AbbVie is next to the VEGF bispecific table

$650m buys the group rights to RemeGen’s RC148.

$650m buys the group rights to RemeGen’s RC148.

AbbVie recently denied rumours linking it to an acquisition of Revolution Medicines, but the big pharma group has still managed to strike the most significant deal of this week’s JP Morgan healthcare conference so far, paying RemeGen $650m for a seat at the PD-1 x VEGF bispecific table.

Specifically the tie-up involves ex-China rights to RemeGen’s RC148, and comes after Bristol Myers Squibb and Pfizer last year bought similar assets, from BioNTech and 3SBio respectively. One question is whether the supply of such bispecifics has outstripped demand and lowered their value, given that the Bristol and Pfizer deals were each worth over $1bn up front.

Still, it’s probably too soon to say that the value of PD-(L)1 x VEGF bispecifics has peaked, considering that RC148 is still in early clinical development. Indeed, possibly the first clinical dataset RC148 yielded came only at last December’s ESMO-IO meeting, from a Chinese phase 1/2 study in treatment-naive and post-checkpoint lung cancer.

Here, in first-line NSCLC RC148 monotherapy yielded a confirmed ORR of 52% among 21 evaluable patients. The result appeared to hold up across histologies, but given that all patients had to be PD-L1 positive it was perhaps nothing to shout about.

67% ORR in checkpoint-relapsed

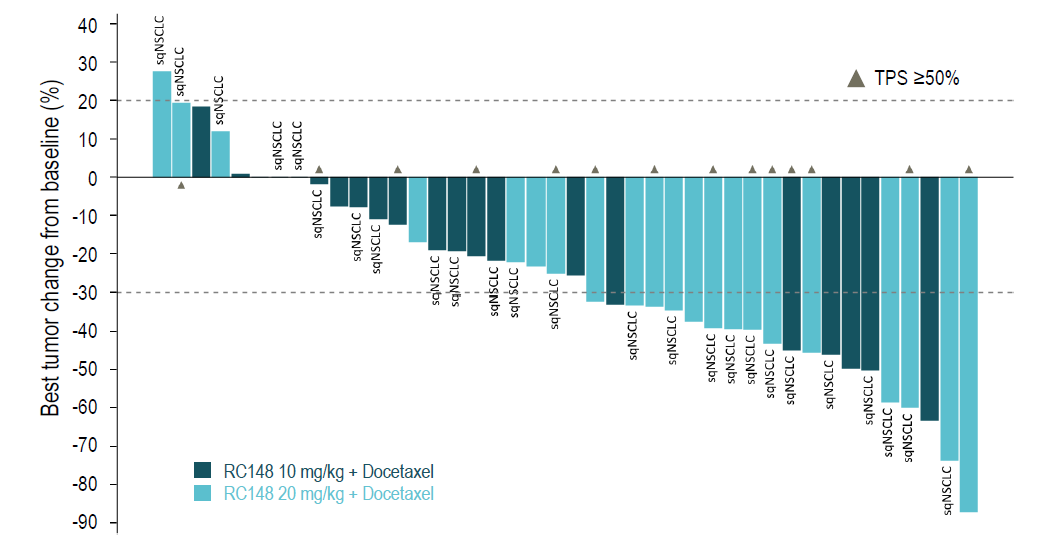

Much more impressive – and perhaps representing a trigger for the AbbVie deal – was the result in relapsed NSCLC. This concerned an RC148 combo with docetaxel, and called for patients to have been pretreated with a PD-(L)1 blocker and platinum chemo, with no requirement for tumours to express PD-L1.

In 21 subjects given a 20mg/kg RC148 dose the confirmed ORR was an astonishing 67%. The 10mg/kg dose produced less impressive activity, but importantly the poster didn’t appear to suggest the higher dose being associated with increased adverse events, though four patients did discontinue, versus two in the 10mg/kg arm.

RC148 + docetaxel in post-checkpoint NSCLC

The deal makes AbbVie the latest big pharma to buy into China-originated PD-(L)1 x VEGF bispecifics, with Bristol now having rights to BioNTech’s Biotheus-derived pumitamig, and Pfizer ramping up pivotal development of 3SBio’s PF-08634404.

Earlier Merck & Co paid $588m for rights to LaNova’s MK-2010. This means that big pharma companies with no disclosed presence at the VEGF bispecific table include AstraZeneca, Roche, Lilly and Novartis; the first of these was last year rumoured to have been considering a deal with Summit Therapeutics, but that came to nothing.

Summit itself, as the first Western player to do a big Chinese deal in this bispecific space, is closely watched, awaiting a second-half readout of ivonescimab’s Harmoni-3 study, which some sellside analysts are calling the biggest biotech catalyst of 2026. On Monday Summit said it had filed ivonescimab in the US in the fourth quarter, for second-line EGFR-mutated NSCLC backed by the Harmoni trial, but the FDA has yet to accept this.

Still, not all these projects were created equal, and just this month Instil Bio scrapped a deal with ImmuneOnco covering palverafusp alfa, an anti-PD-L1 x VEGF trap fusion protein.

As for JP Morgan, the healthcare conference marking the start of the biotech year gets under way in San Francisco on Monday. There’s still no news about any acquisition of Revolution, whose market cap now stands at around $23bn, its shares having climbed 45% over five days. The latest story concerns a buyout by Merck & Co, but like the AbbVie rumour this has yet to amount to anything.

Selected anti-PD-(L)1 x VEGF deals

| Project | Seller | Buyer | Financials | Date |

|---|---|---|---|---|

| Ivonescimab | Akeso | Summit | $500m up front; ex-China rights | Dec 2022 |

| Pumitamig | Biotheus | BioNTech | $55m up front; ex-China rights; BioNTech later acquired Biotheus for $800m | Nov 2023 |

| Palverafusp alfa | InstilBio | ImmuneOnco | $50m up front; ex-China rights; deal terminated in Jan 2026 | Aug 2024 |

| MK-2010 | LaNova Medicines | Merck & Co | $588m up front; global rights | Nov 2024 |

| PF-08634404 | 3SBio | Pfizer | $1.25bn up front; ex-China rights | May 2025 |

| Pumitamig | BioNTech | BMS | $1.5bn up front; 50/50 share | Jun 2025 |

| CR-001 | Crescent | Kelun | $20m up front; China rights | Dec 2025 |

| RC148 | RemeGen | AbbVie | $650m up front; ex-China rights | Jan 2026 |

Source: OncologyPipeline.

2330