More problems for BioNTech & Roche’s neoantigen shot

Autogene cevumeran goes on hold in adjuvant bladder cancer.

Autogene cevumeran goes on hold in adjuvant bladder cancer.

When BioNTech and Roche’s personalised neoantigen candidate autogene cevumeran failed earlier this year in first-line melanoma, the companies claimed that it had a better chance in adjuvant settings – but it has now run into problems here, too. Roche’s phase 2 Imcode-004 trial, in adjuvant muscle-invasive bladder cancer, was quietly put on hold last week, its clinicaltrials.gov entry reveals.

The “temporary” hold is down to a “safety event observed in the safety run-in population”. At the time of publication Roche hadn’t disclosed any more details, but this looks like another bad sign for this troubled asset.

The next readout for auto-ran is likely to be from a BioNTech-sponsored trial in adjuvant colorectal cancer, where the asset is being compared against watchful waiting. Data, once expected in 2024, are now due in late 2025 or early 2026.

Key trials of BioNTech/Roche’s autogene cevumeran

| Trial | Setting | Sponsor | Regimen | Primary endpoint | Note |

|---|---|---|---|---|---|

| Imcode-004 | Adjuvant MIUC | Roche | + Opdivo, vs Opdivo | Investigator-assessed DFS | First pt treated Dec 2024; put on hold Jul 2025 after “safety event” |

| BNT122-01 | Adjuvant colorectal cancer | BioNTech | Vs watchful waiting | DFS | Data due late 2025/early 2026 (delayed from 2024) |

| Imcode-003 | Adjuvant PDAC | Roche | + Tecentriq + chemo, vs chemo | DFS | “Recruitment ongoing”; completes Dec 2029 |

| Imcode-001 | 1st-line melanoma | Roche | + Keytruda, vs Keytruda | PFS | Fail, as per BioNTech’s Q4 2024 presentation |

| GO41836 | Adjuvant NSCLC | Roche | + Tecentriq, vs Tecentriq | DFS | Withdrawn (“accrual timelines”) |

Notes: DFS=disease-free survival; MIUC=muscle-invasive urothelial carcinoma; PDAC=pancreatic ductal adenocarcinoma; PFS=progression-free survival. Source: OncologyPipeline, clinicaltrials.gov & company presentation.

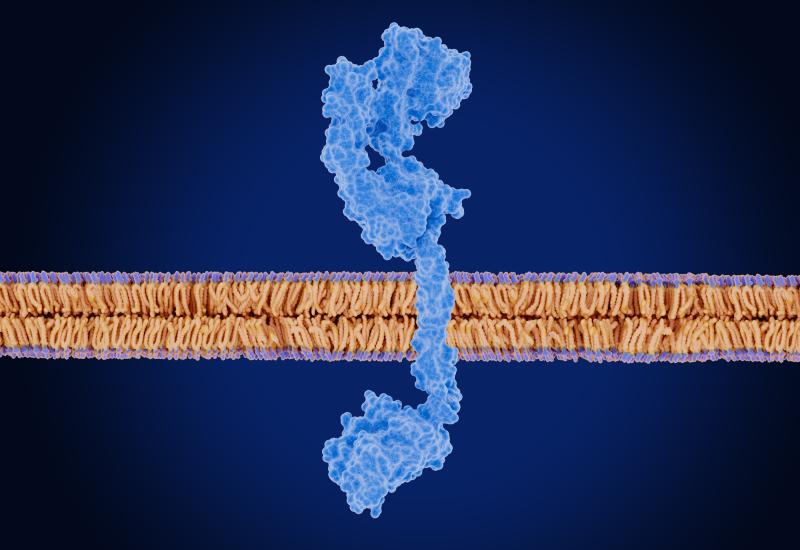

Auto-ran is a personalised mRNA therapeutic created on demand and encoding up to 20 neoantigens present in each patient’s tumour. It’s hoped that these will drive a T-cell response and eliminate the cancer.

However, this approach still has much to prove. BioNTech had already been shifting from metastatic disease to adjuvant uses before the failure in first-line melanoma, saying auto-ran might be more effective in settings with a relatively low tumour burden.

The company has touted data in adjuvant pancreatic cancer, from an investigator-sponsored phase 1 study combining auto-ran with Tecentriq and chemo. However, these results came from just 16 patients, eight of whom responded to therapy.

A bigger test will come from the ongoing Imcode-003 trial, comparing an auto-ran/Tecentriq/chemo triplet against chemo.

Combos approaching?

BioNTech has also revealed plans to combine its mRNA-based immunotherapies with other modalities, such as ADCs, although so far it’s only begun this with its fixed-antigen candidate BNT116, being trialled in NSCLC.

Other neoantigen players have also run into problems. Moderna and Merck & Co had their hopes of an accelerated approval pathway for their contender, intismeran autogene (mRNA-4157), dashed in adjuvant melanoma.

Interestingly, those groups are still hopeful in relatively late disease, recently starting the phase 2 Interpath-11 trial in high-risk non-muscle invasive bladder cancer, and Interpath-12 in first-line melanoma. The partners must think they can succeed where BioNTech and Roche failed, although the bulk of ongoing inti-gene trials are testing adjuvant therapy, including in melanoma, NSCLC, muscle-invasive bladder and kidney cancers.

Gritstone Bio, meanwhile, filed for bankruptcy last October following underwhelming data with its neoantigen contender, Granite.

4877