ASCO 2025 – Lilly makes a folate foray against Genmab

LY4170156 looks similar to Genmab’s rina-S, but cost Lilly a lot less.

LY4170156 looks similar to Genmab’s rina-S, but cost Lilly a lot less.

Lilly, going up against Genmab in the folate receptor alpha (FRα) ADC arena, seems to have bagged a relative bargain, data presented at ASCO on Monday suggest. The former’s contender, LY4170156, has just produced early-stage results in ovarian cancer that look nearly identical to those recently reported by Genmab with its similarly acting project, rinatabart sesutecan.

But Genmab paid $1.8bn for rina-S’s maker, Profound Bio, while Lilly is thought to have spent only around $250m on Mablink, which originated LY4170156.

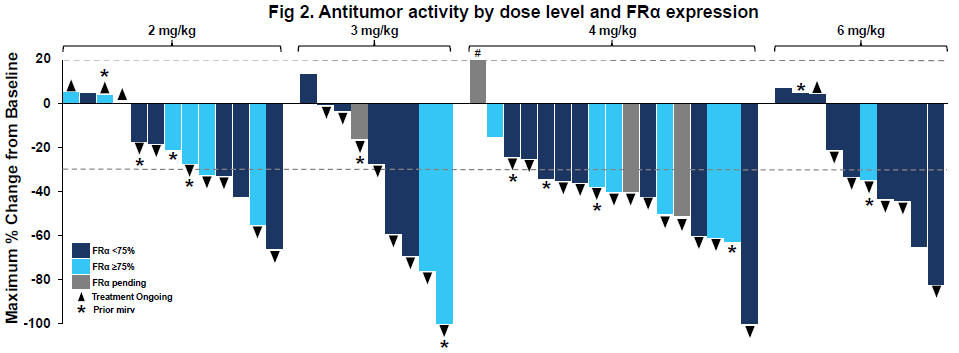

LY4170156 is being tested in a phase 1 study in various advanced solid tumours. An ASCO poster zoomed in on those with platinum-resistant ovarian cancer, where the “potential” go-forward dose of LY4170156, 4mg/kg every three weeks, produced an ORR of 55% among 20 patients.

Meanwhile, at the Society of Gynecologic Oncology meeting in March, Genmab reported a 56% ORR among 18 ovarian cancer patients treated with rina-S dosed at 120mg/m2 every three weeks in the phase 1/2 Rainfol-01 study. Around 90% of patients were platinum resistant.

Cross-trial comparison of LY4170156 and rina-S in ovarian cancer

| LY4170156 | Rina-S | |

|---|---|---|

| Trial | Ph1 | Ph1/2 Rainfol-01 |

| Venue | ASCO 2025 | SGO 2025 |

| Cutoff | 9 March 2025 | 15 Jan 2025 |

| Median prior therapies | 5 | 3 |

| ORR | 55% (11/20)* | 56% (10/18)** |

| Dose reductions due to TEAEs | 24%* | 25%** |

Note: *4mg/kg Q3W dose only; **120mg/m2 Q3W dose only. Source: ASCO 2025.

The patients in the LY4170156 trial were, on average, later line, so Lilly’s trial looks to have enrolled a tougher to treat population.

Each company claimed responses regardless of FRα expression levels. Still, both LY4170156’s ASCO poster and rina-S’s SGO presentation only detailed responses at levels above and below 75%, so it’s unclear whether there’s a cutoff below 75%, under which the assets become ineffective.

FRα expression is important because the approved FRα-targeting ADC, AbbVie’s Elahere, is only indicated for patients with 75% or higher expression, where it produced an ORR of 42% in the Mirasol trial. Elahere uses a tubulin inhibitor payload, while both LY4170156 and rina-S employ topoisomerase 1 inhibitors.

Interestingly, LY4170156 produced several responses among patients who’d previously received Elahere. Genmab has also disclosed a response in an ovarian cancer patient previously treated with the AbbVie drug.

As for how LY4170156 and rina-S compare in terms of toxicity, this is harder to gauge as Lilly didn’t give overall numbers for adverse events, only disclosing treatment-emergent adverse events occurring at 15% or higher. However, dose reductions due to TEAEs look similar between the two projects at their go-forward doses. Anaemia and neutropenia look troublesome with both assets.

Others in the FRα arena include AstraZeneca, whose torvutatug samrotecan also uses a topoisomerase 1 payload, while Sutro recently shelved its tubulin inhibitor-based contender, luveltamab tazevibulin.

Genmab has already begun the pivotal Rainfol-02 trial, in second-line-plus platinum-resistant ovarian cancer, with data expected in 2026. But it looks like Lilly could give the group a run for its money.

3398