After SpringWorks, Immunome has a Ringside seat

Varegacestat’s pivotal study reads out imminently.

Varegacestat’s pivotal study reads out imminently.

The 75% climb in Immunome shares since the start of 2025, taking the group’s valuation up to $1.7bn, shows growing investor enthusiasm around the upcoming results of the Ringside study. This phase 3 trial, due to read out imminently, could position Immunome’s lead project, the small-molecule gamma secretase inhibitor varegacestat, as its first marketed drug.

A key fact: there’s only one gamma secretase inhibitor more advanced than varegacestat, the approved drug Ogsiveo, and its maker, SpringWorks, was this year bought by Merck KGaA for nearly $4bn. This provides one possible blueprint for Immunome bulls, and the data on which Ogsiveo was approved set a benchmark for varegacestat to hit in Ringside.

The setting in question is desmoid tumours that require systemic treatment, where Ogsiveo secured FDA approval in 2023. Backing came from Defi, a small, 142-patient trial in which Ogsiveo scored a massive win over placebo on progression-free survival, amounting to a 71% reduction in risk of progression or death.

Response rate benchmark

However, desmoid tumours can be slow growing, so whether Ringside yields meaningful PFS data at this point is unclear; the Immunome study began in 2021, and completed the enrolment of 198 patients in February 2024. And, although PFS versus placebo is its primary endpoint, analysts expect response rate data to be far more indicative of varegacestat’s potential to rival Ogsiveo.

On ORR Ogsiveo scored 41% in the Defi trial, and this appears to be a level that varegacestat must hit. In Immunome’s favour is the 64% ORR that varegacestat achieved in phase 2, though clearly expecting such high activity to be repeated in the wider setting of phase 3 is unrealistic.

As such, Evercore ISI’s Cory Kasimov reckons an ORR of at least 50% represents a bull case for Immunome. If varegacestat ORR comes in below 41% that would come as a nasty shock to the markets.

A separate consideration is safety, given that Ogsiveo’s label warns of several side effects, including diarrhoea, ovarian toxicity and elevated liver enzymes. It’s possible, for instance, that a meaningfully better safety profile could rescue varegacestat if Ringside shows efficacy only to be on a par with Ogsiveo, a drug that sold $171m last year.

Meanwhile, the most optimistic scenario has Ringside yielding better safety and efficacy, though Casimov admits that this is a long shot.

Ogsiveo in Defi; can varegacestat do better?

| Metric | Result |

|---|---|

| mPFS | NR* |

| ORR | 41% |

| CR rate | 7% |

| Diarrhoea at gr3+ | 16% |

| Ovarian toxicity (all <gr3) | 75% |

| AST elevation at gr3+ | 3% |

| ALT elevation at gr3+ | 6% |

Note: *mPFS for placebo was 15.1mth, and the difference produced HR=0.29 (p<0.001) for Ogsiveo. Source: prescribing info & OncologyPipeline.

Assuming that some investors will see an eventual takeover of Immunome as their dream ticket, it’s also worth considering that the company’s chief executive is Clay Siegall, the co-founder and former head of Seagen.

Seagen, of course, is the ADC specialist that Pfizer bought for $43bn in 2023. Though that deal came after Siegall’s May 2022 resignation, some in the market are already calling Immunome a possible Seagen 2.0.

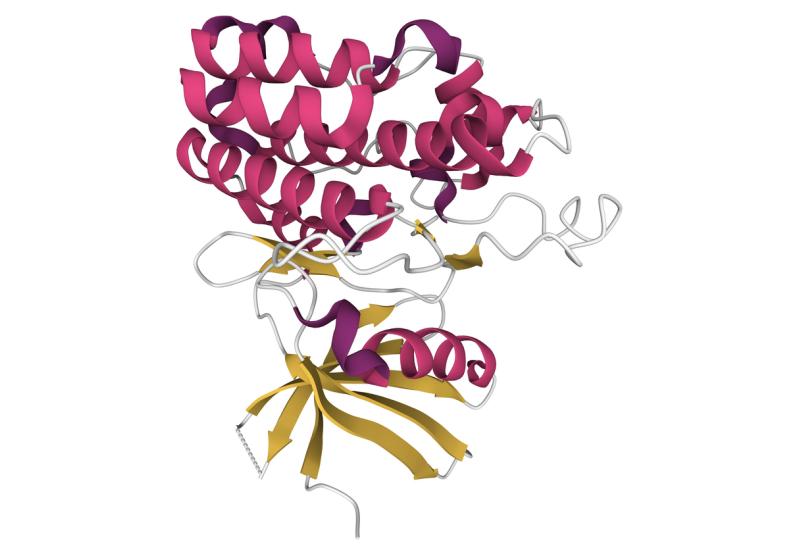

Indeed, the company has some work ongoing in ADCs, but its only disclosed project here is IM-1021, a phase 1 conjugate against ROR1 that was licensed from Zentalis for just $35m up front. Given the distinctly mixed track record of this target, however, investors will most likely see varegacestat and Ringside as the key to seeing Immunome stock climb even higher.

2565