Gritstone fails to convince

The group will need to wait for more data with its neoantigen immunotherapy Granite, but cash is running short.

The group will need to wait for more data with its neoantigen immunotherapy Granite, but cash is running short.

Initial phase 2 data with Gritstone’s neoantigen immunotherapy Granite promised to confuse, and yesterday’s update exceeded those expectations – but perhaps not in the way predicted. Molecular response rates had been expected to be the saving grace of a hard-to-interpret dataset, but in the event both this and progression-free survival look like a bust.

An immediate question is how long Gritstone can keep going. The group ended the year with $87m, enough to get it to the third quarter of 2024, and swiftly followed yesterday’s data with a heavily discounted fundraising. However, the $32.5m raised will be a drop in the ocean for a company burning around $100m a year, and Gritstone will have to limp on until its next readout, in the third quarter.

Yesterday's disappointing result puts into doubt Granite's chances of an accelerated approval; Gritstone previously hoped to pursue this based on molecular response data, which has drawn a blank. The company now intends to use PFS as the primary endpoint in a future pivotal study, Jones Research noted, but phase 3, to begin next year rather than late 2024/early 2025, is a pipe dream without more cash.

Molecular response miss

This shift in endpoint is surely down to Granite's complete failure to show a molecular response benefit. Molecular response was the primary outcome of the phase 2 portion of Granite's ongoing phase 2/3 trial in first-line metastatic microsatellite-stable colorectal cancer – a “cold” tumour that has seen little benefit from immunotherapy.

There was a 30% molecular response rate in the Granite cohort, compared with 42% in the chemo arm, Gritstone revealed yesterday.

The group had been hoping to see molecular response rates of 50% in the Granite arm, and no more than 10% for chemo control; molecular response, measured via circulating tumour DNA (ctDNA), was defined in the trial as a 30% or greater reduction.

Gritstone blames an “unexpectedly persistent ctDNA drop” in some control patients following induction chemotherapy, which all patients received. And it now appears to be squarely focused on PFS – an endpoint more widely accepted by regulators than ctDNA, but which the company previously argued might not be as accurate as molecular response due to Granite’s mechanism of action.

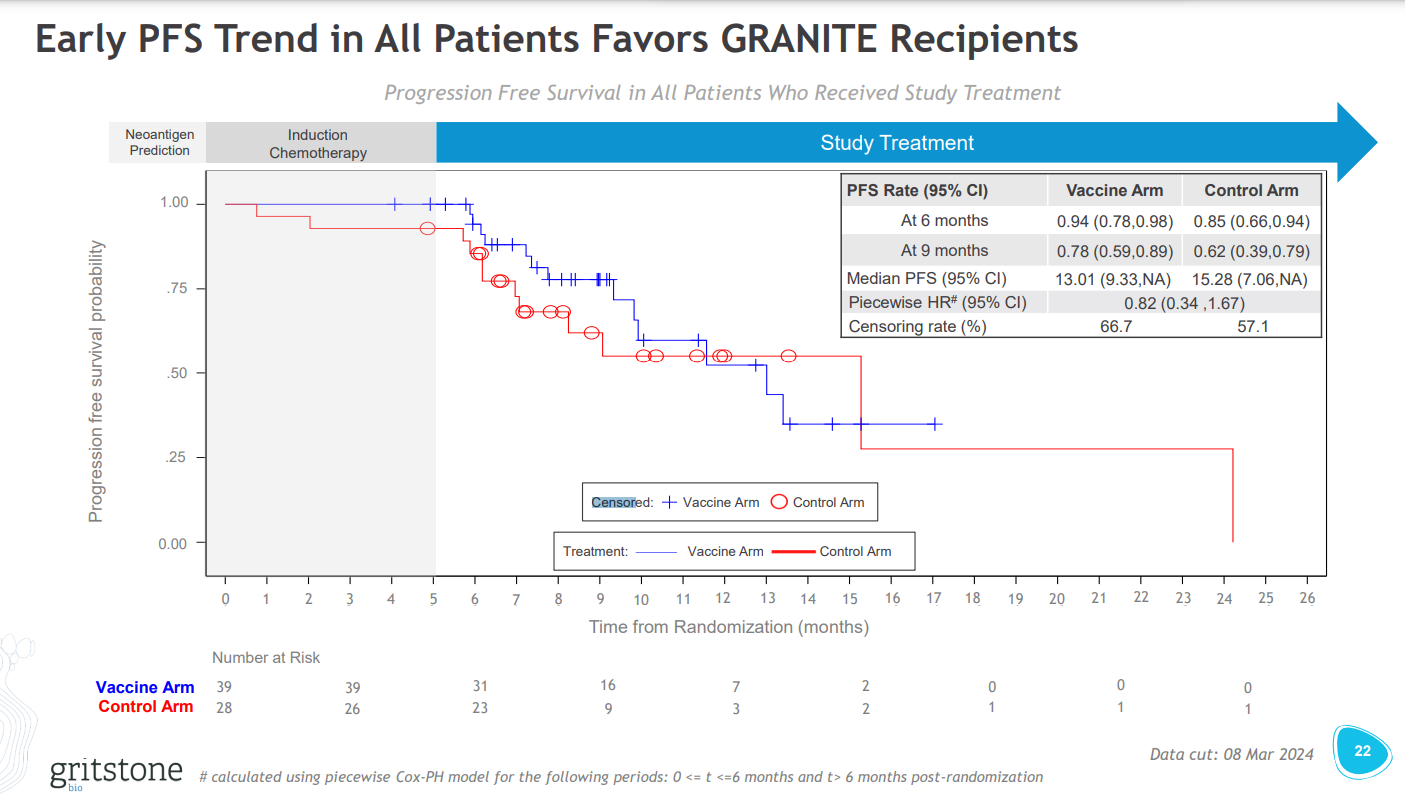

Even on PFS, though, yesterday’s update is far from convincing. Gritstone claimed an early “trend” favouring Granite; however, while there was a numerical benefit with the therapy, the data are effectively rendered meaningless by survival curves that cross over and a 62% rate of censoring.

Next up will be mature PFS data, due in the third quarter of 2024. With these results in hand Gritstone plans to discuss its phase 3 plans with regulators.

However, the real proof of Granite’s worth will only come with overall survival data, and these aren’t due until next year. To get to that point Gritstone will need to find more funds. Unless it produces something more convincing the group will struggle to raise cash.

2382