Is this the end for MacroGenics’ vobra-duo?

The company stops dosing in the troubled Tamarack trial, and is going quiet until ESMO.

The company stops dosing in the troubled Tamarack trial, and is going quiet until ESMO.

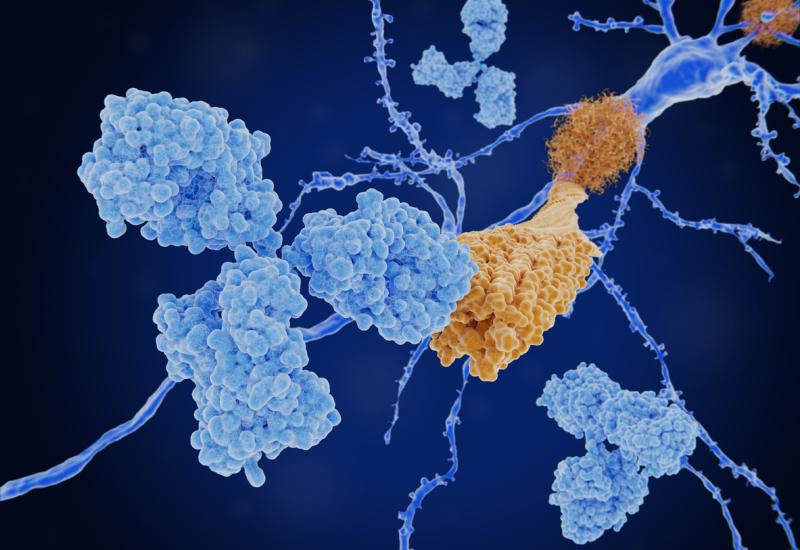

MacroGenics is already having a rough year, with disappointing data from the Tamarack trial of its lead project, vobramitamab duocarmazine (vobra-duo), and now there are growing questions about whether this B7-H3-targeting ADC has a future at all.

The company said on Tuesday that it was stopping dosing in Tamarack on the recommendation of the trial’s data monitoring committee – news that follows worsening toxicity at the most recent data cut. Although MacroGenics didn’t say it was giving up on vobra-duo, some analysts believe that this is the end of the line for the project.

Evercore ISI’s Jonathan Miller and Umer Raffat raised the possibility that the project’s safety profile had deteriorated further. They conceded that MacroGenics “could try to find a setting where [the] safety profile is acceptable”, but concluded that the “situation doesn't look good”. Perhaps the group's time and money would be better spent on its next-gen project.

Unfortunately for investors things don’t look set to become clearer any time soon, with MacroGenics now going into a “quiet period” ahead of a poster presentation on Tamarack at the ESMO meeting in September.

The group’s stock, already in the doldrums, closed down 28% on Wednesday.

Later cutoff

Despite the halt in dosing, however, Tamarack is still in play. The study was fully enrolled in the fourth quarter of 2023, and most of the patients who might have received additional doses had already been given 8-12 cycles of vobra-duo.

The data cutoff for the most recent update was 12 April 2024; this revealed five adverse event-related deaths, versus none when MacroGenics toplined safety data in April. ESMO will see updated results as of 9 July 2024.

MacroGenics previously revealed plans for a phase 3 trial; yesterday it merely said that it would discuss “potential next steps” at an investor conference following the ESMO presentation.

Perhaps the company would be better off cutting its losses and pivoting to its next-generation B7-H3 ADC MGC026, a move that has looked on the cards since the company unveiled the new asset in March. MGC026 uses a topoisomerase 1 inhibitor payload, versus vobra-duo’s DNA alkylating agent.

The Evercore analysts advised against counting the company out, particularly as it also bagged a $100m milestone payment on Tuesday from Incyte, related to its PD-1 inhibitor Zynyz. MacroGenics now has cash into 2026.

B7-H3 is a crowded area, but this hasn’t stopped more deals being struck. On Wednesday Ideaya licensed a preclinical B7-H3 x PTK7 bispecific ADC from Biocytogen for up to $406.5m; the up-front fee wasn’t broken out.

The only PTK7-targeting project in the clinic, according to OncologyPipeline, is Genmab’s PRO1107, gained through the takeout of ProfoundBio.

MacroGenics’ wholly owned pipeline

| Project | Description | Indication | Note |

|---|---|---|---|

| Vobramitamab duocarmazine (vobra-duo) | Anti-B7-H3 ADC (DNA alkylating agent payload) | mCRPC | Ph2 Tamarack trial discontinued Jul 2024; more data due at ESMO 2024 |

| Lorigerlimab | Anti-PD-1 x CTLA-4 bispecific MAb | mCRPC | Ph2 Lorikeet trial; data expected H1 2025 |

| Enoblituzumab | Anti-B7-H3 MAb | Neoadjuvant prostate cancer | Ph2 Heat trial* started Feb 2024 |

| MGC026 | Anti-B7-H3 ADC (topoisomerase 1 inhibitor payload) | Solid tumours | Ph1 started Mar 2024 |

| MGC028 | Anti-Adam9 ADC (topoisomerase 1 inhibitor payload) | Solid tumours | IND submission expected 2024 |

| Tebotelimab | Anti-PD-1 x LAG-3 bispecific MAb | Solid tumours | Had been partnered with Zai Lab, which terminated agreement in Nov 2023; no active studies ongoing |

Note: *investigator sponsored. Source: OncologyPipeline.

1646