ASCO 2025 – Braftovi breaks new ground

The Breakwater study hits on overall survival with "unprecedented" data.

The Breakwater study hits on overall survival with "unprecedented" data.

Pfizer's Braftovi is likely headed for full approval in first-line BRAF-mutated colorectal cancer, based on full data from the Breakwater study just unveiled at ASCO. The trial, in February toplined as positive for PFS as well as for OS, backs the drug's current accelerated US green light for this use, as well as serving as the confirmatory study for formal approval.

One curiosity is that the full benefit against standard of care is only seen with a triplet comprising Braftovi plus Erbitux as well as Folfox chemotherapy. Breakwater included a cohort in which patients were given Braftovi plus Erbitux without chemo, but this performed only slightly better than the standard of care, chemo with or without Avastin.

This Braftovi/Erbitux doublet was originally part of Breakwater's three-cohort design, but enrolment into it was abandoned after a protocol amendment, the lead author, Dr Elena Elez from Vall d'Hebron Institute of Oncology, told a pre-ASCO press briefing. The doublet arm recruited 158 patients (against 236 for the triplet and 243 for control), and its results are deemed exploratory.

Another possible issue in Breakwater was that Avastin was not mandated for control patients, so there was the possibility that a comparison against Folfox alone could have flattered the overall analysis. However, in the event 81% of control patients did receive Avastin as well as chemo, implying a robust comparison against a real-world standard for BRAF-mutated disease, which makes up 8-12% of metastatic colorectal cancers.

Survival confirmed

Data from Breakwater's ORR analysis were first disclosed in Braftovi's US label and discussed at ASCO-GI in January, and Friday's ASCO presentation backed these up with PFS and OS numbers.

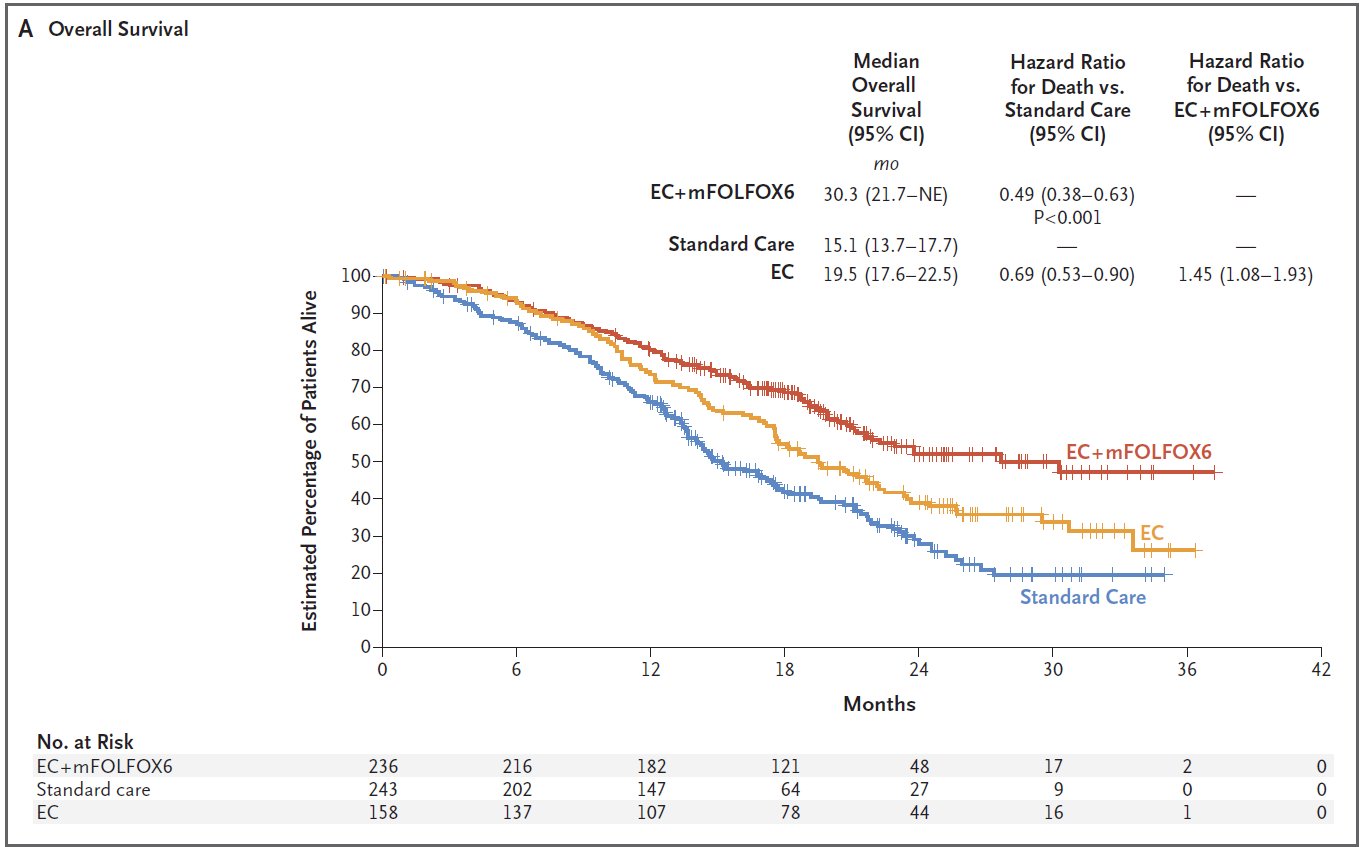

On PFS the triplet beat control with a hazard ratio of 0.53, while the all-important OS endpoint yielded a 51% reduction in risk of death, with medians of 30.3 months versus 15.1 months, ASCO heard. Elez called the survival numbers "unprecedented" in this patient population, and indicative of a new treatment standard.

The OS data came from a second interim analysis, and confirmed the findings from a first interim look, revealed at ASCO-GI, where a highly impressive 0.47 hazard ratio didn't clear an extremely demanding p value boundary. PFS and OS are Breakwater's co-primary endpoints, and clear success on both makes the granting of full FDA approval a formality.

Thus it will remain an intriguing anomaly that the incompletely enrolled Braftovi/Erbitux doublet didn't show any numerical difference versus control as regards PFS. The OS curves painted a more promising picture, with a median of 19.5 months falling neatly between the numbers yielded by the triplet and the control cohorts.

Braftovi was a key reason behind Pfizer's $11.4bn acquisition of Array Biopharma in 2019, but the drug has a curious ownership history.

It had been licensed to Novartis, but when that company inherited the similarly acting Tafinlar through a 2014 asset swap with GSK its ownership of both was deemed incompatible with antitrust concerns. To get around the possible conflict Novartis sold Braftovi back to Array for a "de minimis" payment. Braftovi is separately licensed to Pierre Fabre outside the US.

In 2024 Tafinlar revenues rose 7% to $2.1bn, while Braftovi sales came in at $607m (+27%).

3205