M&A analysis: Genmab bucks the bargain basement trend

The group’s $8bn acquisition of Merus was the standout in the third quarter.

The group’s $8bn acquisition of Merus was the standout in the third quarter.

After several big oncology deals earlier this year, the third quarter of 2025 had been looking like a damp squib – until Genmab’s $8bn acquisition of Merus emerged at the end of September.

Aside from this purchase, the past three months was notable for largely featuring opportunistic buys of struggling biotechs – although there were a couple of more encouraging signs, such as Gilead’s swoop for the in vivo Car-T player Interius, for $350m up front.

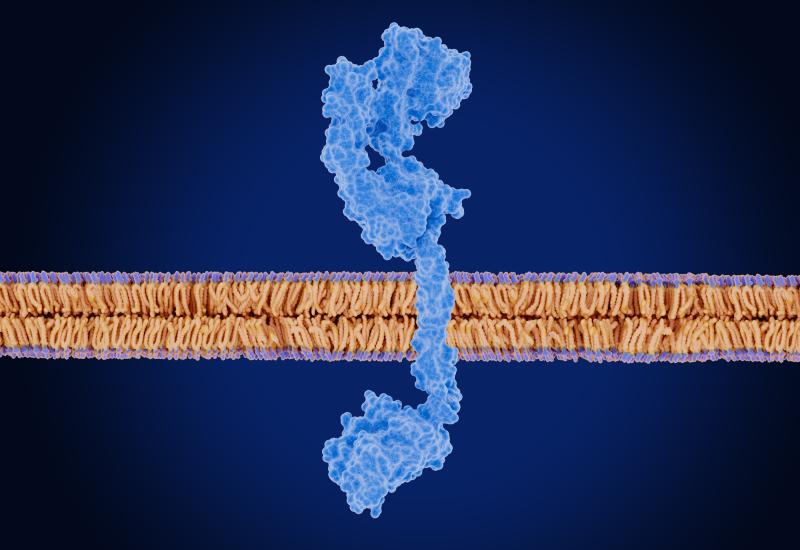

In vivo Car-T continues to be hot, following AstraZeneca’s $425m purchase of EsoBiotec and AbbVie’s $2bn move for Capstan (although the latter was focused on autoimmune disease). These and previous, smaller collaborations could raise hopes of further M&A activity here.

Still, one of the most advanced players, Umoja, already has two agreements with AbbVie; one gives the big pharma the option to license Umoja's lead project, UB-VV111, and the other is a discovery collaboration. There have been fears that AbbVie's purchase of Capstan might signal a waning interest in its earlier partner, but an Umoja spokesperson told ApexOnco that AbbVie "remains committed" to both collaborations.

Another intriguing third-quarter acquisition involved two Chinese companies, with Sino Biopharmaceutical buying LaNova; the latter already had a tie-up with Merck & Co over the anti-VEGF x PD-1 MAb LM-299.

Notable oncology M&A in Q3 2025

| Buyer | Target | Deal type | Note | Financials | Date |

|---|---|---|---|---|---|

| Genmab | Merus | Acquisition | Petosemtamab (anti-EGFR x LGR5 MAb) | £8bn up front | 29 Sep |

| Gilead | Interius | Acquisition | In vivo Car-T | $350m up front | 21 Aug |

| Xoma Royalty (XRA 5 subsidiary) | Mural Oncology | Acquisition | Previously nemvaleukin alfa | $2.035-2.240/share | 20 Aug |

| Serb Pharmaceuticals | Y-mAbs Therapeutics | Acquisition | Danyelza | $412m up front | 5 Aug |

| Xoma Royalty | Lava Therapeutics | Acquisition | Previously γδ T-cell engagers | $1.16-1.24/share + CVR | 4 Aug |

| Concentra Biosciences | iTeos Therapeutics | Acquisition | Previously belrestotug (TIGIT) | $10.047/share + CVR | 21 Jul |

| I-Mab | Bridge Health | Acquisition | Parental antibody used in I-Mab’s givastomig | $1.8m up front | 17 Jul |

| Sino Biopharmaceutical | LaNova | Acquisition | Various MAbs, bispecific antibodies & ADCs | “No more than” $951m ($501m up front taking into account LaNova’s cash balance) | 15 Jul |

| XenoTherapeutics (backed by Xoma Royalty) | Essa Pharma | Acquisition | Previously prostate cancer | Undisclosed (includes CVR) | 14 Jul |

| Concentra Biosciences | Cargo | Acquisition | Previously Car-T | $4.379/share + CVR | 8 Jul |

| CB Biotechnology (Future Pak) | Theratechnologies | Acquisition | HIV & oncology | $3.01/share + CVR | 2 Jul |

Note: sxcludes SPACs & reverse mergers. Source: OncologyPipeline.

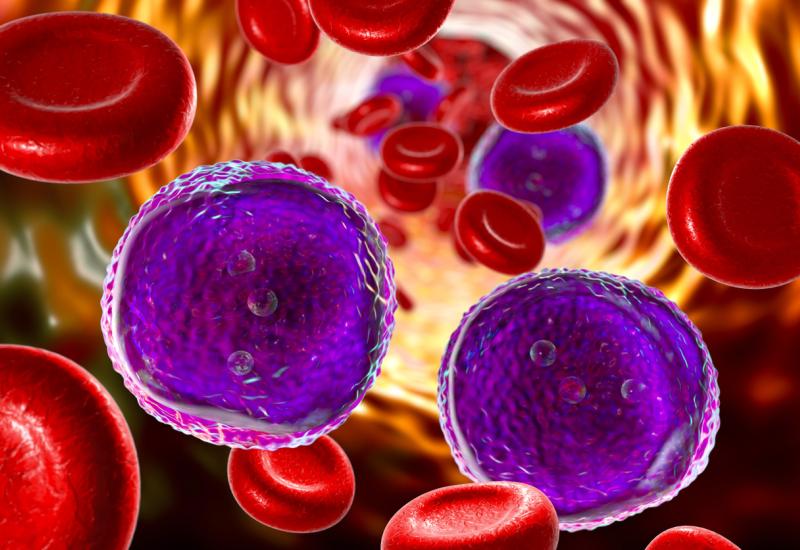

Genmab’s purchase of Merus was undoubtedly the standout in the third quarter, however. The deal was driven by petosemtamab, an anti-EGFR x LGR5 MAb that produced promising data in PD-L1-positive front-line head and neck cancer at this year’s ASCO meeting. At the time, Merus was seen as the winner in a battle against Bicara, which is developing an anti-EGFR x TGF-β fusion protein, ficerafusp alfa, in the same setting.

Still, Merus’s price tag looks steep, especially given that petosemtamab is far from derisked, and Genmab will need to replicate the mid-stage results in more patients. The Danish company paid a reasonable sounding 41% premium to Merus’s closing share price on Friday, but this was on top of Merus's steady runup since ASCO.

More data will show whether Genmab has overpaid, or if it was wise to make a move before Merus got even more expensive.

Opportunistic buys

With many biotechs struggling, Concentra Biosciences and Xoma Royalty have been busy picking up bargains this year, and the third quarter was no exception.

Concentra purchased three companies: the Car-T contender Cargo Therapeutics, the TIGIT player iTeos, and the IgM-based antibody specialist IGM Biosciences (the last isn’t included in this analysis, as it hadn’t been an oncology player for some time before the deal).

Xoma also struck three deals, for the cytokine player Mural, the γδ T-cell engager developer Lava, and the prostate cancer specialist Essa – with the last deal routed via a non-profit organisation, XenoTherapeutics.

The main attraction of these types of transactions is cash, although the speciality pharma player Serb Pharmaceuticals also made the most of turmoil at Y-mAbs, getting that company and its approved anti-GD2 MAb Danyelza for just $412m up front.

At least that acquisition was seemingly spurred by a desire for Y-mAbs’ product. Investors will hope for more technology-driven deals – with hopefully a few more large bolt-ons – as the year continues.

1144