After Blueprint's takeover comes Cogent's big test

The registrational part 2 of bezuclastinib's Summit trial reads out in July.

The registrational part 2 of bezuclastinib's Summit trial reads out in July.

With Cogent Biosciences' key competitor, Blueprint, having just been bought for $9.1bn by Sanofi, attention has fallen on Cogent's lead asset, the kinase inhibitor bezuclastinib. As luck would have it, bezuclastinib's registrational Summit trial in non-advanced systemic mastocytosis is due to read out shortly.

Cogent has positioned bezuclastinib as an alternative to Blueprint's Ayvakit, which despite carrying a warning of intracranial haemorrhage has become a major force as an approved drug for this indolent disease. One fact could make Cogent investors wary, however: the group last week closed a deal giving it up to $400m in debt financing.

Debt rarely plays out well for loss-making biotechs, but perhaps market uncertainty limited Cogent's ability to do a typical equity raise. Still, sceptics might think that if the company was confident of a positive result in Summit it would have waited for one before raising cash – on better terms and backed by a strengthened valuation.

$2bn drug?

Ayvakit, a PDGFRα/c-KIT inhibitor, sold $479m last year, and Blueprint had forecast that it would be bringing in $2bn a year by 2030. This and Sanofi's $9.1bn takeover – virtually all tied to the value of Ayvakit – has put a spotlight on Cogent's market cap, which stands at a mere $825m.

While non-advanced systemic mastocytosis (NASM) has relatively recently become a big market opportunity, it is still a two-horse battle between Ayvakit and bezuclastinib. As such, Blueprint and Cogent have frequently taken potshots at each other, the former accusing bezuclastinib of being a non-selective kinase inhibitor, while the latter has slammed Ayvakit's toxicity.

That said, it's abundantly clear that both molecules are active in NSAM. What is broadly seen as making the difference is safety, and it's this that will be the most closely watched aspect of the topline data release from Summit's registrational part 2, due in July.

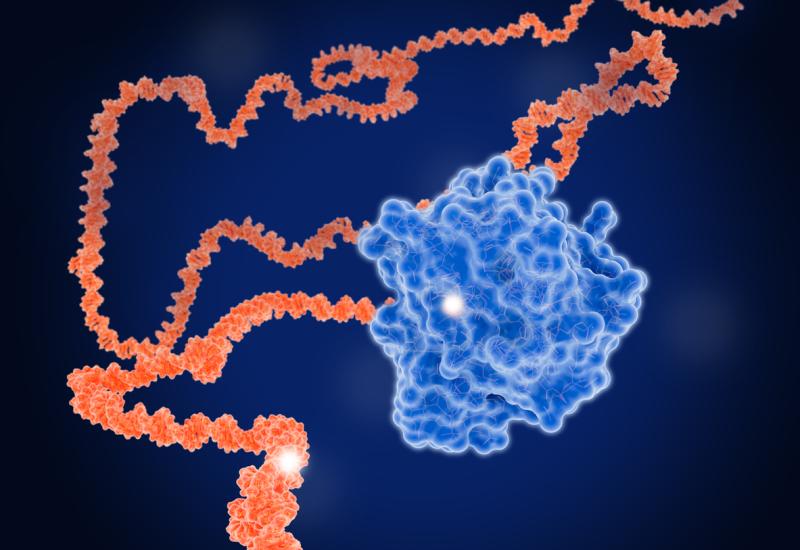

Bezuclastinib is said to have selectivity against D816V-mutated KIT kinase, and in contrast to Ayvakit is not brain penetrant, minimising risk of intracranial haemorrhage. But it has a convoluted history, having been studied by Cancer Research UK and Plexxikon as PLX9486, before passing to Daiichi Sankyo and then Cogent, which gained a Nasdaq listing by reversing into Unum Therapeutics.

Irrespective of bezuclastinib's CNS non-penetration, the Cogent molecule carries risks of its own. In part 1A of Summit an original formulation suffered dose reductions and liver enzyme elevation, and a 400mg dose had to be discontinued after a patient experienced grade 4 neutropenia.

Part 1B then focused on an “optimised formulation”, at 100mg or 150mg, but this too saw dose reductions and liver enzyme elevations, and Cogent subsequently moved all patients to 100mg. 100mg once daily is the dose studied in 179 NASM patients in the now crucial, placebo-controlled, part 2 of Summit.

Cogent's great expectations

Cogent Biosciences | Blueprint (bought by Sanofi) | |||

|---|---|---|---|---|

| Trial | Summit part 1 & OLE | Summit part 2 | Pioneer | |

| Therapy | Bezuclastinib 100mg | Ayvakit | Placebo | |

| Absolute reduction in 24-wk TSS from baseline | 27.6 points | ? | 15.3 points | 9.6 points |

| Absolute reduction in 24-wk TSS, placebo-adjusted | – | ? | 5.7 points | – |

| Percentage reduction in 24-wk TSS from baseline | 56% | ? | 31% | 18% |

Source: company presentations & OncologyPipeline.

At last year's ASH Cogent said patients on 100mg in Summit's open-label expansion experienced a 56% mean improvement from baseline in total symptom score (TSS) at 24 weeks, and an absolute TSS reduction of a mean 27.6 points.

Cogent has spelled out its expectations for Summit's part 2: a 5.7-point mean 24-week placebo-adjusted TSS would show equivalence to Ayvakit, 8.5 points would be a "home run", while an 11.4-point figure would be a "grand slam". On safety it wants to see no cases of drug-induced liver injury or Hy's law, liver enzyme elevations to be asymptomatic and reversible, and 10% or lower rates of grade 3 events and discontinuations.

It's also worth noting that Blueprint has a CNS non-penetrant, KIT D816V-selective inhibitor of its own, elenestinib, which has also shown impressive efficacy. One question is whether it's worth risking cannibalising the Ayvakit franchise, and while Blueprint had insisted that there was a way forward for Ayvakit and elenestinib alike, this is now Sanofi's problem.

Given Ayakit's unexpected success Cogent must contend with the fact that this drug doesn't appear to be held back by toxicity. Even if Summit succeeds beluclastinib will be several years behind what is now an important standard of care.

1279