incumbents.

The figure also seems in line with a 56% ORR seen with Revolution’s selective G12C inhibitor elironrasib, which targets the on state of KRAS G12C. However, Revolution is much further ahead – and could soon be part of AbbVie, if recent buyout rumours are to be believed.

Cross-trial comparison of selected KRAS G12C inhibitors in second-line NSCLC

| Lumakras | Krazati | Elironrasib | BBO-8520 | |

|---|---|---|---|---|

| Mechanism | Off inhibitor | Off inhibitor | On inhibitor | On/off inhibitor |

| Company | Amgen | Bristol Myers Squibb | Revolution Medicines | BridgeBio Oncology Therapeutics |

| Trial | Codebreak-100 | Krystal-1 | RMC-6291-001 | Onkoras-101 |

| N | 124 | 112 | 36 | 17 |

| ORR | 36% | 43% | 56%* | 58%** |

Notes: patients had no prior KRAS G12Ci experience; *200mg twice daily; **100-700mg once daily. Source: OncologyPipeline & product labels.

Meanwhile, combining KRAS G12C inhibitors with checkpoint inhibitors hasn’t gone smoothly in the past, with liver enzyme elevations scuppering Amgen’s plans for a Lumakras/checkpoint inhibitor combo.

But BBOT reckons BBO-8520’s improved therapeutic index could help it get around this problem.

The company reported data from eight patients – treatment-naive as well as experienced – who received BBO-8520 plus Keytruda. Five of eight had a partial response: three of three in the treatment-naive cohort, and two of five in the treatment-experienced arm (in which all patients had previously received a KRAS G12C inhibitor).

The small patient numbers make it difficult to draw conclusions, but on the face of it the data look promising.

Revolution has reported a 100% ORR among five first-line patients receiving elironrasib plus Keytruda, but four of these were unconfirmed, and all patients had PD-L1 expression levels of 50% or more.

BBOT saw activity across PD-L1 expression levels, with two responses coming in patients with 1-2% expression.

As for adverse events with the BBO-8520/Keytruda combo, there was one case of grade 3 liver enzyme increases, but the company put this down to co-medications and, in any case, said these resolved and the patient remained on therapy.

BBOT is promising another update with BBO-8520 in the second half of 2026. The group also plans to combine the project with its PI3Kα:RAS breaker BBO-10203.

1514