Roche pushes a novel myeloma target

The company will be the first to take a FcRH5-targeting project into phase 3.

The company will be the first to take a FcRH5-targeting project into phase 3.

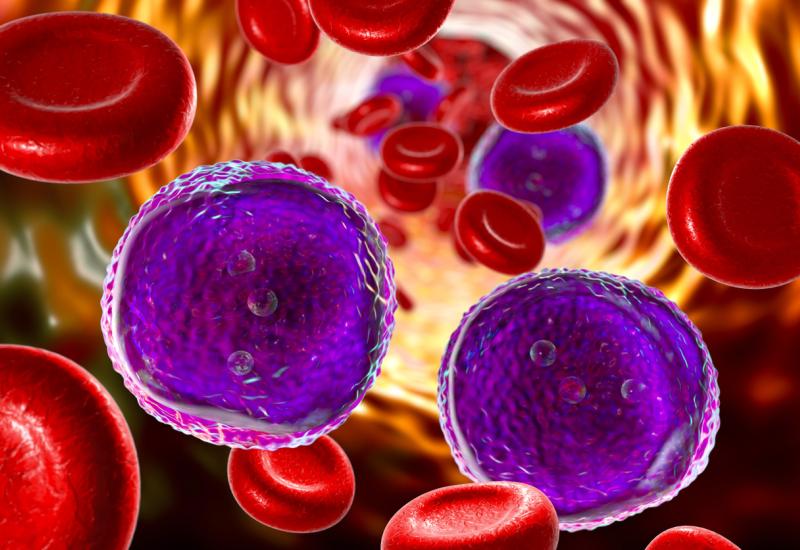

Roche’s haematology pipeline is looking fairly thin but the group is showing that it’s not afraid to take a risk, announcing a phase 3 trial of its FcRH5-targeting T-cell engager, cevostamab, at its pharma day on Monday.

Roche is jumping straight from phase 1 to phase 3 in second-line multiple myeloma, and the move looks particularly dicey because of the unproven nature of this target. Furthermore, there’s barely any other industry activity here, with only a couple of assets, from Legend and Moderna, in early trials. Roche will have to hope that it can compete with a slew of other products vying for a piece of the multiple myeloma market, but it also has hopes for cevostamab as part of a combination approach.

Cevolution revolution?

The phase 3 trial, dubbed Cevolution and slated to start in 2026, will test cevostamab plus Pomalyst and dexamethasone in second-line plus multiple myeloma.

On Monday Roche highlighted data from the phase 1 Camma 1 trial of the same combo in the second-line plus setting. Among 54 patients, the overall response rate was 86% and 88% with cevostamab at 70mg and 105mg respectively. Roche added that the grade 3 infection rate was less than 30%; the company is currently finalising the choice of dose for phase 3.

Roche reckons that, with increasing first-line use of quadruplet therapies that incorporate anti-CD38 antibodies like Darzalex, there’s a high unmet need for novel therapies in the relapsed/refractory setting.

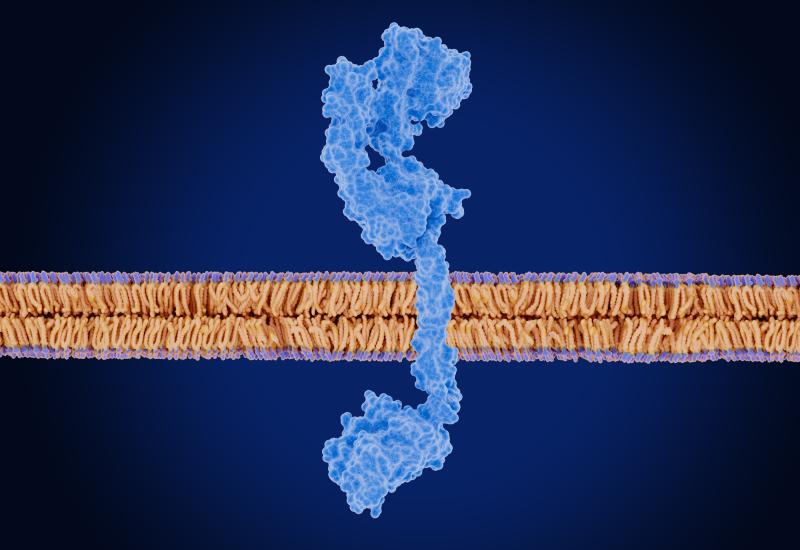

The company’s global head of oncology and haematology development, Charles Fuchs, noted that FcRH5 was expressed on “essentially 100%” of myeloma cells; however, hitting this target has proven tricky because of its similarity to other FcRH family members.

Competition

Other companies that still hope to succeed here include Legend, with the Car-T project LCAR-F33S, which recently went into the clinic, and Moderna. The latter is developing an mRNA-based asset that encodes three T-cell engagers, targeting BCMA, FcRH5, and GPRC5D, in a single product. This could be mRNA-2808, another new entrant into clinical trials.

Despite a lack of other projects targeting FcRH5, cevostamab could be squeezed by differently acting products in the fast-evolving multiple myeloma landscape. Legend and Johnson & Johnson’s BCMA-targeting Car-T Carvykti is already approved in the second line, while J&J, Pfizer and Regeneron hope to expand their BCMA-targeting T-cell engagers, Tecvayli, Elrexfio and Lynozyfic respectively, from their current late-line uses.

And companies are already working on trispecific T-cell engagers, including J&J with the BCMA x GPRC5D project JNJ-79635322, and Ichnos Glenmark, whose BCMA x CD38 project ISB 2001 was recently licensed by AbbVie.

Still, Fuchs contended that cevostamab’s novel target, along with its efficacy and safety profile, could allow it to become a “partner of choice with a range of multiple myeloma therapies across the industry”. The company is now “actively exploring those combinations with various potential companies”, he added.

The FcRH5 pipeline

| Project | Company | Description | Status |

|---|---|---|---|

| Cevostamab | Roche | T-cell engager | Ph3 Cevolution trial, + Pd in 2nd-line+ MM, to start 2026 |

| LCAR-F33S | Legend | Car-T | Ph1 in 4th-line+ MM, began Aug 2025 |

| Undisclosed* | Moderna | mRNA-encoded BCMA, FcRH5 & GPRC5D T-cell engagers | Ph1/2 in 4th-line MM, to start Oct 2025 |

| Unnamed | Light Chain Bioscience | FcRH5 x CD28 bispecific antibody | Preclinical, data at ASH 2024 |

| Unnamed | Moderna | mRNA-encoded FcRH5 x CD16 MAb | Preclinical, data at ASH 2024 |

Notes: *possibly mRNA-2808; Pd=Pomalyst & dexamethasone. Source: OncologyPipeline & company presentation.

3874