Moderna investors prepare for a phase 3 reveal

Intismeran autogene’s Interpath-001 trial reads out this year.

Intismeran autogene’s Interpath-001 trial reads out this year.

For a measure of how importantly the markets still view Moderna/Merck & Co’s neoantigen immunotherapy intismeran autogene – in spite of setbacks – check out Moderna’s share price. The stock is up nearly a third in recent days, and Moderna is one of the most impressively performing biotechs of 2026 so far, sitting on a 75% climb year to date .

Enthusiasm appears to be driven by readout of inti-gene’s phase 3 Interpath-001 study in adjuvant melanoma, expected at some point this year. In recent days investors have taken heart from a five-year update of data from the phase 2 Keynote-942 trial, which apart from being much smaller has a similar design to Interpath-001.

Both studies test a combination of inti-gene with Keytruda in resected melanoma, and compare this against Keytruda alone, both on the primary endpoint of relapse-free survival. Keynote-942 has enrolled 267 patients at hospitals in the US and Australia, while Interpath-001 has an enrolment target of 1,089, and comprises centres across several continents.

First success

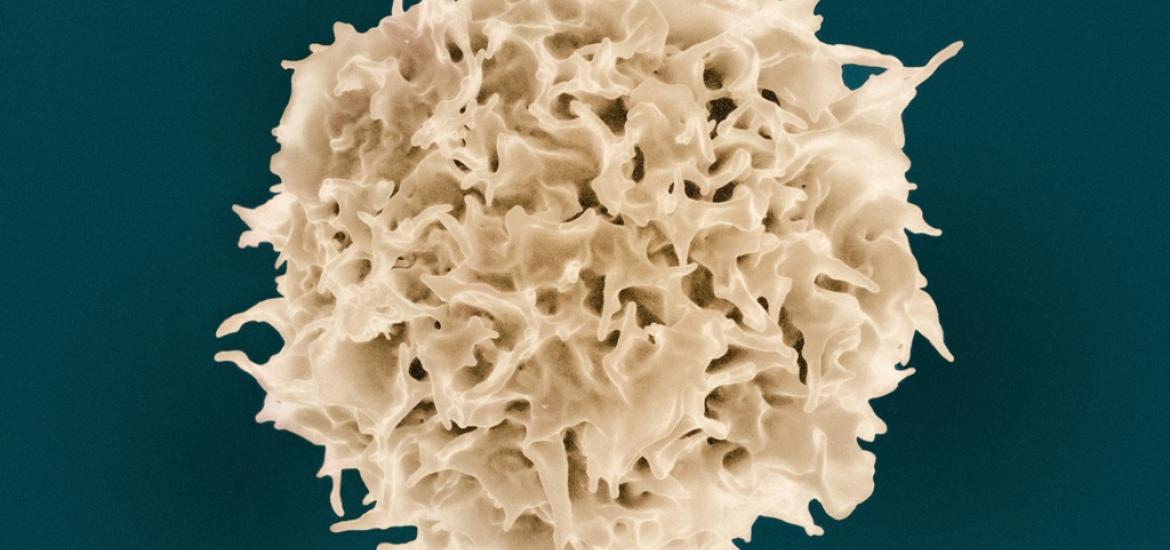

It was the initial Keynote-942 splash, toplined in December 2022, that marked the first real success for a personalised, neoantigen-based anticancer immunotherapy. The news added $15bn to Moderna’s market cap, and justified Merck licensing the project for $250m up front just two months earlier.

Full presentation at the following year’s AACR conference backed up the data, allaying fears that Keytruda control might have underperformed the Merck drug’s registrational Keynote-054 trial, since Keynote-942 included more advanced stage IV melanoma patients, in addition to the stage IIIs to which Keynote-054 was limited.

With subsequent three-year RFS data bringing Keynote-942 into the realms of nominal statistical significance Moderna was gunning for accelerated approval, but then came a major blow. In September 2024 the FDA issued feedback that the agency was “not supportive” of accelerated approval based on Keynote-942, pushing back filing, which would now depend on data from Interpath-001.

Against this backdrop it might be surprising that little has materially changed to drive Moderna stock. The latest Keynote-942 update a few days ago revealed a 49% reduction in risk of recurrence or death at five years’ follow-up – identical to the three-year figure.

As expected confidence intervals have tightened, and interestingly Moderna moved back to citing a one-sided p value, now nominally 0.0075, versus the two-sided 0.019 at three years. Disappointingly, Moderna said nothing about overall survival, or about how the Keytruda control was performing.

How Keynote-942 results have evolved

| Apr 2023 | Sep 2024 | Jan 2026 | |

|---|---|---|---|

| Median follow-up | 23.5mth | 34.9mth | 60.0mth |

| RFS hazard ratio | 0.56 | 0.51 | 0.51 |

| RFS 95% confidence intervals | 0.309-1.017 | 0.288-0.906 | 0.294-0.887 |

| p value | one-sided 0.0266 | two-sided 0.019 (nominal) | one-sided 0.0075 (nominal) |

Source: OncologyPipeline.

So do these data make Interpath-001 a slam dunk? Not exactly, though Evercore ISI’s Cory Kasimov reckons they do incrementally derisk inti-gene.

A key difference versus the phase 2 trial, apart from enrolment size, is that Interpath-001 allows patients with stage IIB, IIC and IIIA melanoma – relatively early – whereas Keynote-942 allows patients with no earlier than stage IIIB disease. This has clear implications as to the bar to beat in the control arm, and could slow event rates.

Keytruda’s approval in adjuvant melanoma, based on Keynote-054, initially concerned stage IIIA-C disease, and it was only later that the drug was greenlit for stage IIB/C melanoma, based on Keynote-716. Landmark analyses show three-year RFS rates for Keytruda of 63.7% in Keynote-054, and 84.4% in Keynote-716, and a similarly wide difference between the two control cohorts.

Should Interpath-001 read out positively investors are no doubt mindful that adjuvant melanoma is only the first of several settings being pursued. NSCLC appears to be an especially significant market, though the phase 3 Interpath-002 trial doesn’t read out until 2030, and is backed by very early data from a phase 1 basket study.

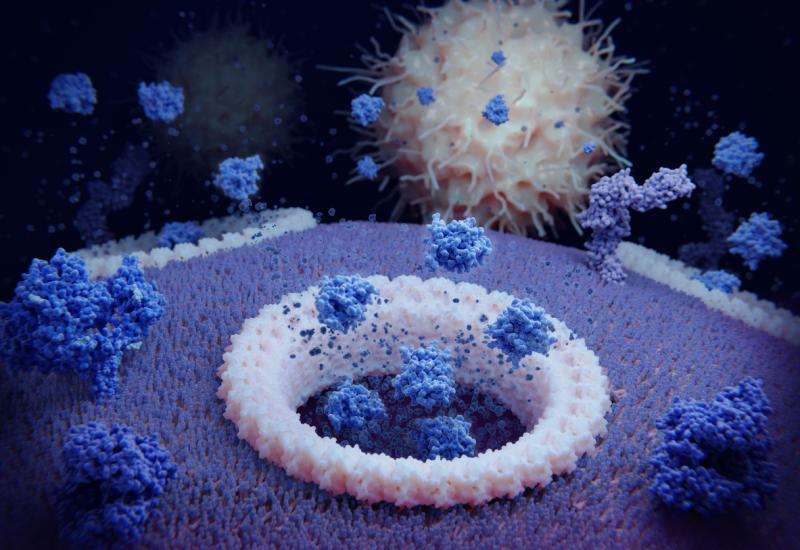

Inti-gene is an mRNA therapeutic created on demand based on the neoantigens present in each patient’s tumour, an approach that hasn’t yet worked out for BioNTech and Roche’s rival project, autogene cevumeran. Other setbacks for inti-gene include the quiet termination of pivotal work in cutaneous squamous cell carcinoma.

Moderna’s market cap is back over $20bn, well off the highs of the Covid pandemic, but suggesting just how much value is tied up in inti-gene. One problem for investors is how to play this catalyst; Interpath-001 is event driven, so it’s impossible to be precise as to the timing of readout.

36