The month ahead: January’s remaining events

JP Morgan approaches.

JP Morgan approaches.

The biotech industry finished 2025 strongly, and investors will be hoping for more of the same this year – with an early litmus test being next week’s JP Morgan healthcare conference. The meeting usually kicks off with a deal or two, which could set the tone for 2026.

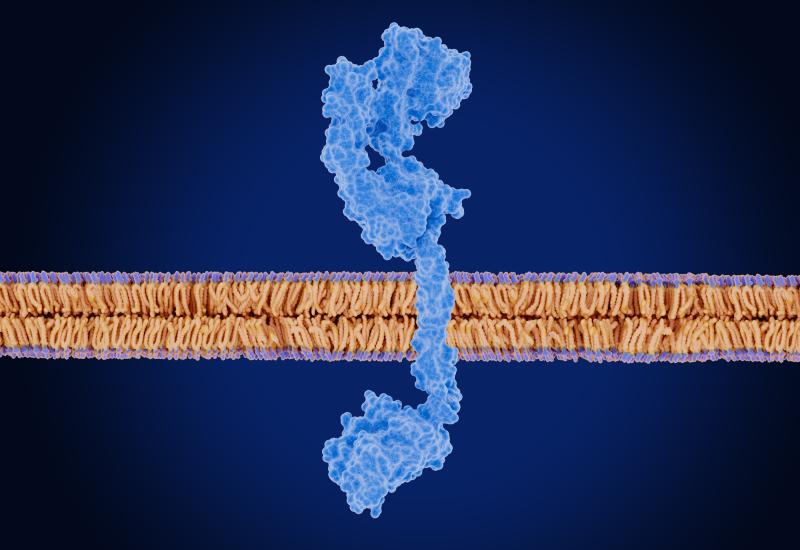

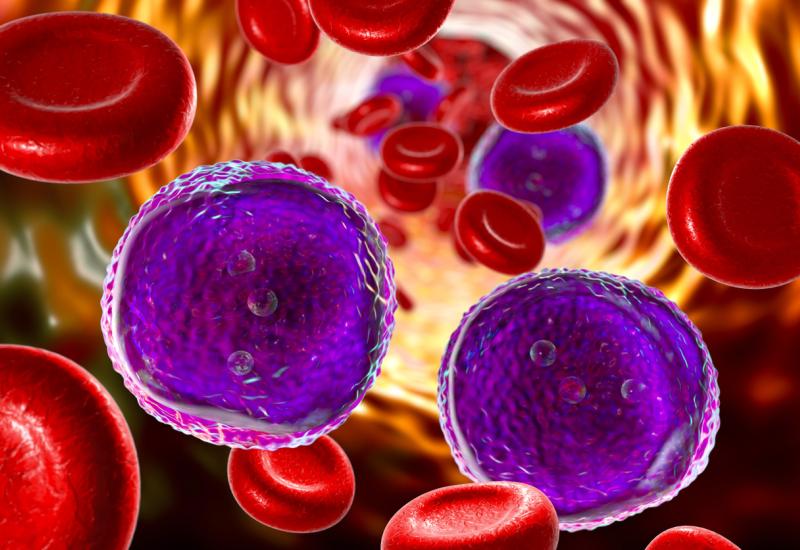

Meanwhile, Atara and Pierre Fabre’s T-cell therapy Ebvallo is awaiting an FDA approval decision in Epstein Barr virus-positive post-transplant lymphoproliferative disease – the second shot for the project following last year’s complete response letter. Verdicts could also come on Boehringer’s Hernexeos in first-line HER2-mutant NSCLC, and AstraZeneca’s SERD camizestrant in an unusual breast cancer setting, although the timings of these decisions are unclear.

Deals

Companies often time deal announcements to coincide with JP Morgan, but last year’s notable oncology transactions were fairly small, with GSK buying IDRx for $1bn and Lilly taking out Scorpion for an undisclosed up-front fee, thought to be around $1bn.

After some bigger purchases later in the year, including Genmab’s $8bn swoop for Merus, Sanofi’s $9bn purchase of Blueprint and, more recently, Johnson & Johnson’s $3bn move for the early-stage Halda, industry watchers might be hoping for more in 2026.

As for scientific conferences, the ASCO Gastrointestinal Cancers symposium begins on Thursday, but its biggest readout has already been scooped, with early release of the Horizon-GEA-01 trial of Jazz and BeOne’s Ziihera, presumably owing to an embargo breach. And J&J will kick off earnings season on 21 January.

Second time lucky?

Nearly a year ago Atara received a CRL for Ebvallo over third-party manufacturing issues, swiftly followed by a clinical hold; since then, it has refiled the project and transferred responsibility to its partner Pierre Fabre. If Ebvallo is approved Atara is set to receive a $40m milestone from its collaborator, something that's sorely needed; as of September Atara had just $13.7m in the bank.

A decision could also be imminent on Boehringer’s Hernexeos in first-line HER2-mutated NSCLC, where the drug has a commissioner’s national priority voucher (CNPV), although exact timings are unclear.

And AstraZeneca has said it’s expecting a verdict on camizestrant in the first half. The FDA is reviewing the Serena-6 trial, which tested a new use for oral SERDs, namely in patients who develop an ESR1 mutation during first-line therapy with CDK4/6 and aromatase inhibitors, but before formal progression.

The company presented positive data at ASCO but, even if Astra wins over regulators, getting doctors on board with a new monitoring paradigm could be a big hurdle.

Finally, Astra and AbbVie might get the go ahead for a fixed-duration regimen of the BTK inhibitor Calquence plus Venclexta in first-line CLL, based on the Amplify trial. Calquence is already approved in the front line, but is currently given until disease progression.

Astra reckons that fixed-duration therapy could reduce the risk of long-term adverse events and drug resistance, although a bigger question is whether this will help Calquence compete against BeOne’s Brukinsa, which is emerging as the BTK inhibitor to beat.

Upcoming readouts

Elsewhere, ArriVent is expecting data in “early 2026” with its EGFR inhibitor firmonertinib, from the Furvent trial in first-line NSCLC with EGFR exon 20 insertion mutations. Results had once been expected last year. The company is also taking aim at NSCLC with EGFR PACC mutations, with the recently begun Alpacca trial.

And BioNTech will be hoping for better news with its Roche-partnered personalised neoantigen candidate autogene cevumeran in adjuvant colorectal cancer. Last year the German group disclosed that, at its first interim analysis, the phase 2 BNT122-01 trial had crossed the boundary for futility but, as the data were immature, the trial continued. The next update is due in early 2026.

January’s upcoming events

| Event | Timing | Details |

|---|---|---|

| ASCO-GI meeting | 8-10 Jan | San Francisco |

| Ebvallo PDUFA | 10 Jan | 2nd-line EBV+ve post-transplant lymphoproliferative disease (CRL Jan 2025 on 3rd-party manufacturing issues, followed by clinical hold) |

| Sachs oncology innovation forum | 10 Jan | San Francisco |

| JP Morgan healthcare conference | 12-15 Jan | San Francisco |

| Biotech Showcase | 12-14 Jan | San Francisco |

| J&J Q4 2025 | 21 Jan | |

| CHMP day | 30 Jan | Decisions could come on AstraZeneca’s Imfinzi + chemo in perioperative gastric cancers (FDA approved Nov 2025) & Ipsen/Day One’s Ojemda r/r BRAFm paediatric low-grade glioma (FDA approved Apr 2024) |

| Camizestrant PDUFA | H1 2026 (assumed Jan) | ER+ve, HER2-ve breast cancer that develops ESR1m during 1st-line therapy (Serena-6 trial) |

| Hernexeos PDUFA | Assumed Jan | 1st-line HER2m NSCLC (Beamion Lung-1, new use); decision believed imminent following CNPV |

| Venclexta + Calquence PDUFA | Assumed Jan | 1st-line CLL (Amplify trial) |

| Data from ph3 Furvent trial of Arrivent’s firmonertinib | “Early 2026” | 1st-line exon-20 insertion NSCLC |

| Update from ph2 BNT122-01 of BioNTech/Roche’s autogene cevumeran | “Early 2026” | Adjuvant colorectal cancer; trial previously crossed boundary for futility |

Note: CNPV=commissioner’s national priority voucher. Source: OncologyPipeline.

863