FDA red and green lights: December 2025

Seven oncology approvals included nods for subcutaneous Rybrevant and Lunsumio.

Seven oncology approvals included nods for subcutaneous Rybrevant and Lunsumio.

Following delays for subcutaneous versions of Johnson & Johnson’s Rybrevant and Roche’s Lunsumio, the FDA delivered the companies an early Christmas present, with approvals of both projects last month.

Overall, there were seven oncology green lights in December, suggesting the agency has picked up the pace following an earlier government shutdown. Other decisions included a thumbs up for AstraZeneca and Daiichi’s Enhertu, plus Roche’s Perjeta, in first-line breast cancer; and a long-awaited full approval for Lilly’s Jaypirca, confirming an earlier accelerated nod and expanding use into second-line CLL.

One approval decision that didn’t come last month, but is believed to be imminent, concerns Boehringer’s Hernexeos in first-line HER2-mutated NSCLC, where the drug has a commissioner’s national priority voucher (CNPV). Before the holidays, Boehringer’s head of oncology, Itziar Canamasas, told ApexOnco that the company didn’t have a formal PDUFA date, but was ready to answer any questions from the FDA within 24 hours, as required by the scheme.

Subcutaneous

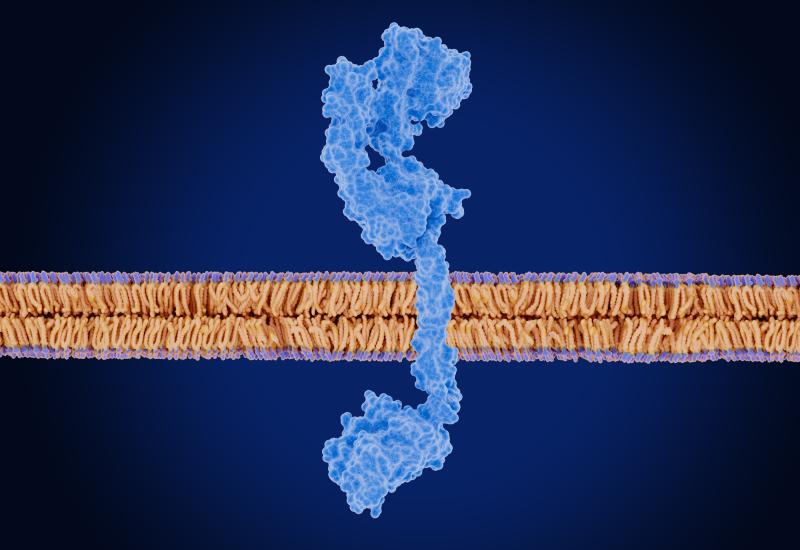

The nod for subcutaneous Rybrevant, now known as Rybrevant Faspro, came around a year after the FDA issued a complete response letter, with J&J citing manufacturing issues. Now the SC version of the anti-EGFR x cMet bispecific can be used across the same uses as the intravenous formulation, the most lucrative of which is in combination with Lazcluze in first-line EGFR-mutated NSCLC.

Rybrevant Faspro can be administered in five minutes, versus “several hours” for the IV version, according to J&J. The Paloma-3 trial also showed a trend towards a survival improvement versus the IV formulation.

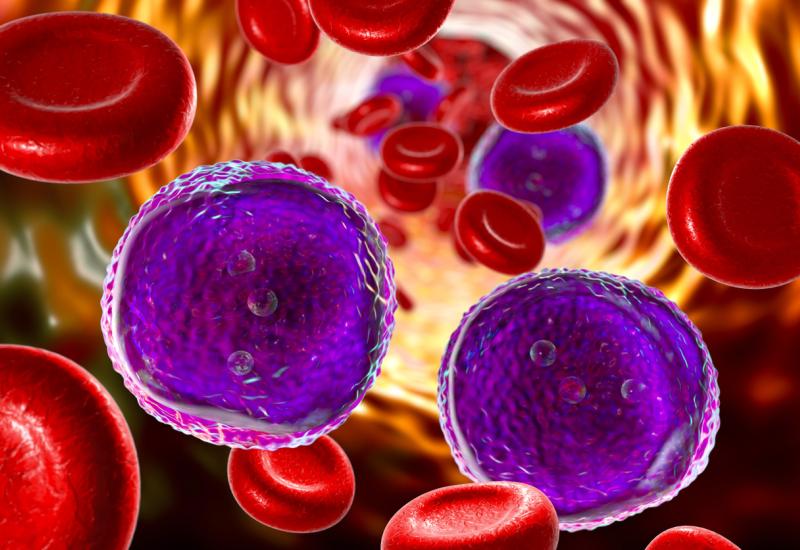

Roche has only bagged accelerated approval for Lunsumio Velo, the SC version of its anti-CD20 T-cell engager, and only in third-line follicular lymphoma – reflecting the current status of the IV version.

Still, the Swiss group will be relieved to have got the green light – the FDA decision on SC Lunsumio had once been expected in September, but was pushed back by three months so the agency could review additional data.

IV Lunsumio’s confirmatory trial, Celestimo, in second-line FL has been delayed until this year (from 2025 previously); while Roche is also pushing into DLBCL, where the Sunmo trial has returned positive results with Lunsumio plus Polivy in the second line.

Going earlier

Enhertu’s go ahead in first-line HER2-positive breast cancer could help it achieve the $5bn peak sales that Astra has predicted. The front line is the drug's biggest approved use so far, with around 135,000 addressable patients, according to the company, which is additionally hoping to move into perioperative settings.

Lilly is also looking earlier with Jaypirca, with front-line CLL studies recently yielding positive data at ASH – although the group is still highlighting the second-line setting as the main market for the drug. December’s full approval in post-BTK inhibitor patients came despite the confirmatory Bruin CLL-321 trial only showing a benefit on PFS, not OS. The latest decision followed a 2023 accelerated approval in the third line.

Meanwhile, Bristol has expanded its CD19-targeting Car-T Breyanzi into relapsed/refractory marginal zone lymphoma, stealing a march on competitors like Gilead’s Yescarta and Novartis’s Kymriah. However, MZL is a relatively rare and slow-growing lymphoma type, and the new label demonstrates one of the issues with Car-T: among 77 leukapheresed patients, only 67 received Breyanzi. In the intent-to-treat population, ORR was 84%, but this climbed to 96% among Breyanzi-treated patients.

Selected December 2025 US regulatory decisions in oncology

| PDUFA date | Outcome | Drug | Company | Indication | Note |

|---|---|---|---|---|---|

| Undisclosed | Full approval 3 Dec 2025 | Jaypirca | Lilly | 2nd-line CLL/SLL (post-BTKi) | Previously had AA for 3rd-line; confirmatory Bruin-CLL-321 trial hit on PFS, but not OS |

| 5 Dec 2025 | Full approval 4 Dec 2025 | Breyanzi | Bristol Myers Squibb | 3rd-line marginal zone lymphoma | New use, based on Transcend FL-MZL cohort |

| Assumed Dec 2025 | Full approval 12 Dec 2025 | Akeega | J&J | BRCA2m mCSPC (+ prednisone) | New use, based on Amplitude |

| 23 Jan 2026 | Full approval 15 Dec | Enhertu + Perjeta | AstraZeneca/ Daiichi/ Roche | 1st-line HER2+ve breast cancer | New use, based on Destiny-Breast09 |

| Undisclosed | Full approval 17 Dec | Rybrevant Faspro (SC) | J&J | All indications approved for IV formulation | CRL Dec 2024 on manufacturing issues |

| 12 Jan 2026 | Full approval 17 Dec | Rubraca | pharmaand (originated by Clovis) | 2nd-line BRCAm mCRPC | Previously had AA for 3rd-line |

| ‘22 Dec 2025 | AA 22 Dec 2025 | Lunsumio Velo (SC) | Roche | 3rd-line follicular lymphoma | Decision delayed from 22 Sept 2025 on additional data |

Source: OncologyPipeline.

1083