After failing to get Seagen Merck turns to Daiichi

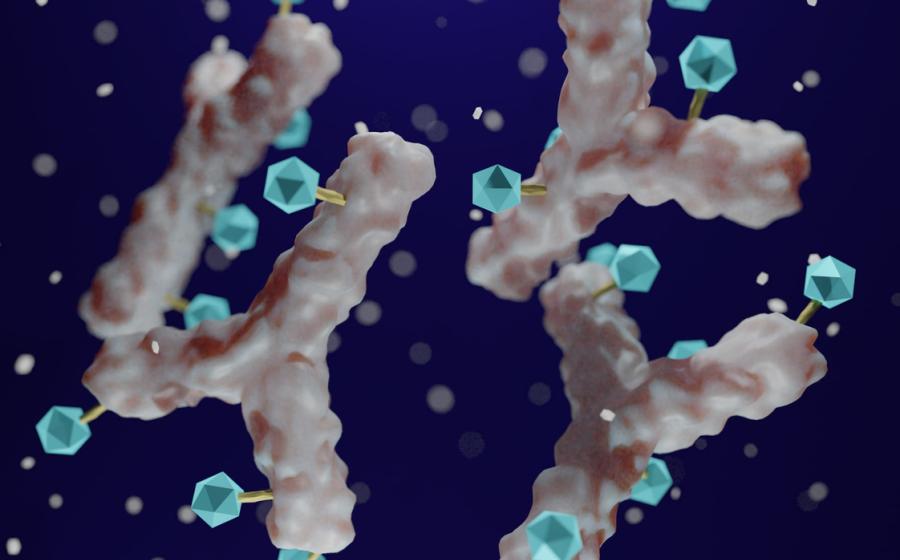

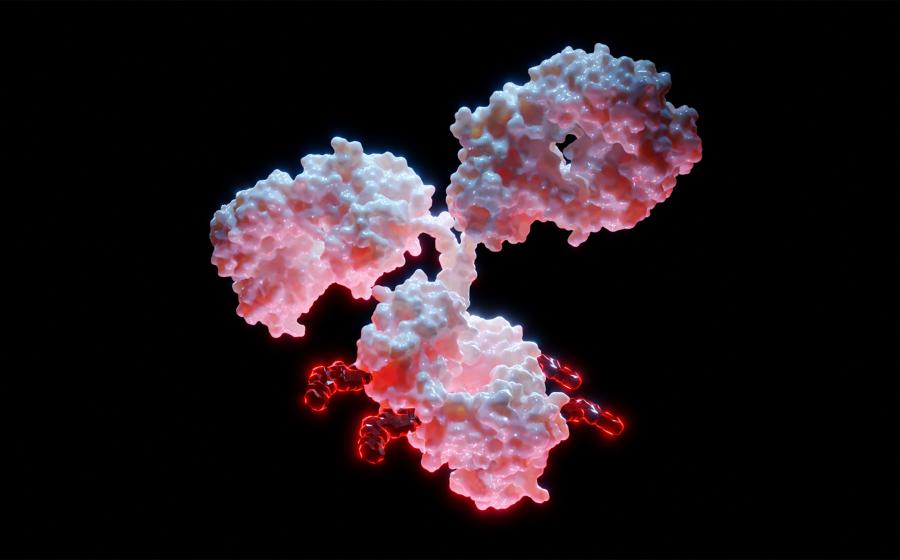

In paying $5.5bn for immediate rights to three Daiichi Sankyo assets Merck & Co has made its biggest bet on ADCs to date.

ESMO 2023 – some Tropion fears allayed

However, lack of meaningful efficacy in Tropion-Lung01 suggests that datopotamab deruxtecan might be restricted to a histology-defined NSCLC subgroup.

Astra works to avoid a datopotamab double dip

As Tropion-Breast01 is toplined positive Astra ensures the markets know that overall survival isn’t a washout.

Bicycle aims to follow in Padcev’s slipstream

A study to back accelerated approval is to start next year, but the prospect of seeing a fully greenlit Padcev before then looms large.

ASCO 2023 – Merck’s Kelun deal gets its first validation

Asco data suggest that the TROP2 ADC Merck & Co licensed from Kelun is at least as good as Gilead and Astra/Daiichi’s assets.