Eikon steps down into Nasdaq

With a slashed valuation the newly listed biotech heads for phase 3.

With a slashed valuation the newly listed biotech heads for phase 3.

There’s a lot riding on Eikon Therapeutics, a biotech company founded by former Merck & Co executives that begins trading on Nasdaq today. One thing clear from the IPO, however, is the extent to which the enthusiasm of Eikon’s private investors ran away from reality as the company stretched itself financially.

That’s emerged from Eikon’s updated listing document, which revealed that the $18 per share at which Eikon is floating is barely half the price at which the company raised $1.1bn as a private entity – a surprising and worrying step down for venture financiers. Valuations notwithstanding, Eikon is set to become a pivotal-stage biotech, a new clinicaltrials.gov listing has disclosed.

That listing concerns the phase 2/3 Teluride-008 trial, which will test Eikon’s lead pipeline asset, EIK1001, in combination with Keytruda and chemo in first-line non-small cell lung cancer. The study is described as “adaptive”, with a phase 2 stage to determine the optimal dose of EIK1001, a TLR7/8 inhibitor Eikon licensed in 2023 from an entity called Seven and Eight Biotherapeutics.

The phase 3 stage will co-primarily measure PFS, OS and ORR compared with Keytruda plus chemo. The median OS bar to beat seems to be Keytruda plus chemo’s 18.4 months in the Keynote-406 study (squamous histology) and 22.0 months in Keynote-189 (non-squamous), and Eikon might be hoping for low-PD-L1 expressers to drive a benefit.

$381m raise

No doubt much of the $381m Eikon’s IPO is raising on Thursday will go towards funding Teluride-008, and given that this is only the company’s first phase 3 effort it’s astonishing how much Eikon has already sunk into its pipeline.

Filings reveal that Eikon spent $205m on R&D alone in 2024, and likely spent even more last year, reporting 2025 nine-month R&D expenditure of $185m. As of the end of September Eikon had burned through $841m of cash, according to its updated S-1 filing with the SEC.

Such a level of spending seems high for a private biotech, and investor enthusiasm was likely driven by the top-tier record of Eikon’s senior management. The group counts Roger Perlmutter as chief executive, Roy Baynes as chief medical officer, and Ken Frazier as a director; all three were high-profile senior execs at Merck.

But what’s notable about the IPO is the step down in Eikon’s valuation. When a company floats it’s usual for its private financiers to secure a significant step up in stock valuation, but the S-1 reveals that Eikon raised cash from private investors at an average $34.42 per share – almost double the $18 at which it’s just floated.

Eikon tapped venture financiers for a total $1.1bn, a sum that exceeds the $972m market cap at which $18 per share values the business – another indication of how enthusiasm has cooled.

Why now?

This is all highly relevant given how important Eikon’s flotation is as an indicator of biotech sentiment. Floating at well below the valuation at which private investors bought in could be taken as desperation to get out onto the public markets before sentiment turns gloomy and the IPO window shuts.

That’s especially pertinent given that Eikon wasn’t at all desperate for more cash. The S-1 document reveals that Eikon still had $376m in the bank at the end of last September, having tapped private investors less than a year ago in a $351m series D round. Why did it decide that now was the time for an IPO?

That said, these pre-IPO considerations go out of the window if Eikon’s stock surges after the float, causing the book value of private stakes to rise accordingly, and perhaps even to exceed the $34.42 per share at which private capital was sunk. All eyes now turn to the performance of Eikon shares as they start trading on Nasdaq.

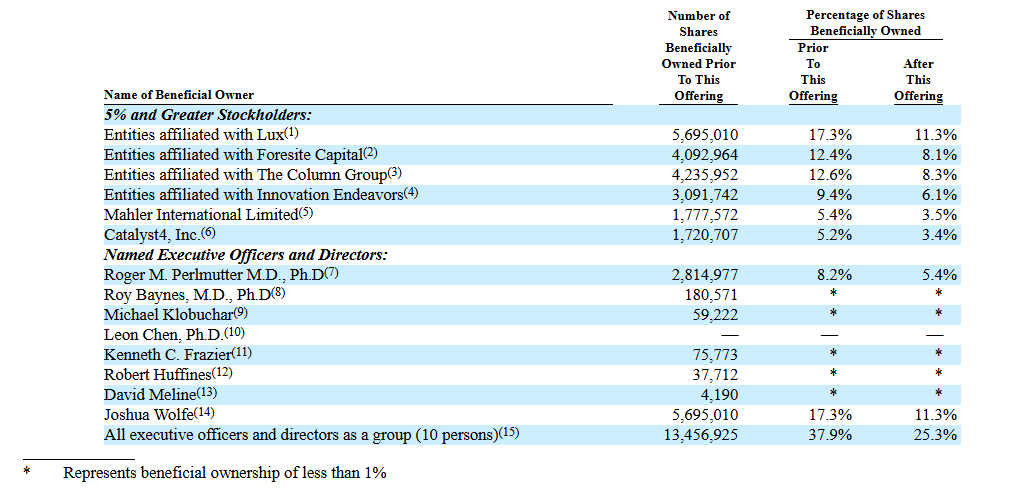

Eikon’s principal shareholders

667