IO comes agonisingly close to success

Keynote-D18 might have failed on a technicality, but now cash is running out.

Keynote-D18 might have failed on a technicality, but now cash is running out.

IO Biotech's immunotherapy Cylembio last year failed its "long shot" of an interim response rate hit in the Keynote-D18 trial, and now it's failed on the study's primary progression-free survival endpoint. However, the PFS data, presented on Monday, actually look encouraging, and it's possible that IO's biggest mistake was to have underpowered this study.

Of course, this is easy to say in hindsight; IO previously insisted that Keynote-D18, a first-line melanoma trial, was appropriately powered to detect a difference between its active Cylembio plus Keytruda cohort versus Keytruda alone. The company now calls the PFS miss narrow and plans a US filing this year, and there seems to be at least some basis for such bullishness.

For instance, the median PFS number for Keytruda control of 11 months looks in line with the nine months cited on the Merck & Co drug's label based on the now rather old Keynote-006 study. It's also in line with subsequently approved therapies, including Bristol Myers Squibb's Opdivo plus Yervoy as well as that company's anti-Lag3 combo Opdualag.

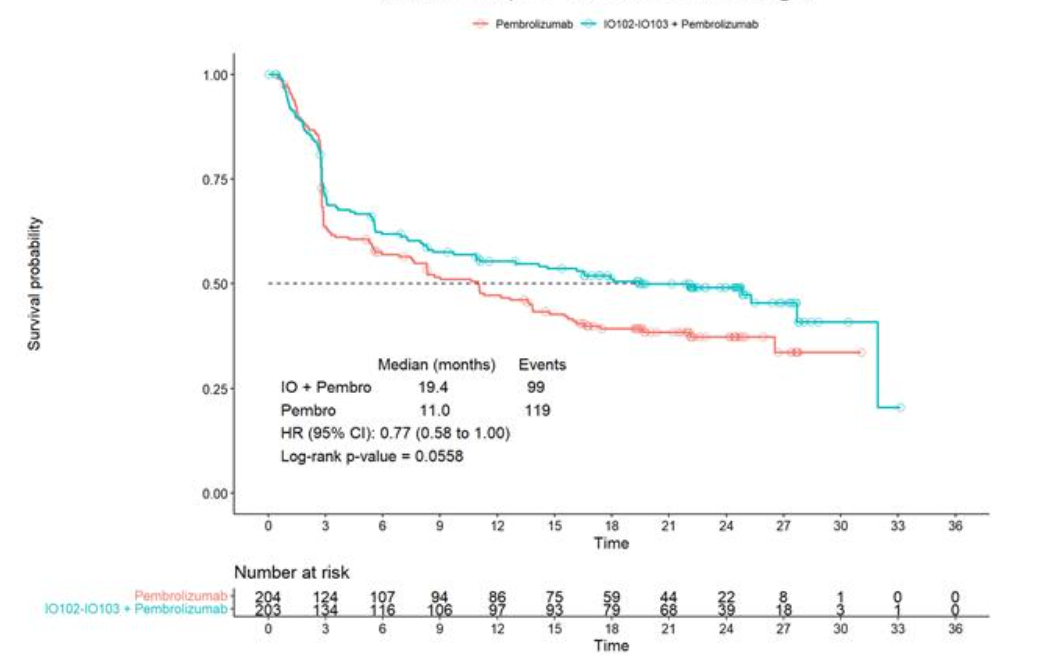

Moreover, PFS curves presented on an investor call appear robust, separating after about three months and maintaining a gap throughout. The median PFS that Cylembio plus Keytruda scored, 19.4 months, seems impressive on a cross-trial basis, though ultimately the 23% reduction in risk of progression or death scored a p value of 0.056, which failed to clear a 0.045 significance threshold.

PFS curves from Keynote-D18

IO’s chief executive officer, Mai-Britt Zocca, stated: "We believe that we do have a drug in hand." She said a path forward would now be discussed with the FDA, with a view to filing towards the end of this year.

That said, IO's biggest problem appears to be lack of cash, which stood at $28m at the half year, plus a €12.5m loan drawn down last month. This will only sustain IO into the first quarter of 2026, so unless a licensing deal materialises it's hard to see what the company can do; its stock closed down 42% on Monday, valuing the group at just $69m.

While a partner might be interested, IO is hardly in a strong position to negotiate a lucrative deal. The shape of the PFS curves and a positive numerical OS trend are points in its favour, as is the fact that the Keynote-D18 data were driven by PD-L1-negative disease – where Keytruda might not be expected to work, but precisely where an immunotherapy like Cylembio could help.

And IO pointed to the fact that 9% of Keynote-D18's 407 enrollees had received PD-(L)1 blockade in the pre-metastatic setting, something that might have made them more intractable to subsequent Keytruda therapy. If these are excluded – on a post hoc basis, of course – the PFS result swings into nominally positive territory, IO claimed.

Then again, Keynote-D18 included just 17 US patients, though it had aimed for 10% US enrolment. This is something with which the FDA might not be happy, though IO claimed that the population was ethnically representative of the US.

IDOn't know...

If the FDA does take a positive view of the data it still remains unclear whether it might narrow a potential approval to PD-L1 non-expressers, or patients completely naive to PD-(L)1 therapy.

Cylembio is an off-the-shelf project comprising the IDO and PD-L1 peptide antigens imsapepimut (IO102) and etimupepimut (IO103) respectively, seeking to activate T cells specific for those antigens. Any positive outcome would be a boon for the field of IDO (indoleamine 2,3-dioxygenase), though the problem here was the failure of IDO inhibitors, an entirely separate approach.

Last September Keynote-D18 failed an interim halt for efficacy on ORR, missing an aggressive p value of 0.0005. IO earlier said this was a long shot, and the trial continued to the current PFS readout for which most of its powering had been saved.

Its progress is of interest to Moderna, which is developing a similar off-the-shelf immunotherapeutic coded mRNA-4359. This is mRNA-based, but also seeks to stimulate an immune response against IDO and PD-L1, though so far it's impossible to say whether mRNA-4359 will fare any better than Cylembio.

Cross-trial comparison in 1st-line melanoma

| Regimen | Company | Study | Median PFS |

|---|---|---|---|

| Cylembio + Keytruda | IO Biotech | Keynote-D18 | 19.4mth (vs 11.0mth for Keytruda) |

| Opdivo + Yervoy | Bristol Myers Squibb | Checkmate-067 | 11.5mth |

| Opdualag | Bristol Myers Squibb | Relativity-047 | 10.1mth |

| Keytruda | Merck & Co | Keynote-006 | 9.4mth |

Source: OncologyPipeline.

4164