Safety remains in focus for Cogent’s bezuclastinib

An “optimised formulation” of bezuclastinib looks promising, but the safety question remains open.

An “optimised formulation” of bezuclastinib looks promising, but the safety question remains open.

After Blueprint last week showed that indolent systemic mastocytosis was a market worth going after, Cogent has moved to remind investors that it too is a player here.

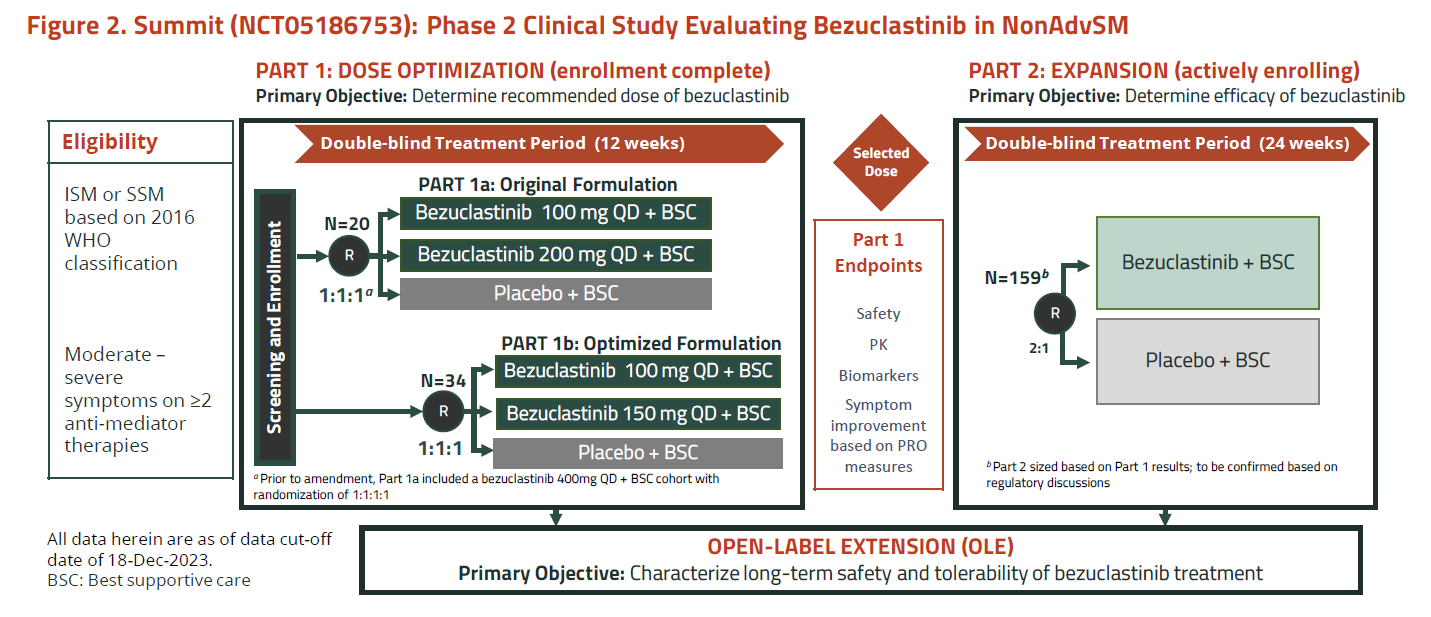

Cogent’s contender is bezuclastinib, a KIT D816V kinase inhibitor acquired from Daiichi Sankyo that at last year’s ASH squared off against Blueprint’s similarly acting next-generation agent elenestinib. Now Cogent has come out with additional clinical results, and revealed plans to start the Summit trial’s registrational portion, which will yield data by the end of 2025.

It was Summit’s part 1A that featured at ASH, showing that (with caveats about slightly different efficacy measures used) bezuclastinib had activity in indolent systemic mastocytosis on a par with Blueprint’s elenestinib. However, safety emerged as the differentiator: bezuclastinib suffered dose reductions and a liver enzyme elevation, and a 400mg dose had to be discontinued after a patient experienced grade 4 neutropenia.

New formulation

That all concerned the “original formulation” of bezuclastinib, and Cogent offered investors the promise of a new form optimised for improved bioavailability, to be tested in part 1B of Summit.

It’s this “optimised formulation”, at 100mg or 150mg once-daily, that forms the basis of today’s bullish update. A presentation at the American Academy of Allergy Asthma & Immunology meeting shows reductions in the disease markers serum tryptase, peripheral blood KIT D816V and bone marrow mast cell burden that look similarly promising to those in part 1A.

However, the spotlight remains on safety, and in the 100mg group Cogent cites a profile generally similar to placebo, with no grade 3/4 events, bleeding, oedema, cognitive events, dose reductions or discontinuations.

But the note of caution comes with the 150mg group, which saw two dose reductions, and two liver enzyme elevations, one of which led to discontinuation.

Accordingly, Cogent has played down 150mg, focusing attention on 100mg, the dose it will now take into the registrational part 2 of Summit. This trial will enrol 159 patients, randomising them 2:1 to bezuclastinib or placebo, though the actual recruitment target has yet to be agreed with regulators, as apparently has the efficacy endpoint, which is described as “mean absolute change in a disease-specific patient reported outcome”.

Competition

The driver of bezuclastinib’s development is the search for a non-brain penetrant KIT D816V kinase inhibitor to improve on the profile of Blueprint’s first-to-market drug Ayvakit.

Cogent stock fell heavily at ASH when bezuclastinib underperformed elenestinib on safety, but the shares mounted a comeback last week as Blueprint hiked peak sales estimates for Ayvakit from $1bn to $2bn, and Cogent completed a $225m private placement.

Interestingly, though elenestinib continues in the phase 3 Harbor trial, Blueprint has been somewhat secretive about specific development plans. This is understandable given that Ayvakit is a marketed drug that, despite a label warning of intracranial haemorrhage, is clearly selling well; it makes little sense for Blueprint to cannibalise its own position.

Cogent’s problem now is that it must try to destabilise Ayvakit as well as heading off a potential future challenge from elenestinib – all the while convincing that bezuclastinib has a squeaky clean safety profile.

Cogent's bezuclastinib development plan

1675