Deals mask CytomX’s fundamental problem

Another disappointment raises fresh doubts about CytomX’s extensively partnered masked therapeutics.

Another disappointment raises fresh doubts about CytomX’s extensively partnered masked therapeutics.

CytomX’s business development team should congratulate itself for the number of biopharma deals the company has struck and continues to strike. These have been done despite a lack of truly convincing clinical data supporting the technology behind CytomX’s conditionally acting “probody” therapeutics.

Yesterday brought a fresh setback, with the revelation that Bristol Myers Squibb had pulled the plug on an anti-CTLA-4 probody, the second on which it had worked with CytomX, and the second that it’s now axed. Despite this, and now trading well below cash, CytomX ploughs on with probody therapeutics, having signed deals that brought it a combined $510m in up-front fees.

In reality, only an Amgen tie-up remains of near-term interest, given that it has a specific project focus: the anti EGFR T-cell engaging probody CX-904 remains in development in EGFR-positive solid tumours, and is set to deliver phase 1 data this year.

That Amgen deal was struck in 2017, after CytomX had signed its biggest-ever transaction, the one with Bristol that just delivered its second setback. Also still in play are CytomX tie-ups with Astellas, Regeneron and Moderna – all focusing on probodies – but these have no disclosed assets, and for now remain early-stage discovery alliances.

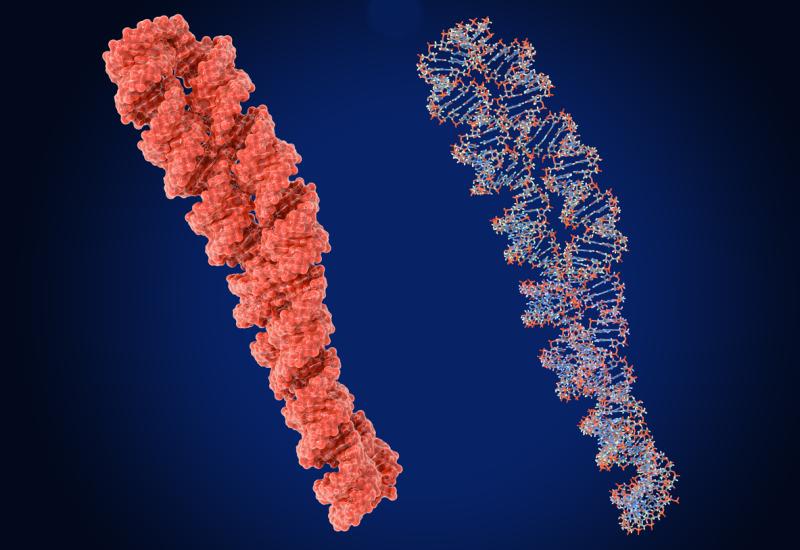

Masking domains

Probodies have an antibody structure, but add masking domains that render them inactive until cleaved by proteases in the tumour microenvironment. The fundamental aim is to avoid off-tumour activity, and they can be used to build naked MAbs, bispecific T-cell engagers, antibody-drug conjugates or other proteins.

That's a good theory, but the work CytomX itself has done in its 16 years of existence has shown little to shout about. Nevertheless, numerous companies bought in, and CytomX’s shares peaked in early 2018, since when the group has lost 94% of its value. During this time Pfizer pulled out of an EGFR-directed probody deal, while AbbVie discontinued CX-2029, an anti-CD71 asset, in a recent pipeline cull.

And neither has CytomX’s in-house pipeline delivered. The group discontinued praluzatamab ravtansine in mid-2022 after this anti-CD166 probody-drug conjugate disappointed in breast cancer. At the time it was also developing the anti-PD-L1 probody pacmilimab, but this proved not to be meaningfully different from standard anti-PD-(L)1 MAbs and was also scrapped.

Against such a backdrop it seems remarkable that Bristol bet much of its post-Yervoy immuno-oncology strategy on CytomX. This delivered two Yervoy-based anti-CTLA-4 probodies: BMS-986249, terminated a year ago, and the non-fucosylated version BMS-986288, which CytomX yesterday revealed Bristol had unexpectedly discontinued in a portfolio review on 6 March.

The Bristol alliance continues, but like the Moderna, Regeneron and Astellas deals it’s effectively a preclinical discovery collaboration. Meanwhile, CytomX’s in-house focus is now on the probodies CX-2051, an ADC that targets Epcam and carries a topoisomerase 1 payload, and CX-801, an interferon α2b; neither has yet entered clinical trials.

Given CytomX’s slow progress it’s worth noting the positive clinical data Janux reported last month with the anti-PSMA conditionally acting project JANX007. These early results suggest that Janux can design a molecule that does what a masked therapeutic of this sort should do: widen the therapeutic window of standard MAbs, and improve safety.

That’s the one thing CytomX has still not done, and until it does its shares will languish.

Buying into probodies: CytomX's biopharma deals

| Date | Licensee | Assets covered | Up-front |

|---|---|---|---|

| Jan 2023 | Moderna | Undisclosed probody discovery | $35m |

| Nov 2022 | Regeneron | xCD3 probody discovery | $30m |

| Mar 2020 | Astellas | xCD3 probody discovery | $80m |

| Oct 2017 | Amgen | EGFRxCD3 probody, CX-904 | $60m* |

| Mar 2017 | Bristol Myers Squibb | Deal extension, additional targets | $200m |

| Apr 2016 | AbbVie** | Anti-CD71 probody-drug conjugate, CX-2029 | $30m |

| May 2014 | Bristol Myers Squibb^ | Anti-CTLA-4 probodies & others | $50m |

| Jun 2013 | Pfizer^^ | Anti-EGFR probody & others | $25m |

Notes: *included $20m equity; **deal terminated Mar 2023; ^BMS-986249 terminated Feb 2023, BMS-986288 terminated Mar 2024; ^^deal terminated in Mar 2018. Source: company filings.

2439