Iovance and the Amtagvi poisoned chalice

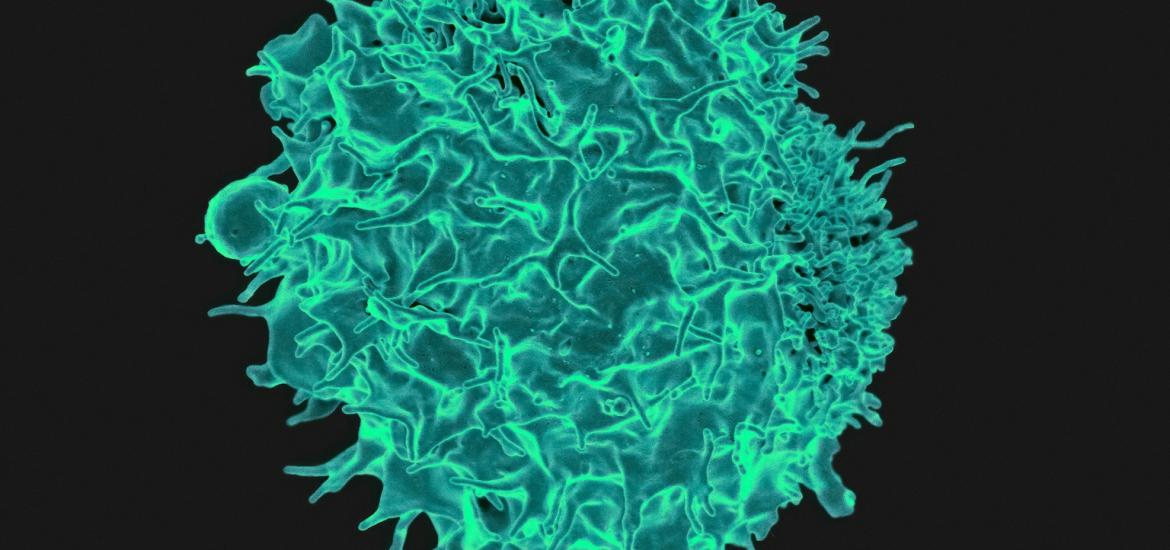

Iovance stands as the only company to have managed, after years of delays, to bring a TIL-based treatment to market, but as its investors are finding out this accolade is a poisoned chalice. The group's revelation that the therapy in question, Amtagvi, sold just $44m in the first quarter, and that the group was slashing its 2025 full-year revenue forecast from $450-475m to $240-300m, prompted a 45% share price collapse on Friday. This means that Iovance is now valued at just 20% of its market cap just before Amtagvi's approval for melanoma on 16 February 2024. The TIL (tumour-infiltrating lymphocyte) therapy had suffered numerous regulatory pushbacks going back to 2020, and when it did finally secure FDA approval ApexOnco argued that Iovance would struggle with a solo launch. The latest problems are related to maintenance at Iovance's production facility, which the company recently played down as being a short pause, but which in fact cut capacity in half for about a month. Iovance now promises that Amtagvi infusions will grow in the second quarter, but it's not the first to find this area a struggle: Lyell, Achilles, Instil Bio and Immatics have all abandoned TIL development.

1607